Why Stress Testing Matters to Investors

Understanding the dynamics of investment stress testing strategies in US equities is crucial for investors seeking to safeguard their portfolios against potential market downturns. These strategies offer insights into the robustness of an investment portfolio, allowing investors to assess their risk tolerance levels and make informed long-term investment decisions.

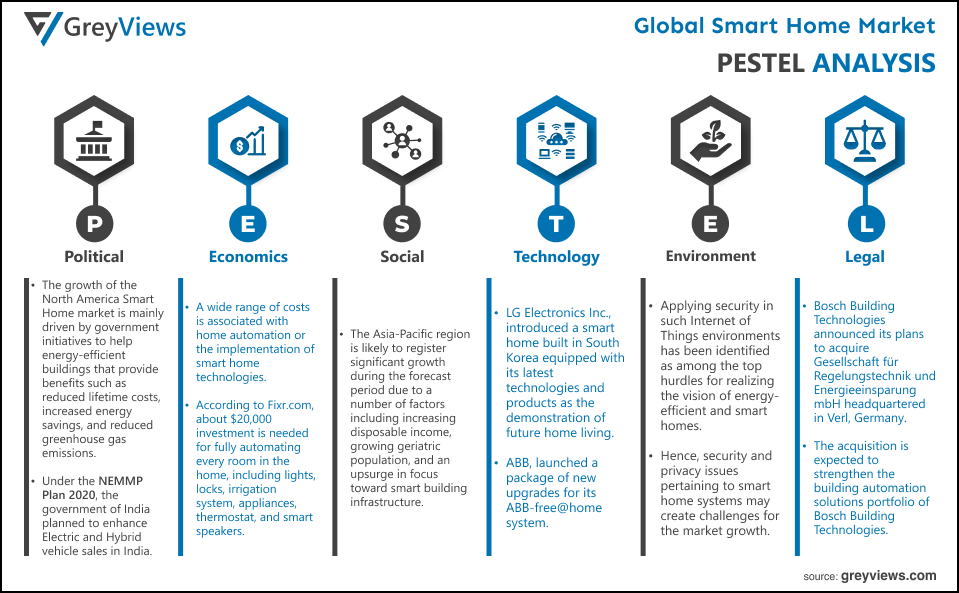

Key Business and Financial Drivers

The primary business and financial drivers that influence the effectiveness of stress testing strategies include the market volatility, economic indicators, sector performance, and company-specific factors. These elements can significantly impact the risk profile of a portfolio, thereby influencing the outcomes of stress tests.

Expectations vs Reality

Investors often expect stress testing strategies to provide a foolproof shield against any potential losses. However, in reality, while these strategies can help in identifying potential risks, they cannot entirely eliminate the possibility of losses. Investors must, therefore, approach stress testing as a risk management tool rather than a profit guarantee.

What Could Go Wrong

Despite the benefits, stress testing strategies in US equities could go wrong if not implemented correctly. Over-reliance on historical data, ignoring sector-specific risks, or not considering extreme market events are some of the common pitfalls that could render these strategies ineffective.

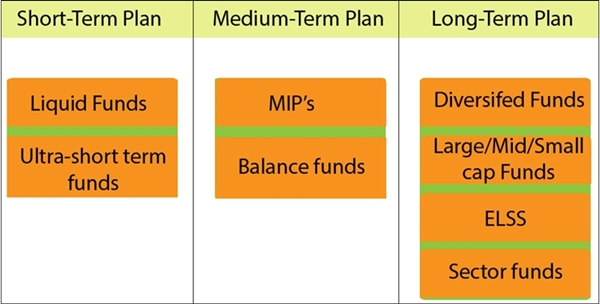

A Long-Term Perspective

While stress testing can help investors navigate short-term market fluctuations, its real value lies in its ability to provide a long-term perspective. It enables investors to understand potential vulnerabilities in their investment strategies and make necessary adjustments for sustainable growth over multiple years.

