Why This Topic Matters to Investors

Understanding the industrial trends and sectoral shifts in the US stock market can provide investors with valuable insights to make informed investment decisions. It equips them to identify potential growth sectors, assess company’s performance within its industry, and gauge the economic climate. Hence, an in-depth industry research evaluation of US stocks is crucial for long-term investment success.

Key Business and Financial Drivers

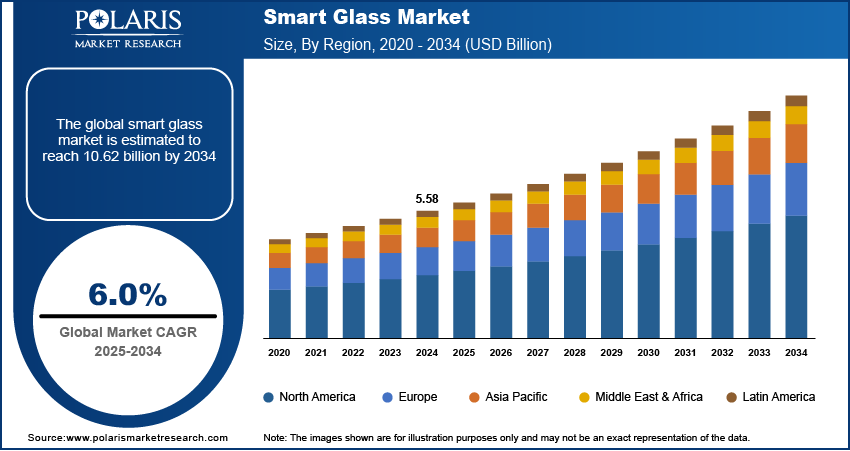

Several factors drive the performance of industries and consequently the US stocks. Economic conditions, technological advancements, regulatory changes, and consumer behavior are among the primary drivers. For instance, a booming economy often correlates with an uptick in industrial production and consumer spending, both of which can spur the growth of related stocks.

Expectations vs Reality

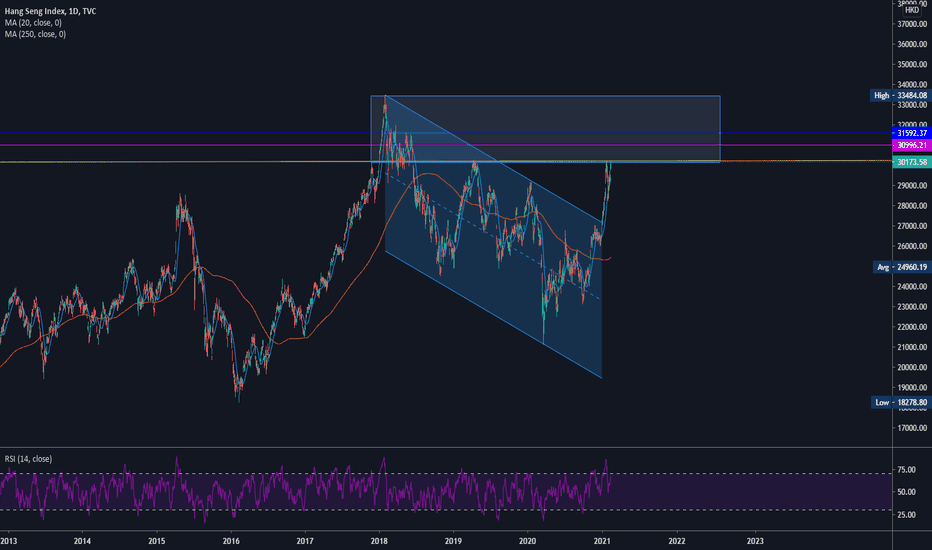

Investors typically price their expectations into the stock market based on the perceived future growth of industries. However, these projections may not always align with reality. For instance, while investors may anticipate robust growth in the technology sector due to technological advancements, regulatory changes or unforeseen economic downturns could hamper this growth.

What Could Go Wrong

Investments in the stock market are subject to various risks. Economic downturns, policy changes, or major disruptions in the industry can negatively impact stock performance. Additionally, overvaluation of stocks based on inflated expectations can also lead to market corrections, impacting long-term investments.

Long-term Perspective

While short-term market fluctuations can affect investment returns, a long-term perspective can help investors ride out temporary market volatility. By focusing on sectors with sustainable growth prospects and considering macroeconomic factors, investors can potentially secure positive multi-year outcomes.

Investor Tips

- Stay updated with industry trends and economic indicators.

- Assess the realistic growth prospects of sectors before investing.

- Consider the risks and maintain a diversified portfolio to mitigate potential losses.

Please note, this article is for informational purposes only and should not be considered as financial advice. Always consult with a financial advisor before making any investment decisions.

Leave a Reply