Introduction

The financial structure of a company, which includes its capital structure and sources of financing, plays a crucial role in determining its risk and return profile. For long-term investors in US stocks, understanding financial structure trends can offer valuable insights into the investment worthiness of different sectors and companies. This analysis can help them make informed decisions and potentially enhance their portfolio returns.

Key Business and Financial Drivers

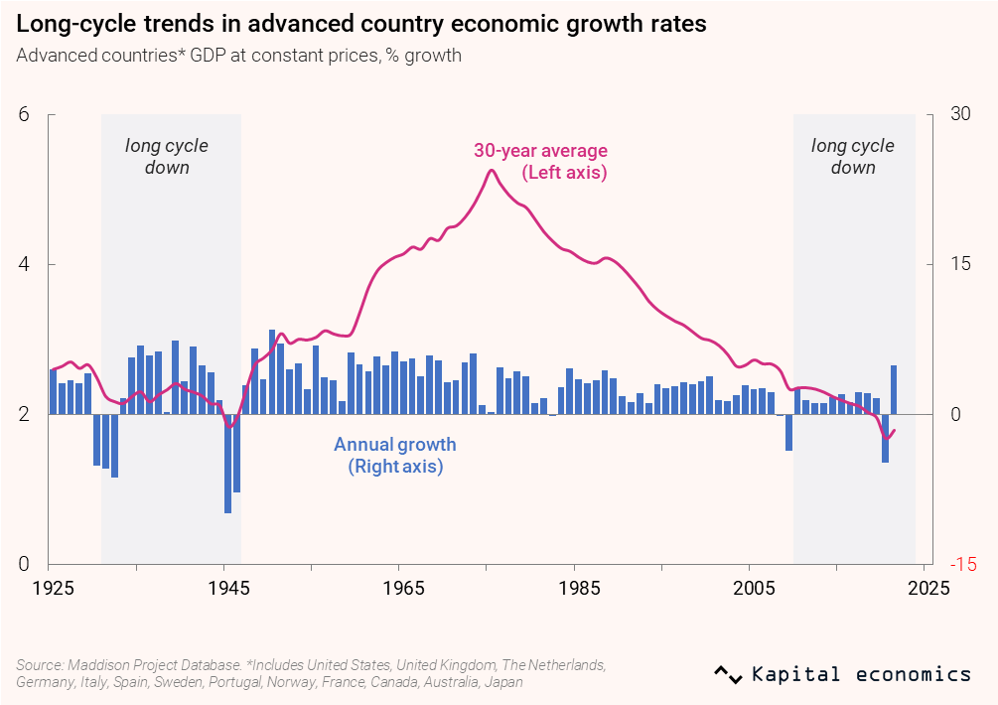

Several factors influence the financial structure trends in US stocks. These include interest rates, profitability, growth opportunities, tax considerations, and the overall economic environment. For instance, in a low-interest-rate environment, companies may prefer debt financing over equity financing due to the cost advantage. However, high levels of debt can increase financial risk, especially in uncertain economic times.

Expectations vs Reality

Investors often expect companies with strong profitability and growth prospects to have a more equity-oriented financial structure. This is because such companies can afford to finance their operations and growth through retained earnings, reducing their reliance on external financing. However, in reality, many high-growth companies often have a high debt-to-equity ratio due to aggressive expansion strategies. Therefore, investors should not rely solely on expectations but should analyze the actual financial structure and its implications.

What Could Go Wrong

While financial structure trends can provide valuable clues about a company’s financial health and risk profile, they are not infallible. A company with a seemingly healthy financial structure could still face financial distress due to unforeseen circumstances like economic downturns or industry-specific challenges. Therefore, investors should also consider other risk factors, such as market risk, credit risk, and operational risk, when making investment decisions.

Long-term Perspective

Financial structure trends can impact a company’s long-term financial health and profitability. For instance, a company with a high debt-to-equity ratio may face higher interest costs in the future, which could erode its profitability. On the other hand, a company with a low debt-to-equity ratio might not be taking full advantage of the tax benefits of debt financing. Therefore, investors should consider the implications of financial structure trends on multi-year outcomes.

Investor Tips

- Look beyond the headline numbers: Analyze the underlying factors influencing the financial structure trends.

- Consider the industry context: Different industries have different norms and trends related to financial structures.

- Stay updated: Keep track of changes in financial structure trends as they can provide early warning signals of potential risks or opportunities.

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own due diligence before making investment decisions.

Leave a Reply