Investor Tips

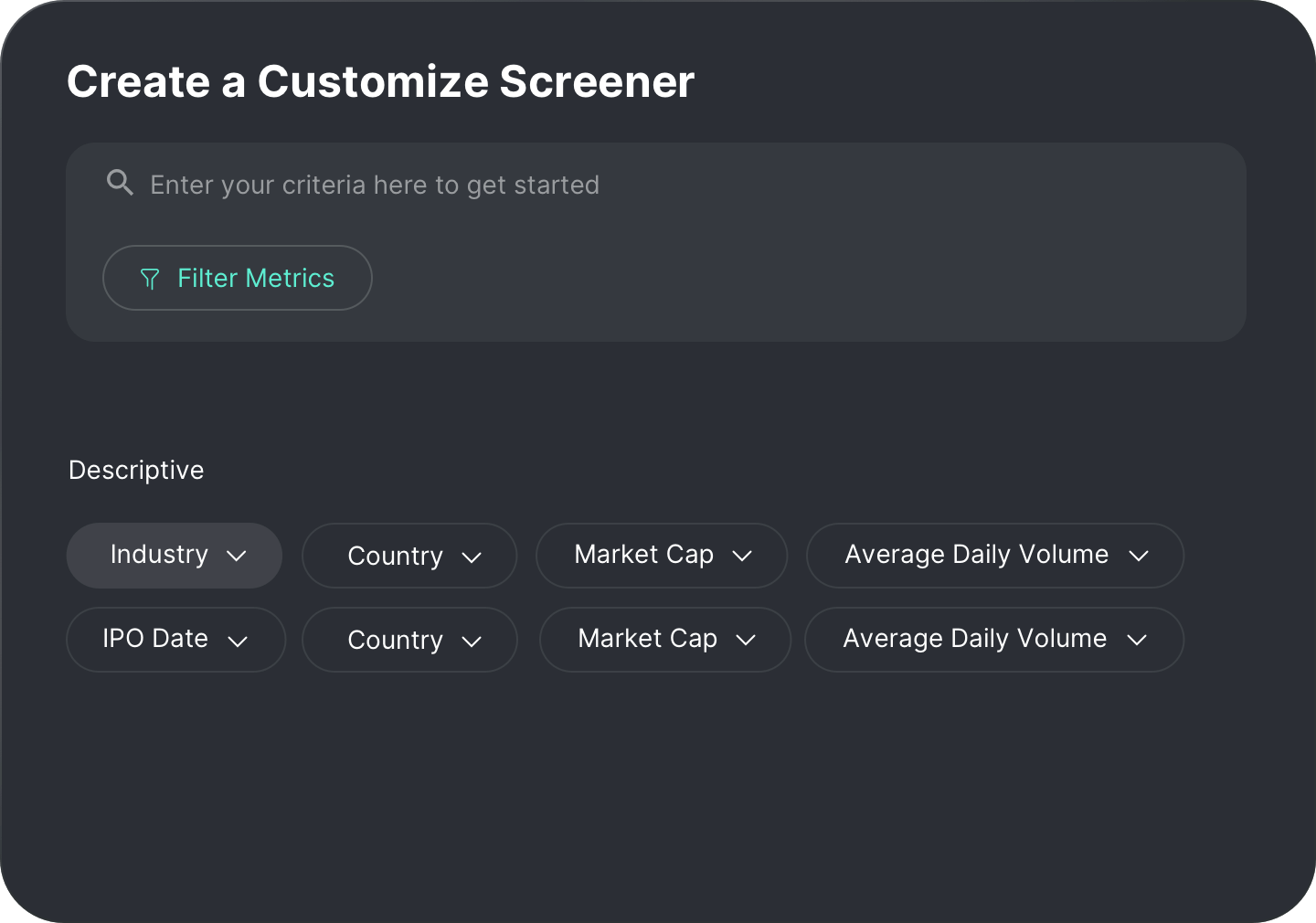

- Regularly perform stress tests on your portfolio to identify potential risks and vulnerabilities.

- Consider a wide range of market scenarios in your stress tests to ensure robust risk management.

- Use the insights from stress tests to adjust your investment strategy and optimize your portfolio for long-term growth.

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a professional advisor before making any investment decisions.

Leave a Reply