Why US Stock Research Standards Matter

As a long-term investor, understanding the US stock research standards aids in making informed decisions. These standards provide a framework for evaluating a company’s financial health, growth potential, and market position, ultimately influencing your investment strategy.

Key Business and Financial Drivers

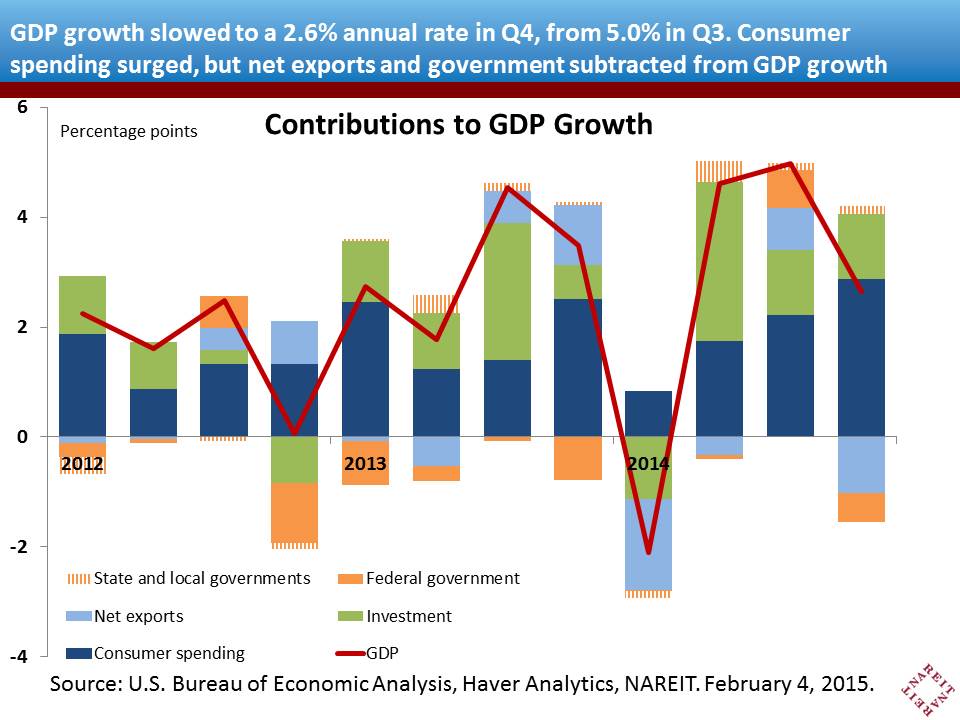

Primarily, business and financial drivers such as revenue growth, profitability, cash flow, and competitive advantage shape a company’s value and its stock performance. Recognizing these drivers helps investors to foresee potential risks and opportunities.

Revenue Growth

A company’s ability to increase sales over time can be a strong indicator of its potential for long-term success. Steady revenue growth often indicates a strong demand for a company’s products or services, a crucial factor for investors.

Profitability

Profitability measures a company’s ability to generate earnings relative to its revenue, operating costs, and other expenses. A consistently profitable company is likely to attract long-term investors.

