Why Consistent US Stock Research Matters

For long-term investors, understanding the importance of consistent US stock research is critical. It’s not just about picking the right stocks, but also about monitoring their performance and making necessary adjustments over time. Consistent research helps investors stay informed about market trends and make sound decisions based on the most recent data.

Key Business and Financial Drivers

Several factors drive the success of stocks in the US market. These include the company’s financial health, economic conditions, and industry trends. By consistently researching these factors, investors can gain a better understanding of a company’s potential for long-term growth.

Economic Conditions

Investors must keep an eye on the overall economic conditions. Recession, inflation, or high unemployment rates can negatively affect stock prices. Conversely, a booming economy can lead to growth in the stock market.

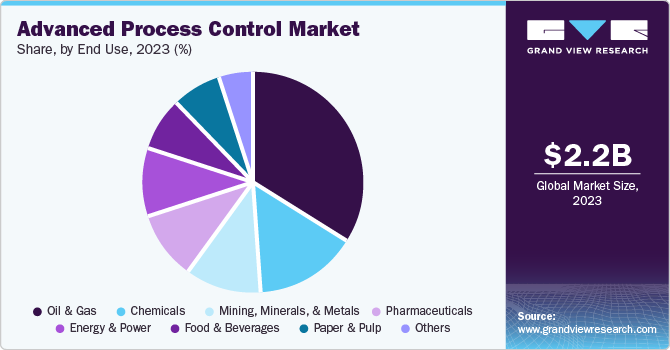

Industry Trends

Changes in industry trends can significantly impact a company’s success. For instance, the rise of technology and remote work has boosted certain sectors like IT and communications.

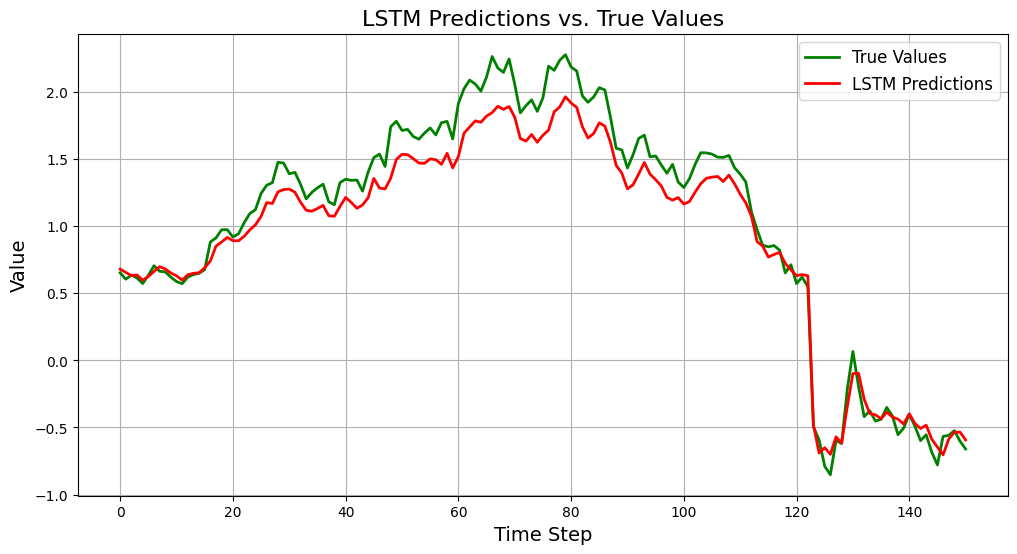

Expectations Vs. Reality

The stock market is largely driven by expectations. Investors form expectations about a company’s future performance based on their research. However, there is always the risk that reality may not meet these expectations. For instance, a company might report lower than expected earnings or face an unforeseen issue, causing its stock price to drop.

What Could Go Wrong

Several things could go wrong when investing in stocks. Market volatility, poor company performance, and economic downturns are all potential risks. Consistent research helps investors anticipate these risks and take steps to mitigate them.

Investing from a Long-Term Perspective

Investing in stocks is not about quick gains. It requires a long-term perspective and consistent research. Short-term fluctuations in the market should not deter investors. Instead, they should focus on the company’s long-term growth potential.

Investor Tips

- Stay informed about market trends and economic conditions

- Monitor your stocks regularly and make adjustments as needed

- Don’t let short-term market fluctuations deter you from your long-term investment strategy

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or seek advice from a financial advisor before making investment decisions.

Leave a Reply