Introduction

Investment in US stocks is an integral part of many long-term investment strategies. Understanding the buy-side investment research workflow for US stocks can provide investors with the tools they need to make informed investment decisions and potentially generate higher returns. This article delves into the core aspects of the research workflow and provides a few tips for investors to better navigate the US stock market.

Key Business or Financial Drivers

Understanding the key business and financial drivers is crucial for any investor. These factors provide insights into a company’s financial health, future growth prospects, and potential risks. They include revenue growth, profit margins, cash flow, debt levels, and competitive positioning. By analyzing these drivers, investors can gauge the potential return on investment.

Expectations vs Reality

Investors often base their decisions on expectations about a company’s future performance. However, these expectations may not always align with reality. For instance, a company might be overvalued if its stock price reflects overly optimistic growth projections. Conversely, a company might be undervalued if the market underestimates its potential. Therefore, it’s essential for investors to critically assess the gap between expectations and reality when making investment decisions.

What Could Go Wrong

Investing in stocks always involves a degree of risk. Market volatility, regulatory changes, management missteps, or unexpected events like economic downturns can negatively impact a company’s stock price. Therefore, investors need to consider these potential pitfalls and ensure they have a diversified portfolio to mitigate these risks.

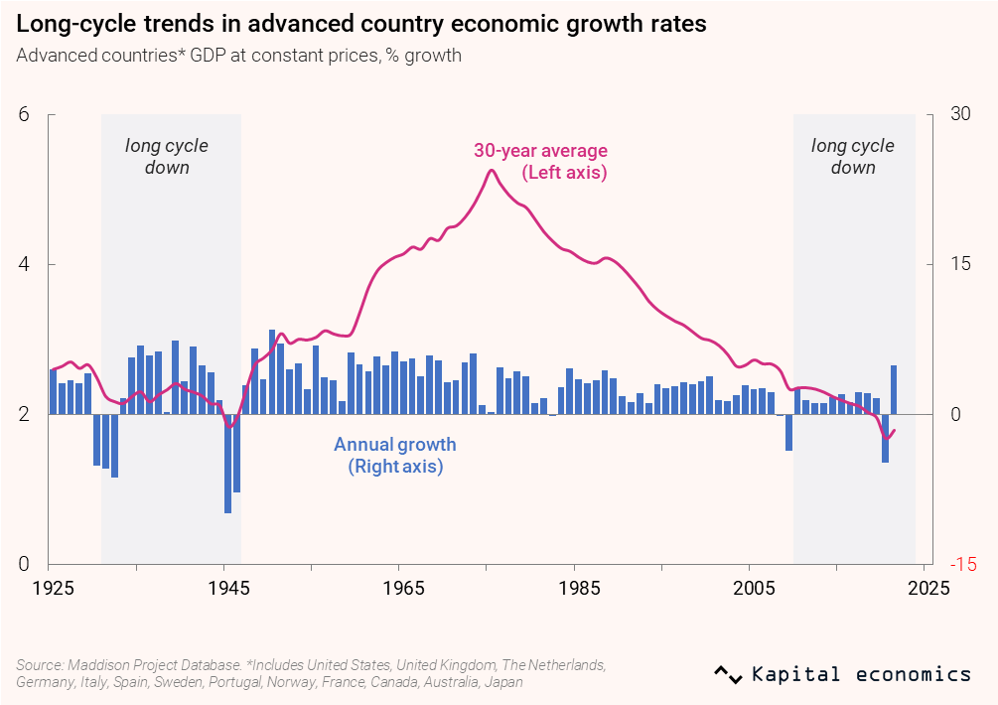

Long-Term Perspective

While short-term market fluctuations can influence investment decisions, it’s important for investors to maintain a long-term perspective. By focusing on a company’s fundamental strengths, growth potential, and the overall economic outlook, investors can better navigate short-term volatility and potentially achieve more substantial returns over time.

Investor Tips

- Understand the key business and financial drivers that affect a company’s stock price.

- Assess the gap between market expectations and reality when making investment decisions.

- Consider potential risks and ensure you have a diversified portfolio.

- Maintain a long-term investment perspective.

This article is intended for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply