Introduction

Professional stock research is a fundamental tool for long-term investors. It provides valuable insights into the health and potential growth of companies, helping to inform investment decisions and shape a profitable portfolio. This article explores why this topic is crucial to investors and how it can support them in making informed long-term investment decisions.

Key Business and Financial Drivers

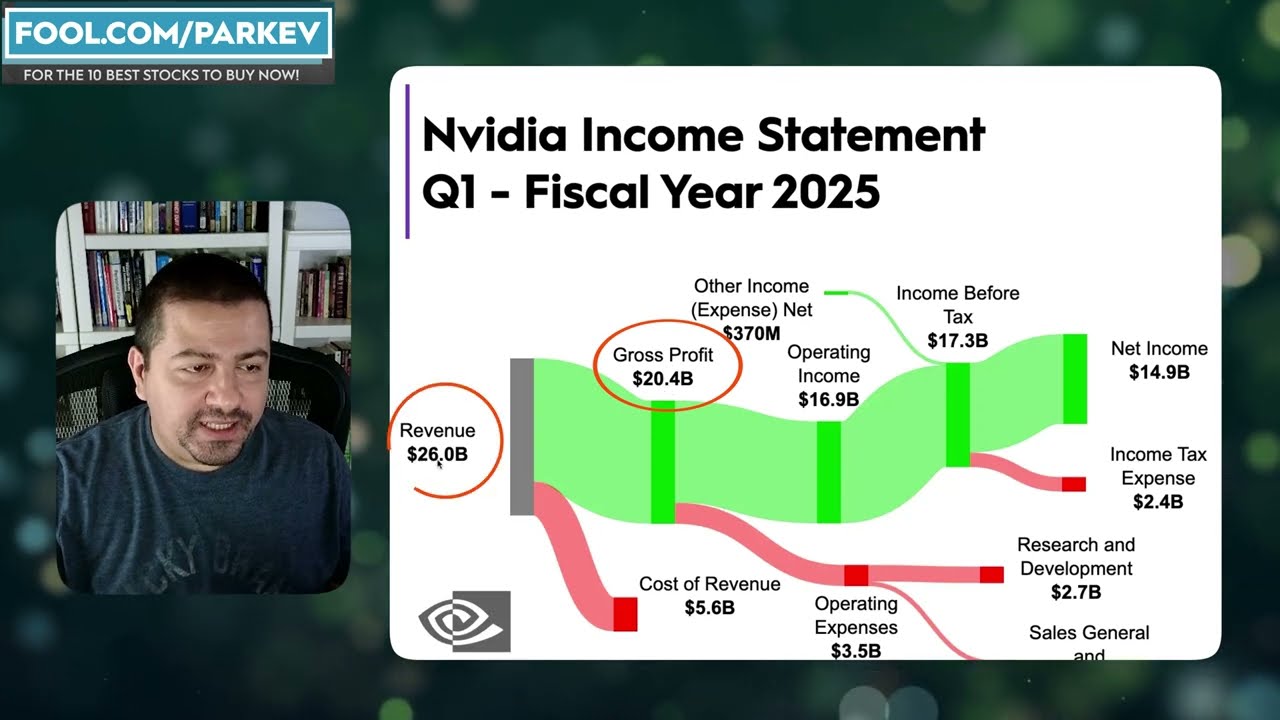

Understanding the key business and financial drivers of a company is essential in stock research. These factors, which include revenue growth, profit margins, and cash flow, can significantly impact a company’s stock price over the long term. For example, a company with strong revenue growth and healthy profit margins is likely to be a good investment. Similarly, a company with strong cash flow can invest in growth opportunities, leading to increased shareholder value.

Expectations vs Reality

One of the most critical aspects of stock research is assessing the gap between market expectations and the actual performance of a company. If a company’s performance exceeds market expectations, its stock price is likely to rise. Conversely, if a company fails to meet market expectations, its stock price may fall. Therefore, understanding this gap can help investors make more informed decisions about when to buy or sell stocks.

What Could Go Wrong

Despite thorough research, there are still factors that could negatively impact a company’s stock price. These could include sudden market downturns, regulatory changes, or unexpected operational challenges. Therefore, a comprehensive risk assessment is an integral part of professional stock research. It helps investors understand potential risks and prepare for potential losses.

Long-Term Perspective

While short-term market fluctuations can impact a company’s stock price, a long-term perspective is essential in investment decisions. Over the long term, the fundamentals of a company, such as its financial health and growth prospects, are likely to have a more significant impact on its stock price. Therefore, professional stock research focuses on these long-term factors, helping investors build a profitable long-term portfolio.

Investor Tips

- Always conduct thorough research before making investment decisions.

- Consider both the financial health and growth prospects of a company.

- Keep a long-term perspective, focusing on the fundamentals of a company.

This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or consult with a professional financial advisor before making investment decisions.

Leave a Reply