Why Portfolio Balance Strategies Matter

A well-balanced investment portfolio is essential to maximize returns and mitigate risks. It’s not just about having a diversified portfolio but how well you balance it that determines your success in the long run. For long-term investors, understanding the right balance strategy for US stocks can mean the difference between a decent return and a great one.

Key Business and Financial Drivers

Several factors can influence the performance of US stocks, including the overall health of the economy, interest rates, inflation, and corporate earnings. Investors should pay attention to these indicators as they can provide valuable insights into the potential performance of US stocks.

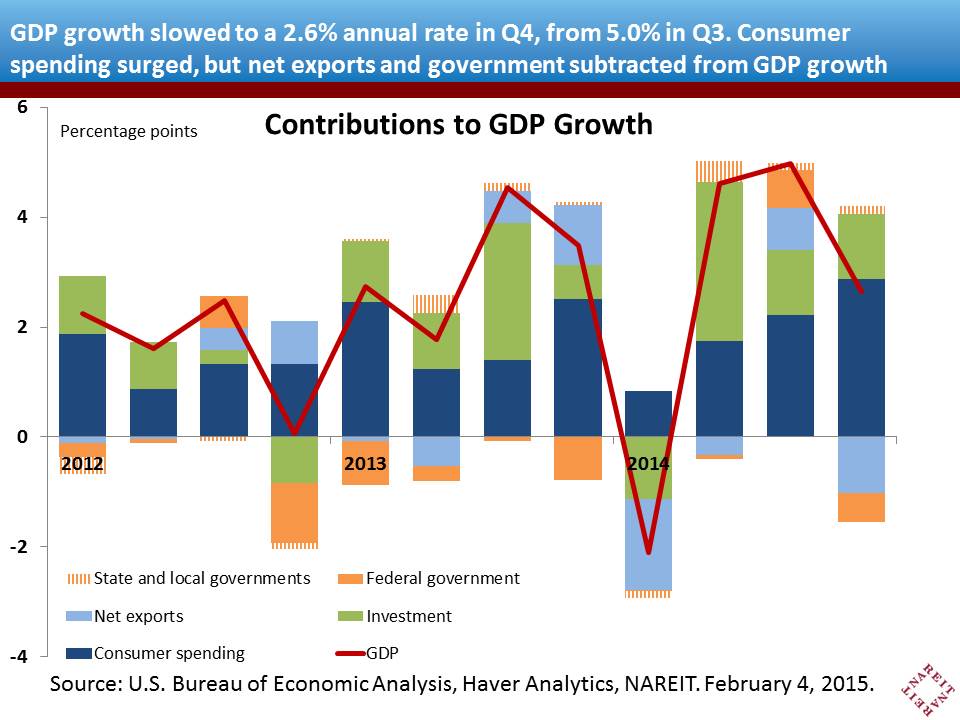

Economic Health

When the economy is doing well, businesses tend to prosper, which can lead to higher stock prices. On the other hand, during a recession or economic downturn, stock prices may fall as businesses face challenges in generating profits.

Interest Rates and Inflation

Interest rates and inflation can also significantly impact stock prices. High interest rates can reduce business investment, leading to lower stock prices. Similarly, high inflation can erode purchasing power and negatively impact corporate profits, leading to a decline in stock prices.

Corporate Earnings

Corporate earnings are perhaps the most crucial driver of stock prices. If a company is profitable and expectations are that it will remain so, its stock price will likely rise. Conversely, if a company is not profitable, or if doubts exist about future profitability, its stock price may fall.

Expectations vs Reality

Investors often have expectations about a stock’s future performance based on various factors. However, these expectations may not always align with reality. For example, a company may be expected to post strong earnings due to a recent product launch, but if the product fails to meet sales expectations, the company’s stock price may fall. Therefore, it’s crucial for investors to regularly review and adjust their portfolio balance strategies based on actual performance and not just expectations.

What Could Go Wrong

While investing in US stocks can offer significant returns, several risks could derail your investment strategy. These include economic downturns, changes in government policy, corporate scandals, and unexpected events like natural disasters or pandemics. It’s important for investors to consider these risks and have a plan in place to manage them.

Long-term Perspective

While short-term market fluctuations can impact the performance of US stocks, it’s essential to maintain a long-term perspective. Over the long term, the performance of US stocks has historically been positive, despite periods of volatility. Therefore, a well-balanced portfolio that includes US stocks can help investors achieve their long-term financial goals.

Investor Tips

- Regularly review and adjust your portfolio balance strategies based on actual performance and market conditions.

- Stay informed about economic indicators, changes in government policy, and corporate earnings.

- Maintain a long-term perspective and avoid making investment decisions based on short-term market fluctuations.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always do your research before making any investment decisions.

Leave a Reply