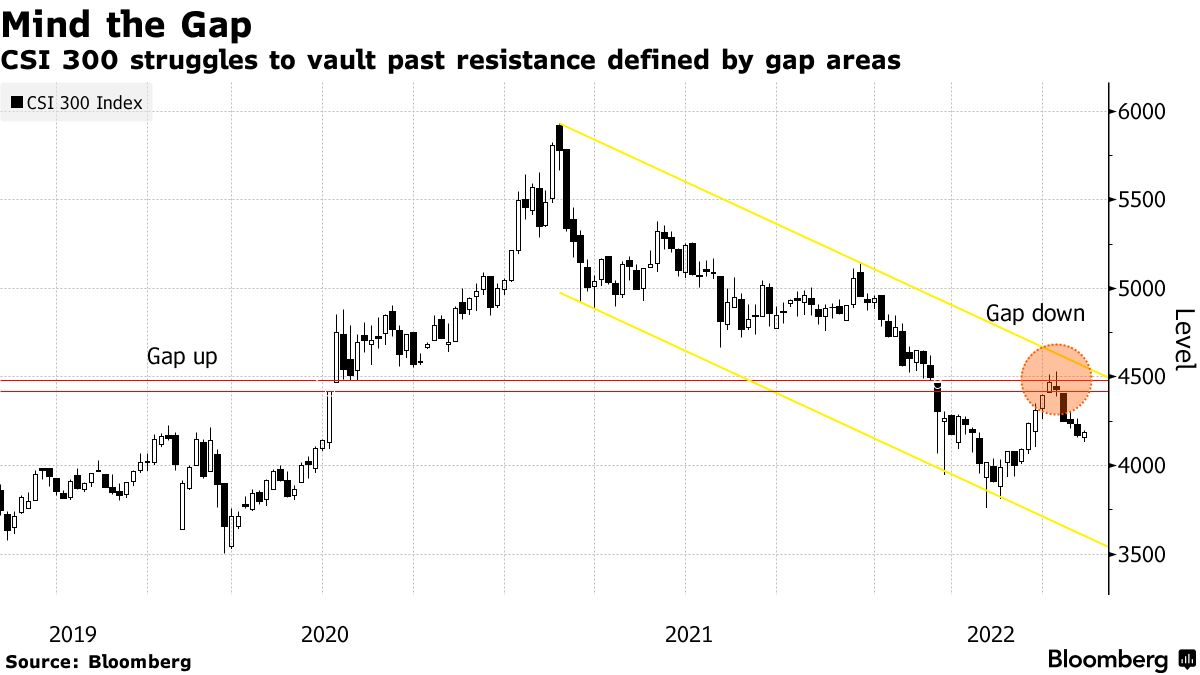

Introduction: The Importance of Downside Risk

As a long-term investor, understanding downside risks in US equities is crucial. These risks can significantly impact the returns on your investments. Recognizing potential pitfalls can help you make more informed decisions and potentially mitigate losses.

Key Business and Financial Drivers

Several factors drive the US equity market, including economic indicators, interest rates, corporate earnings, and geopolitical events. A change in these drivers can trigger downside risks.

Economic Indicators

The performance of the economy directly impacts the stock market. High unemployment rates, low GDP growth, and inflation can lead to a decrease in consumer spending, affecting corporate profits and subsequently, stock prices.

Interest Rates

Interest rate hikes can make borrowing more expensive, potentially slowing down economic growth and negatively impacting stock prices.

Expectations vs Reality

Investor sentiment often drives stock prices. When expectations are high, stocks can be overvalued, and when reality does not meet these expectations, a market correction may occur, resulting in downside risk.

What Could Go Wrong

An unexpected economic downturn, sudden changes in monetary policy, or geopolitical events can trigger a market sell-off. Additionally, a significant decrease in corporate earnings can lead to a drop in stock prices.

Long-Term Perspective

While short-term factors can cause volatility in the market, it’s essential to keep a long-term perspective. Market downturns can provide opportunities to buy quality stocks at lower prices, potentially leading to higher returns in the long run.

Investor Tips

- Stay informed about economic trends and corporate earnings reports.

- Consider diversifying your portfolio to spread risk.

- Invest in companies with strong fundamentals and a proven track record.

- Don’t let short-term market fluctuations influence your long-term investment strategy.

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

Leave a Reply