Why This Topic Matters to Investors

Investing in companies with durable business models is crucial for long-term investors focusing on US stocks. Such companies are characterized by sustainable competitive advantages, stable cash flows, and the ability to withstand economic downturns, making them potentially profitable investments over the long haul.

Key Business and Financial Drivers

The strength of a company’s business model, its market position, and the predictability of its earnings are vital factors to consider when investing. Companies with a high degree of operational leverage can generate consistent revenue growth, enabling them to reinvest in their business and provide attractive returns to shareholders.

Operational Leverage

Operational leverage refers to a company’s ability to increase its operating income as revenue grows. Companies with high operational leverage can scale their operations effectively, which can result in higher profit margins.

Market Position

Companies with a strong market position often have a competitive edge, which can protect their earnings from rivals. This competitive advantage can come from a variety of sources, such as brand recognition, intellectual property, or a large customer base.

Expectations Vs Reality

While investors may anticipate steady returns from companies with durable business models, the reality can be more complex. There are numerous factors that can affect a company’s performance, such as changes in the economic environment, competition, and management decisions. Therefore, it is essential for investors to consider these variables and adjust their expectations accordingly.

What Could Go Wrong

Investing in stocks always carries risks. For companies with durable business models, these risks could include a sudden economic downturn, increased competition, or management missteps. If a company fails to adapt to changes in its industry or the broader economy, its earnings and stock price could suffer.

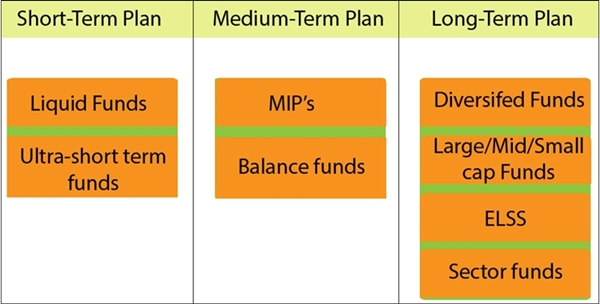

Long-Term Perspective

Despite short-term fluctuations, investing in companies with durable business models can provide steady returns over the long term. Such companies are often able to navigate economic downturns and maintain their competitive edge, making them attractive investments for long-term investors.

Investor Tips

- Look for companies with a strong competitive position and high operational leverage.

- Be aware of the risks associated with investing in stocks and adjust your expectations accordingly.

- Consider the long-term prospects of a company, not just its short-term performance.

This article is intended for informational purposes only. It is not intended to be investment advice or a recommendation to buy or sell any specific securities. Always do your own research and consider your financial position before making investment decisions.

Leave a Reply