Why Sector Rotation Matters to Investors

Understanding sector rotation, the shifting investment from one sector of the economy to another by investors, is crucial for any investor looking to maximize returns and minimize risk over the long term. It provides insight into market trends, economic cycles and investor sentiment, enabling informed decision-making and effective portfolio management.

Key Drivers of Sector Rotation

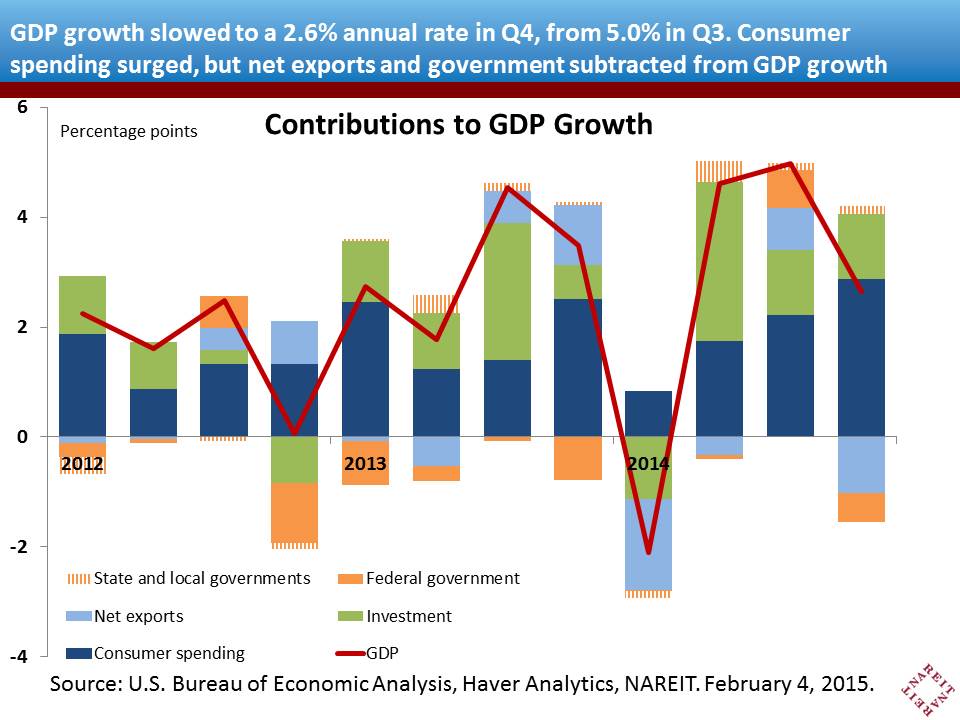

Sector rotation is primarily driven by changes in economic cycles, which impact different sectors at varying degrees. For example, during the expansion phase, sectors like technology and consumer discretionary tend to perform well. In contrast, in a recession, defensive sectors like utilities and consumer staples often outperform.

Expectations vs Reality

While sector rotation theory suggests that investors can achieve superior returns by accurately predicting economic cycles and adjusting their portfolios accordingly, in reality, this can be challenging. Economic cycles are not always predictable, and market movements cannot be accurately forecasted consistently. Therefore, the actual performance of a sector can significantly deviate from expectations, resulting in potential investment risks.

What Could Go Wrong

If investors overly rely on sector rotation as an investment strategy, they could be exposed to increased risk. Misinterpreting or incorrectly predicting economic indicators could lead to poor investment decisions and potential losses. Additionally, a heavy focus on sector rotation might cause investors to overlook individual company fundamentals, which are equally important for long-term investment success.

Long-Term Perspective

While sector rotation can certainly impact short-term market performance, it’s important for long-term investors to maintain a diversified portfolio that can withstand various market cycles. The key is to balance the focus between understanding sector trends and assessing individual company performance to achieve sustainable long-term growth.

Investor Tips

- Keep an eye on economic indicators and market trends to identify potential sector rotation.

- Maintain a diversified portfolio to mitigate the risks associated with sector rotation.

- Don’t overlook individual company fundamentals when focusing on sector trends.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Always do your own research and consider your financial position before making investment decisions.

Leave a Reply