Introduction: Why Risk Management Matters

For long-term investors, understanding risk management strategies can be a game-changer. It helps to safeguard investment capital and ensure steady returns, regardless of market fluctuations. This article delves into a case study of risk management in a US stock portfolio, offering insights into the core investment question: How does effective risk management impact the long-term performance of a stock portfolio?

Key Business or Financial Drivers

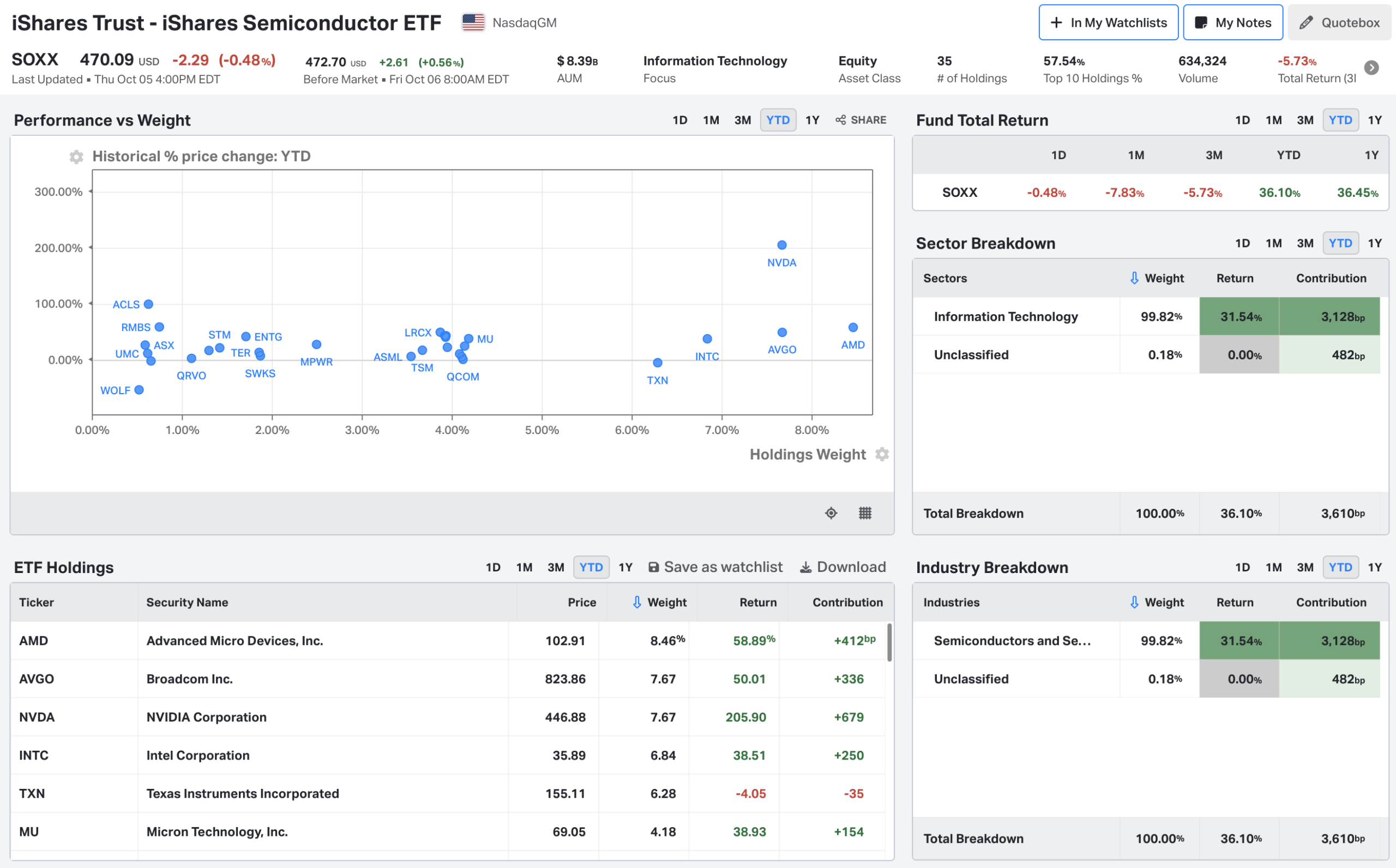

Several business and financial drivers influence risk management in a stock portfolio. These include the company’s financial health, industry trends, macroeconomic factors, and market volatility. For instance, a firm with strong financial health will likely have lower risk levels compared to a financially unstable one. Similarly, industries with stable growth may offer lower risk investments than volatile sectors.

Expectations Vs. Reality

The stock market is often viewed as a high-risk, high-reward arena. Investors may expect that a well-diversified US stock portfolio can mitigate risks and generate significant returns. However, diversification alone does not guarantee safety. The truth is, even a diversified portfolio can suffer losses during market downturns. Therefore, investors must employ other risk management strategies such as regular portfolio review and rebalancing, and investing in quality stocks with strong fundamentals.

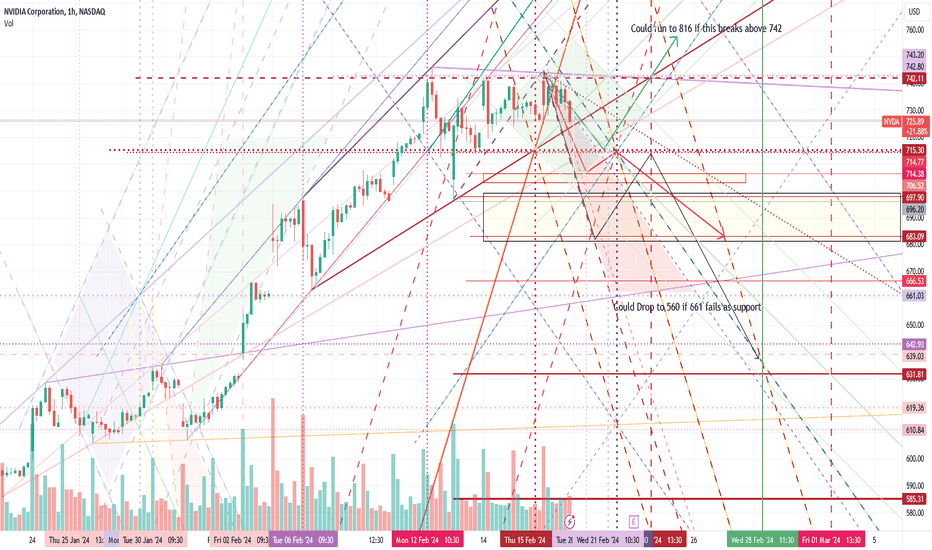

What Could Go Wrong

Despite implementing risk management strategies, things could still go wrong. Market volatility, economic downturns, or a company’s poor financial performance can negatively impact a portfolio’s value. Also, over diversification can dilute potential returns. Therefore, a balance must be struck between risk mitigation and return potential.

Long-term Perspective

From a long-term perspective, effective risk management can help investors weather short-term market fluctuations and protect their investment capital. It can also help them achieve their financial goals by ensuring steady returns over the years. However, investors must be patient and disciplined, as the benefits of risk management are often realized over the long run.

Investor Tips

- Regularly review and rebalance your portfolio to align with your risk tolerance and investment goals.

- Invest in quality stocks with strong fundamentals for long-term stability.

- Avoid over diversification to ensure meaningful returns.

This article is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.

Leave a Reply