Introduction: Why Low Volatility Matters to Investors

Low volatility stocks have often been a safe haven for investors seeking stable returns over the long run. Such stocks are less sensitive to market fluctuations, offering protection in turbulent times while providing steady growth during market upswings. Understanding the dynamics behind low volatility stocks can aid in creating a resilient investment portfolio.

Key Business or Financial Drivers

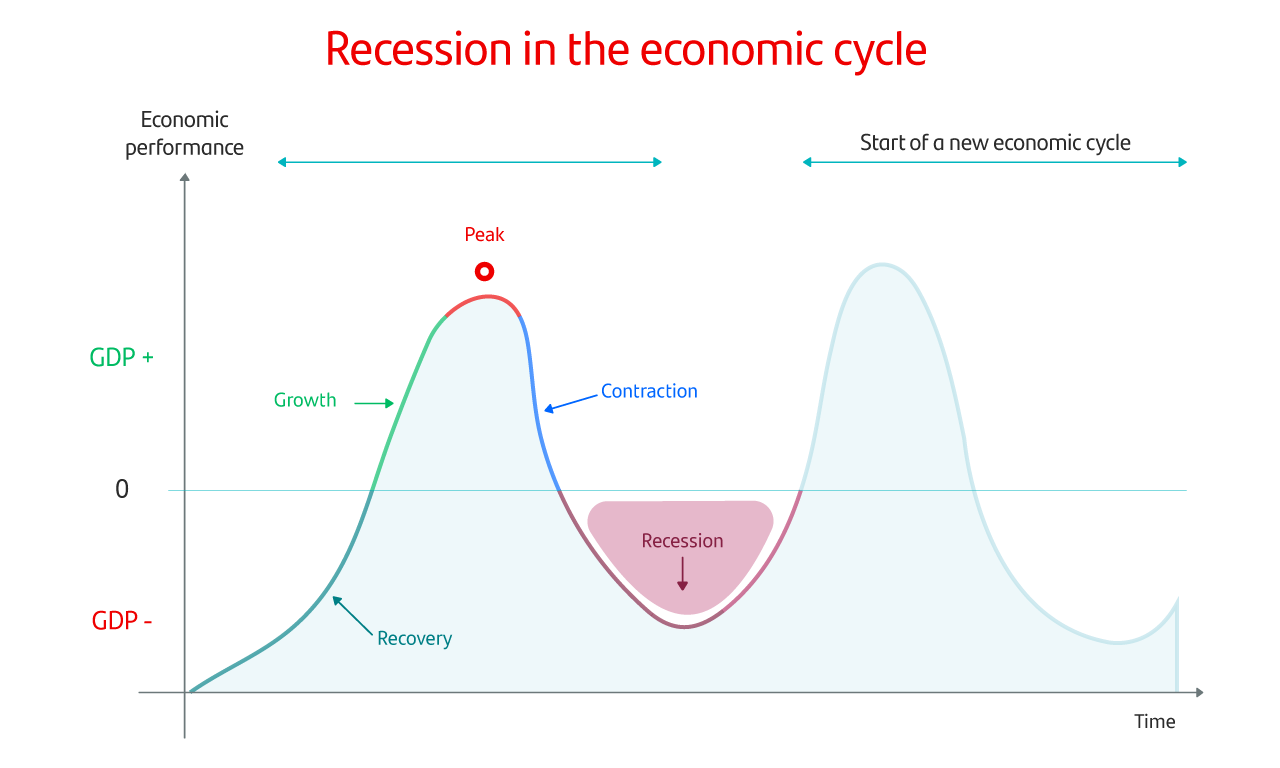

Low volatility stocks are often found in sectors like utilities, consumer staples, and healthcare. These sectors are less susceptible to economic cycles due to their essential nature. Stable cash flows, consistent dividends, and strong balance sheets are key financial drivers that make these stocks less volatile.

Stable Cash Flows

Companies with stable cash flows can better manage economic downturns, thereby reducing stock price volatility. This financial stability is crucial for long-term investors.

Consistent Dividends

Regular dividend payments are a hallmark of low volatility stocks. These dividends provide a consistent return to investors and can cushion against potential price drops.

Expectations Vs Reality

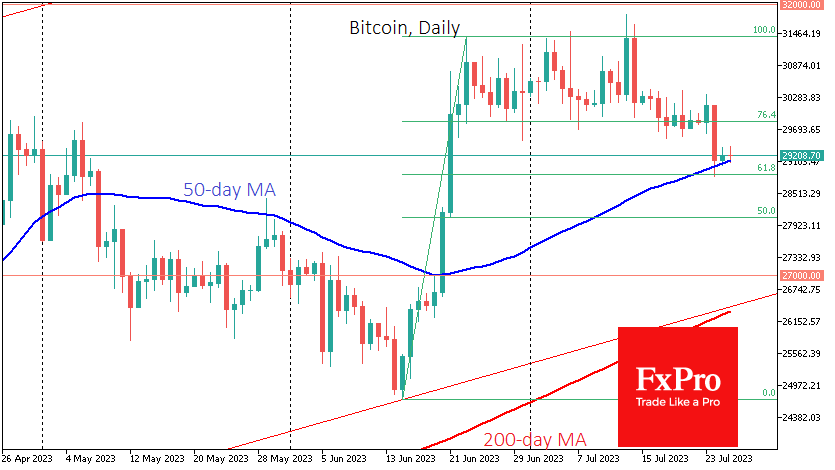

Investors often associate low volatility stocks with less risk and steady returns. However, these stocks may underperform during bull markets. Investors must balance the desire for stability with the potential for missed opportunities in higher-growth sectors.

What Could Go Wrong

While low volatility stocks offer stability, they are not immune to risks. Companies can face industry disruptions, regulatory changes, or unforeseen crises that destabilize their earnings. Moreover, a sudden market swing towards high-growth stocks can lead to underperformance of low volatility stocks.

Long-Term Perspective

From a multi-year perspective, low volatility stocks can provide steady returns and capital preservation. Yet, it’s essential to consider the opportunity cost of not being exposed to potentially higher-growth sectors. Hence, a balanced portfolio with a mix of low and high volatility stocks can be an optimal strategy for long-term investors.

Investor Tips

- Identify low volatility stocks in stable sectors like utilities, consumer staples, and healthcare.

- Look for companies with stable cash flows and consistent dividends.

- Balance your portfolio with a mix of low and high volatility stocks to safeguard against market swings and tap into growth opportunities.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply