Why Sector Profit Cycle Analysis Matters

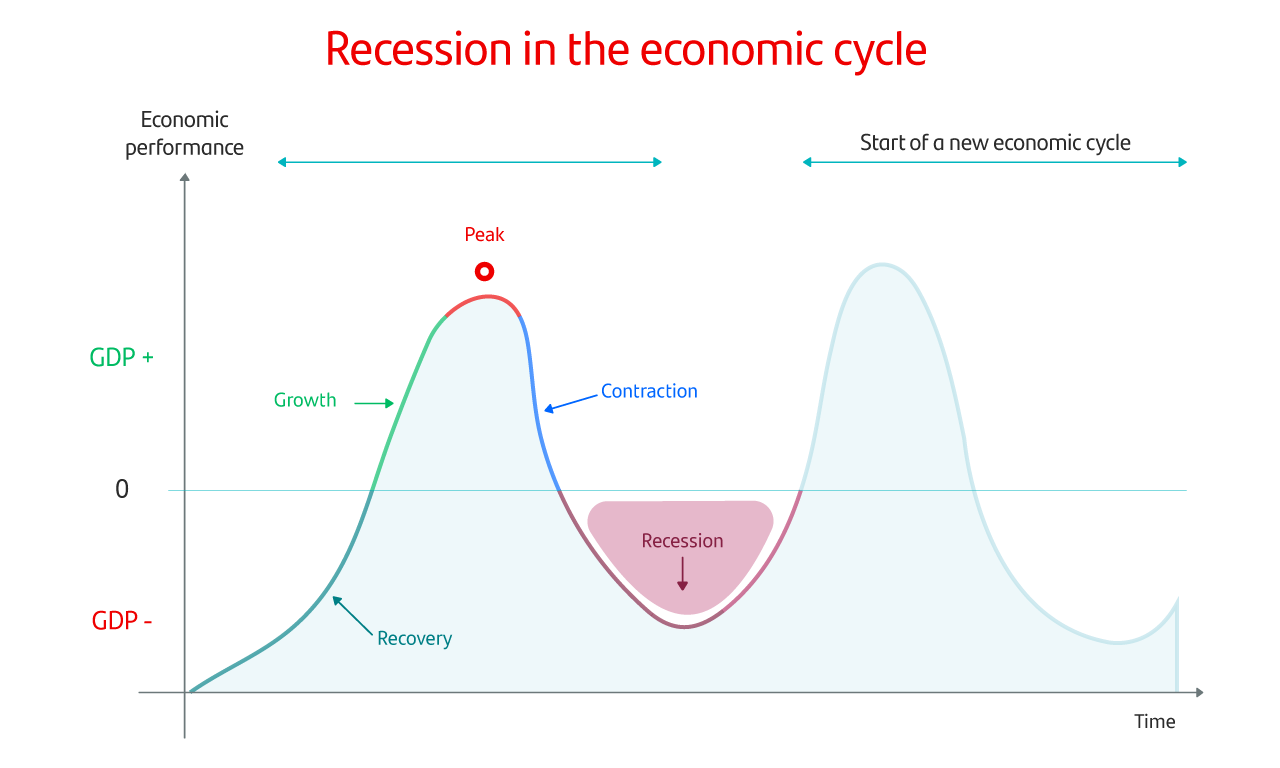

For long-term investors, understanding the sector profit cycle, a key component of the broader business cycle, is essential. It provides insights into how profits fluctuate across different sectors at various stages of the economic cycle. This knowledge can guide investment decisions, by highlighting which sectors are likely to outperform or underperform in the coming years. Ultimately, it can lead to better portfolio diversification and risk management.

Key Business and Financial Drivers

The sector profit cycle is influenced by several factors such as demand-supply dynamics, interest rate trends, inflation, technological innovation, and government policies. For instance, in an expansion phase, sectors like technology and consumer discretionary typically perform well due to increased consumer spending and business investment. Conversely, in a downturn, defensive sectors such as utilities and consumer staples may outperform as they are less sensitive to economic fluctuations.

Expectations vs Reality

Investors often have preconceived notions about which sectors will flourish during certain economic phases. However, these expectations may not always align with reality. For example, it is commonly believed that the financial sector thrives in a rising interest rate environment. However, this isn’t always the case. If interest rate hikes are too aggressive, it could lead to decreased borrowing and negatively impact the sector’s profitability.

What Could Go Wrong

Predicating investment decisions solely on the sector profit cycle can be risky. The cycle is influenced by numerous factors that are often unpredictable, such as geopolitical events, policy changes, and global pandemics. Additionally, each sector comprises diverse companies, each with its unique business model and growth prospects. Hence, a broad-brush approach might overlook company-specific factors that could impact performance.

Long-term Perspective

While the sector profit cycle can provide guidance on short-term investment decisions, it is important to connect these factors to multi-year outcomes. For instance, a sector that performs poorly during a recession may still be a good long-term investment if it has strong fundamentals and is poised to benefit from long-term economic trends.

Investor Tips

- Use sector profit cycle analysis as one of many tools in your investment decision-making process.

- Stay updated with economic trends and how they impact different sectors.

- Look beyond the cycle: Consider company-specific factors and long-term sector trends.

This article is provided for informational purposes only and is not intended as investment advice. Always conduct your own research or consult with a professional before making investment decisions.

Leave a Reply