Expectations vs Reality

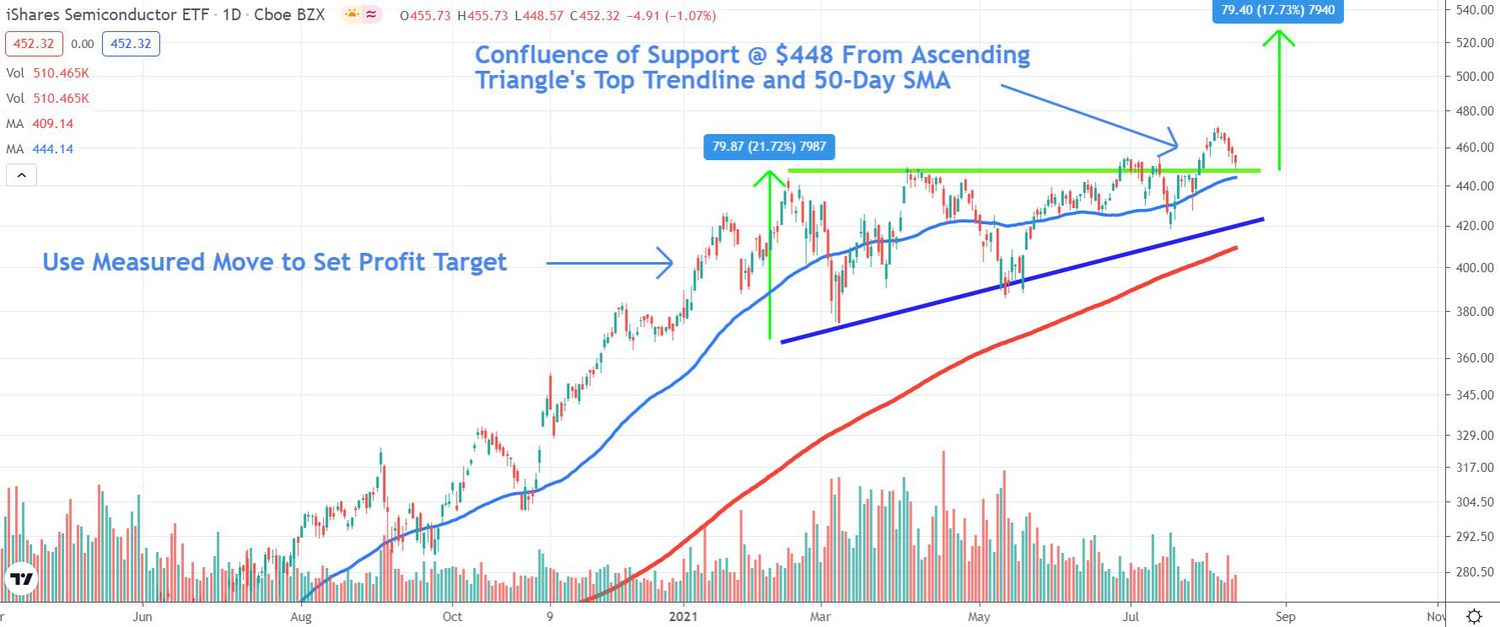

Understanding the difference between expectations and reality is crucial when analyzing stocks. Market expectations are often reflected in a company’s stock price. However, these expectations may not always align with the company’s actual performance. For instance, a company may be overvalued if the stock price reflects overly optimistic expectations.

What Could Go Wrong

Investing in stocks involves risks. Market volatility, economic downturns, poor corporate governance, and unexpected industry changes can negatively impact a company’s stock performance. A solid understanding of these potential pitfalls can help investors manage risks effectively.

Long-Term Perspective

While short-term market fluctuations can be significant, it’s the long-term economic fundamentals that often determine a company’s value. Investors who focus on a company’s long-term growth prospects, rather than short-term price movements, are more likely to achieve sustainable returns.

Investor Tips

- Stay informed about industry trends and macroeconomic factors that could impact your investments.

- Regularly review your portfolio to ensure it aligns with your investment goals.

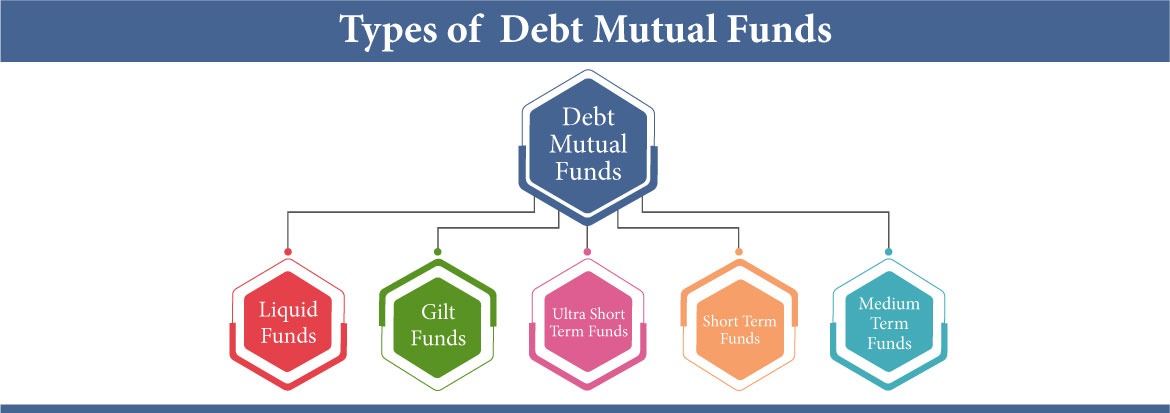

- Consider diversification to spread risk across different asset classes.

Please note that this article is for informational purposes only and should not be considered as investment advice. Always do your own research before making any investment decisions.

Leave a Reply