Why Portfolio Concentration Analysis Matters

Portfolio concentration analysis is a critical aspect of investment management that allows investors to understand their risk exposure and potential return. By understanding the degree of portfolio concentration, investors can make informed decisions about asset allocation, risk management, and long-term investment strategies.

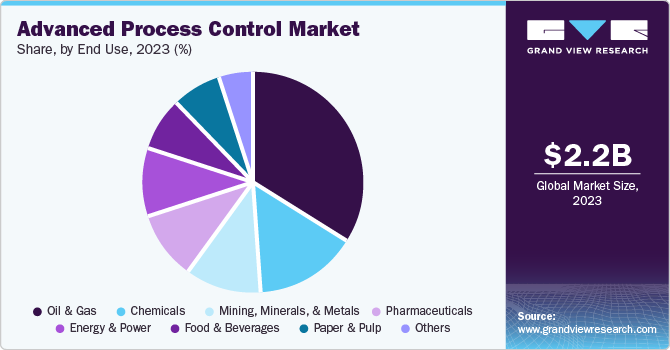

Key Business and Financial Drivers

Several key drivers affect the concentration of a portfolio. These include the investor’s risk tolerance, investment objectives, asset allocation strategies, market conditions, and the performance of individual investments within the portfolio.

Risk Tolerance and Investment Objectives

An investor’s risk tolerance and investment objectives are key determinants of portfolio concentration. Investors with higher risk tolerance may opt for a more concentrated portfolio to maximize potential returns, while those with lower risk tolerance may prefer a diversified portfolio to mitigate risks.

Asset Allocation Strategies

Asset allocation strategies also play a crucial role in portfolio concentration. Strategic asset allocation involves creating a diversified portfolio based on long-term investment goals, while tactical asset allocation involves short-term adjustments to take advantage of market conditions.

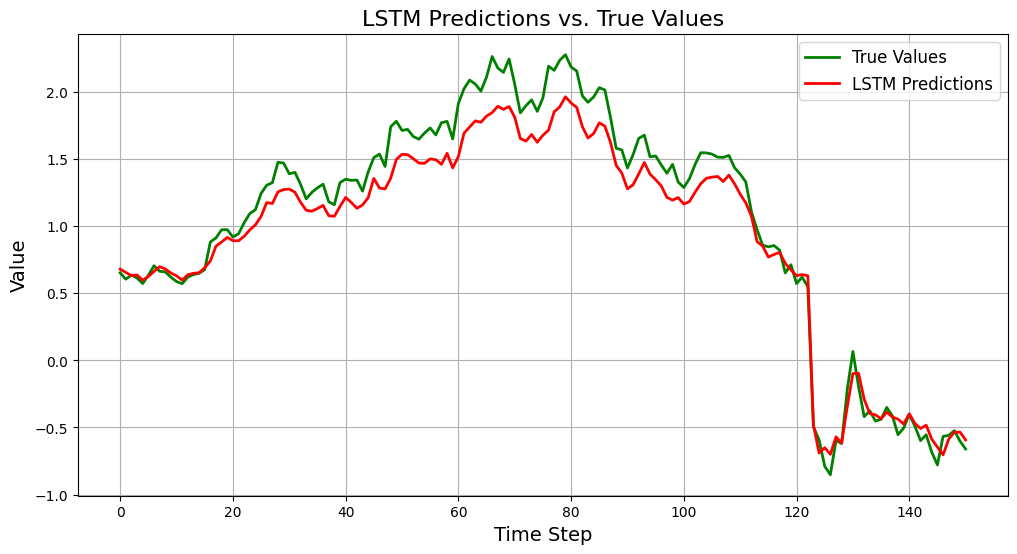

Expectations vs Reality

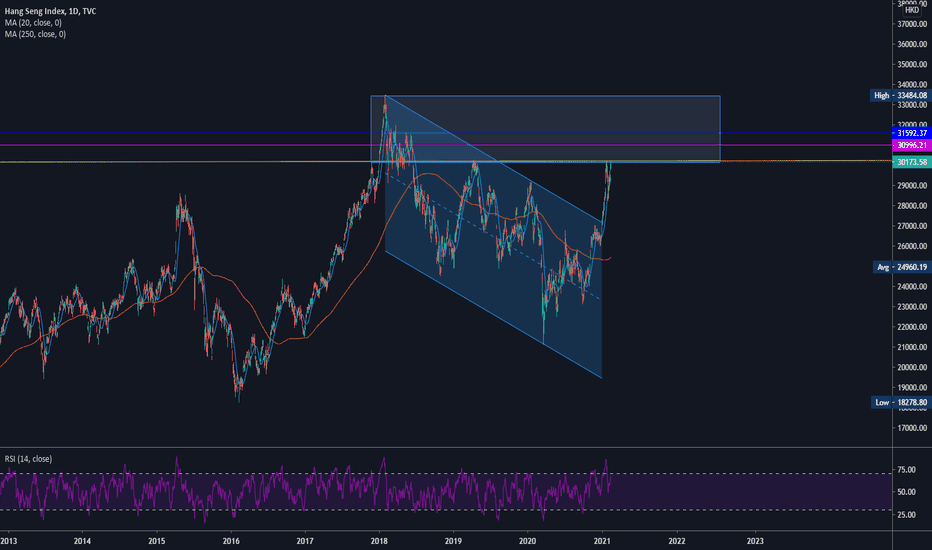

Many investors expect that a concentrated portfolio will yield higher returns due to the potential for outperformance by individual investments. However, this is not always the case. A concentrated portfolio is also more susceptible to volatility and potential losses, especially if the investments perform poorly.

What Could Go Wrong

Concentration risk is the primary concern with concentrated portfolios. If a significant portion of the portfolio is invested in a single asset or a small number of assets, the portfolio’s performance could be severely affected if these assets perform poorly. Additionally, a lack of diversification can also lead to higher volatility and potential losses.

Long-term Perspective

While a concentrated portfolio can provide significant returns in the short term, it’s important to consider the long-term implications. Over time, a diversified portfolio can potentially offer more stable returns and lower risk, making it a more suitable choice for long-term investors.

Investor Tips

- Consider your risk tolerance and investment objectives before deciding on the degree of portfolio concentration.

- Regularly review and adjust your asset allocation strategies to mitigate concentration risk.

- Understand that while a concentrated portfolio can offer higher returns, it also comes with higher risks.

This article is intended for informational purposes only. It is not to be construed as investment advice or a recommendation to buy or sell any security. Always conduct your own research and consult with a professional investment advisor before making investment decisions.

Leave a Reply