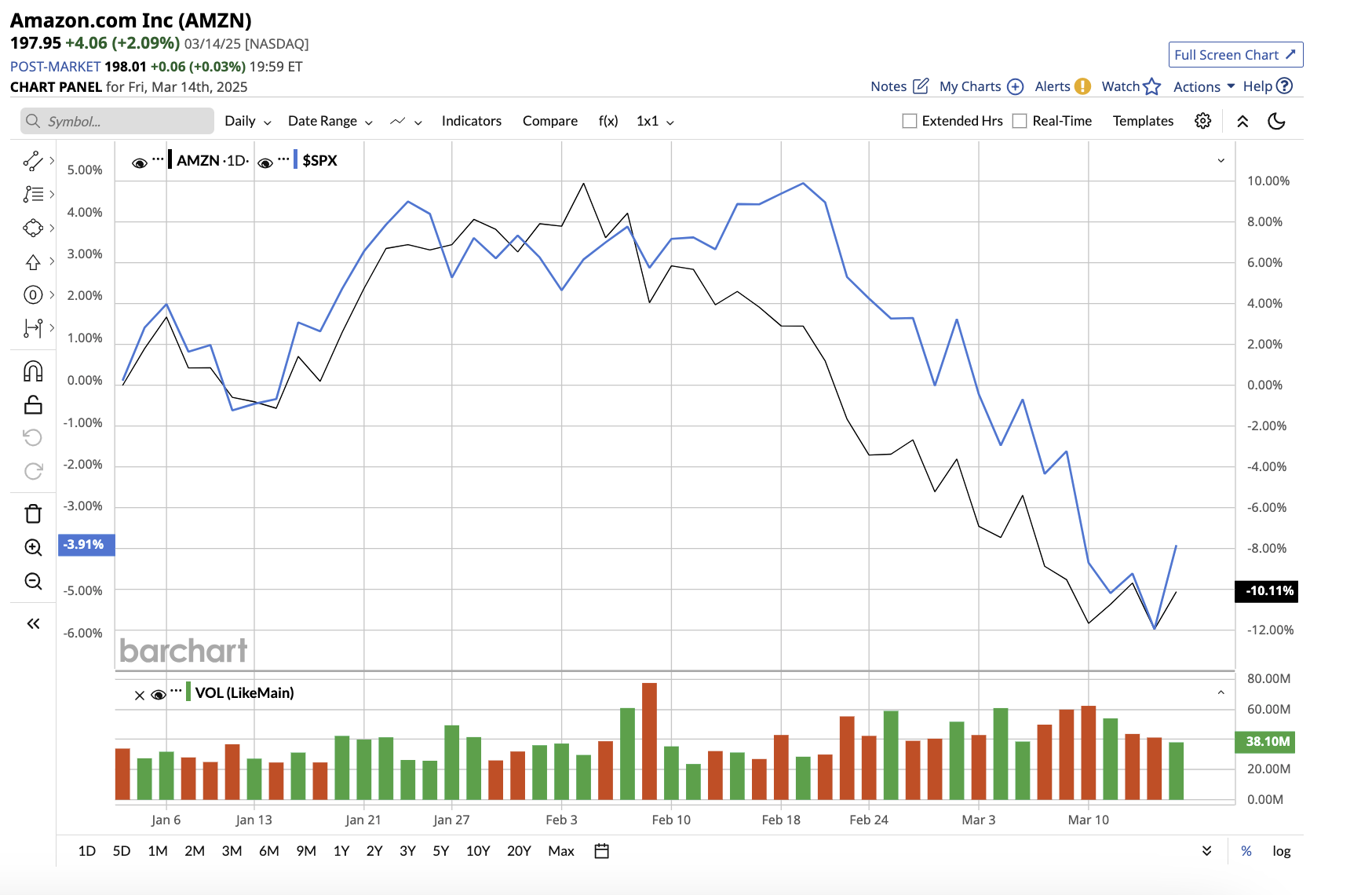

Introduction: Why Industry Valuation Reset Matters to Investors

The topic of ‘industry valuation reset in US stocks’ is a significant one for investors. It represents a fundamental shift in how a sector or industry is priced in the stock market, often driven by a transformative event or change in market dynamics. Such shifts can open up new investment opportunities or pose challenges for existing holdings.

Key Business and Financial Drivers

Several factors can trigger an industry valuation reset. These include changes in regulatory environment, technological advancements, shifts in consumer behavior, or macroeconomic conditions. Understanding these drivers is key to anticipating potential valuation resets and making informed investment decisions.

Expectations Vs. Reality

Often, the market’s expectations about a particular industry’s future performance are baked into stock prices. However, when there is a significant discrepancy between these expectations and the industry’s actual performance, a valuation reset may occur. In other words, the market reassesses the value of the industry’s stocks based on new information or changed assumptions.

What Could Go Wrong

An industry valuation reset could go wrong for investors in several ways. For instance, if investors fail to anticipate the reset, they may find their holdings significantly devalued. Additionally, if the reset is driven by a systemic risk that affects the entire market, even diversified portfolios may be impacted.

Long-Term Perspective

While industry valuation resets can cause significant short-term fluctuations in stock prices, it’s important to take a long-term perspective. Over several years, the impact of a reset may level out as the industry and market adjust to the new conditions. Therefore, a valuation reset can be seen as a chance to reassess investment strategies and make adjustments that align with long-term investment goals.

Investor Tips

- Stay informed about market and industry trends that could trigger a valuation reset.

- Assess the potential impact of a reset on your portfolio and consider adjustments as needed.

- Remember to take a long-term perspective and not overreact to short-term market fluctuations.

Disclaimer: This article is for informational purposes only and should not be taken as investment advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply