Why This Topic Matters

Investing is all about discerning between temporary setbacks and structural problems in a company. Temporary setbacks are often opportunities for investors to buy stocks at a discount, while structural problems may signal a long-term decline. Understanding the difference is crucial for making informed, profitable investment decisions.

Understanding Key Business or Financial Drivers

Key business or financial drivers such as revenue growth, profit margins, and cash flows can help investors distinguish between temporary setbacks and structural problems. For instance, a dip in revenue may be a temporary setback due to a seasonal slump or a one-off event, while consistently declining profit margins may indicate deeper structural issues.

Expectations Vs Reality

It’s essential for investors to separate the hype from the actual performance of a company. Overly optimistic expectations can inflate a company’s stock price, making it vulnerable to sharp drops when these expectations aren’t met. On the other hand, a company may be undervalued if the market overreacts to temporary setbacks, providing a potential investment opportunity.

What Could Go Wrong

Investments always come with risk. A company may fail to recover from a temporary setback due to unforeseen circumstances, or a perceived structural problem may turn out to be more damaging than initially thought. Moreover, investors could misconstrue a structural problem as a temporary setback, leading to significant losses.

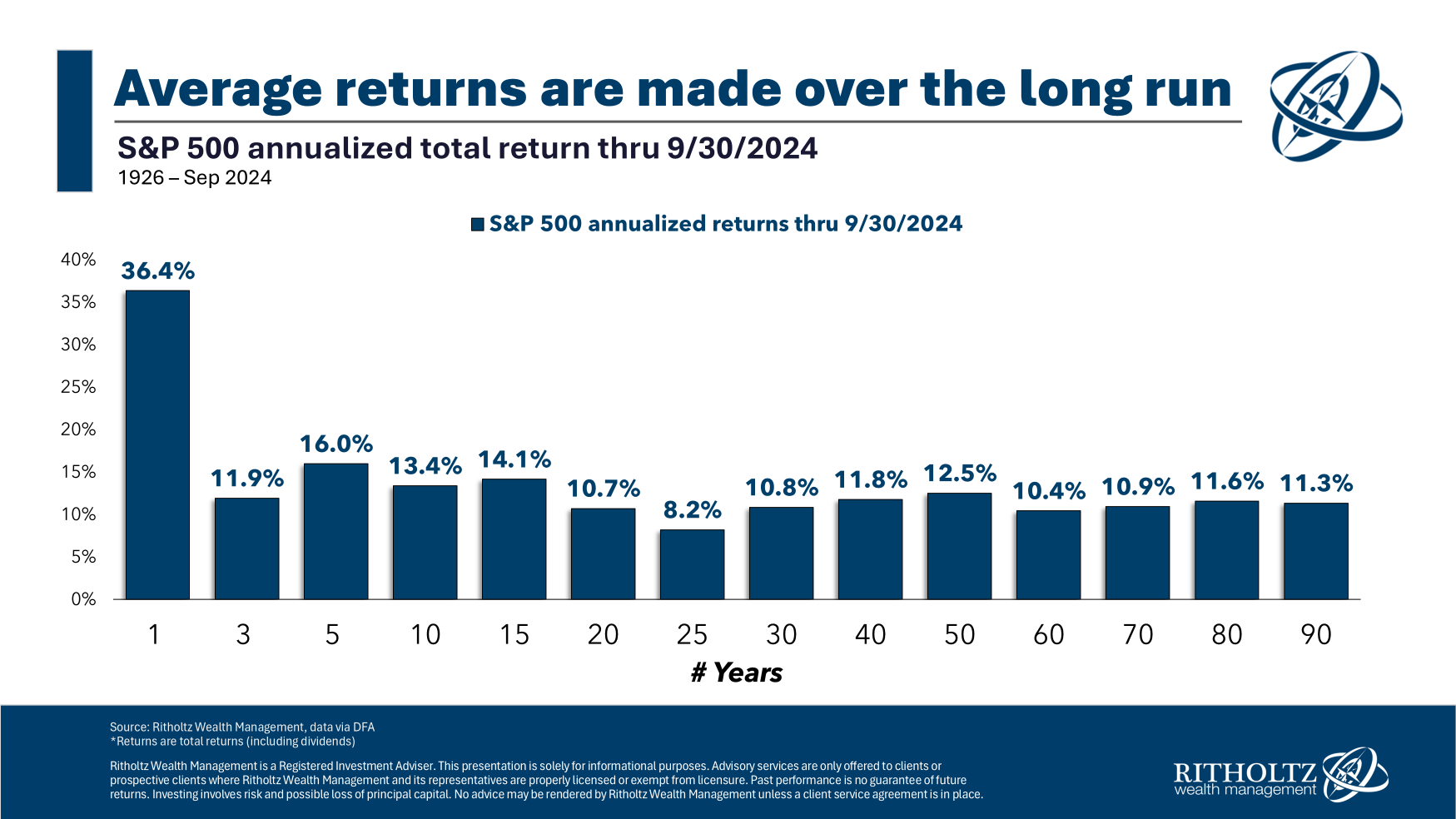

Long-term Perspective

While it’s crucial to consider short-term factors, investors should always view these within the context of multi-year outcomes. A series of temporary setbacks could potentially signal an emerging structural problem. Conversely, a company may devise effective strategies to resolve structural issues, leading to a turnaround in its fortunes. Therefore, investors must adopt a long-term perspective when evaluating investment opportunities.

Investor Tips

- Keep a close watch on key financial indicators and company announcements.

- Always compare a company’s performance with market expectations.

- Don’t let short-term market volatility sway your long-term investment strategy.

- Regularly review your investments to ensure they align with your financial goals.

Please note that this article is for informational purposes only and does not constitute investment advice.

Leave a Reply