Introduction: Why Investment Strategy Refinement Matters

Refining your investment strategy is pivotal to long-term success in the US stock market. It involves regular reassessment of market trends, company fundamentals, and risk tolerance, allowing investors to adapt to changing market conditions and optimize returns.

Key Business or Financial Drivers

Several key drivers impact a company’s performance and, consequently, its stock price. These include company earnings, economic indicators, and sector trends.

Company Earnings

Company earnings are a reflection of a company’s financial health. A consistent record of strong earnings can indicate a successful business model and competent management, which can drive stock prices upwards in the long term.

Economic Indicators

Economic indicators such as GDP growth, inflation, and unemployment rates impact investor sentiment and market trends. For instance, robust GDP growth often translates to higher corporate earnings, which can boost stock prices.

Sector Trends

Understanding sector trends allows investors to identify sectors that are poised for growth. Investing in growth sectors can enhance portfolio performance and mitigate risk.

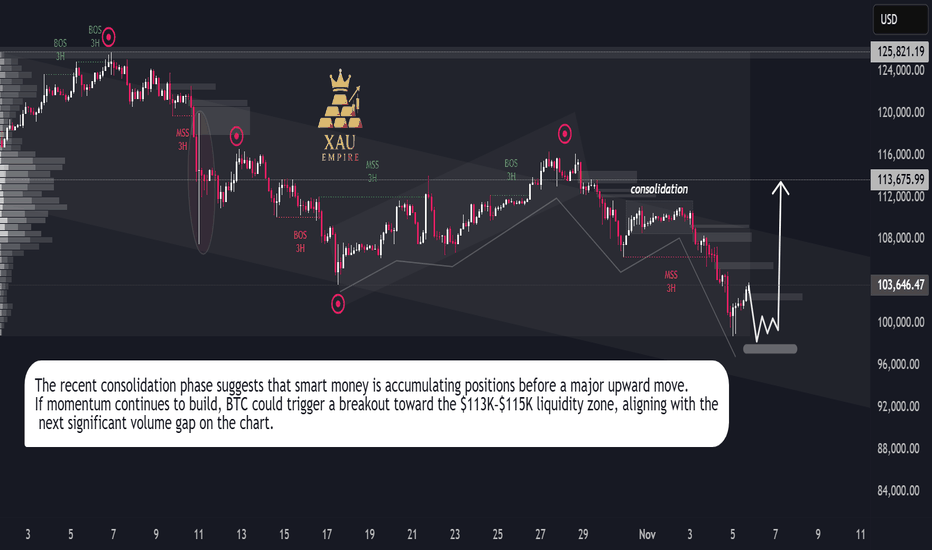

Expectations vs Reality

The stock market is, fundamentally, a market of expectations. While a company’s current earnings and cash flows are important, its future earnings potential, as perceived by investors, largely determines its stock price. However, these expectations can often deviate from reality, leading to overvalued or undervalued stocks. Therefore, it’s important to regularly reassess your investment strategy based on realistic expectations.

What Could Go Wrong

Investing in stocks carries inherent risks. Market volatility, economic downturns, and company-specific risks like poor earnings or corporate governance issues can negatively impact stock prices. Therefore, a well-diversified portfolio and a disciplined investment approach are essential to manage these risks.

Long-Term Perspective

While short-term market trends and company news can influence stock prices, long-term investors should focus on a company’s fundamental strengths and growth potential. Over time, quality companies with strong earnings growth and a sustainable competitive advantage are likely to deliver solid returns.

Investor Tips

- Stay informed about market trends and economic indicators.

- Regularly review and rebalance your portfolio.

- Invest in fundamentally strong companies with growth potential.

- Maintain a long-term perspective and avoid short-term market noise.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always do your own research or consult with a financial advisor before making investment decisions.

Leave a Reply