Why This Topic Matters to Investors

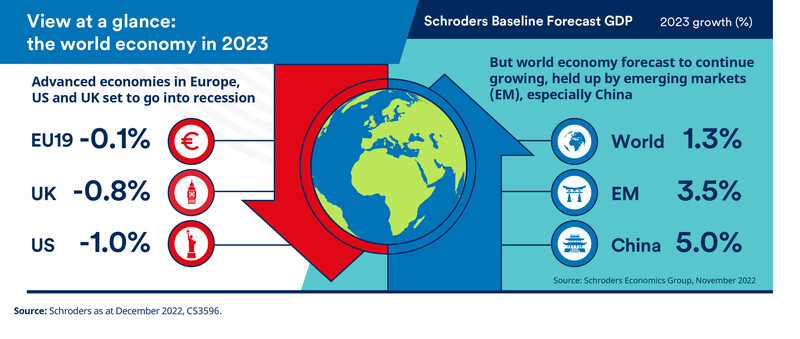

The deceleration of industry growth can significantly impact the performance of US stocks. This change can signal a potential shift in the market dynamics, altering the investment landscape. Understanding these trends allows investors to make informed decisions and adjust their investment strategies accordingly.

Key Business and Financial Drivers

Several factors drive the deceleration of industry growth. These can include market saturation, changes in consumer behavior, technological advancements, regulatory changes, and shifts in global economic conditions. These factors can impact individual companies differently, leading to a wide variation in stock performance within the same industry.

Expectations vs Reality

While market expectations often factor in known growth deceleration, unexpected changes can create a gap between expectations and reality. For example, if the deceleration is faster or slower than anticipated, it may result in significant stock price adjustments. Investors who are aware of these potential discrepancies can better manage risks and capitalize on opportunities.

What Could Go Wrong

Industry growth deceleration can lead to lower-than-expected earnings, resulting in stock price declines. Further, if the growth slowdown is accompanied by economic contraction, it could result in a bear market. Additionally, companies facing decelerating growth may cut back on dividends or buybacks, impacting investor returns.

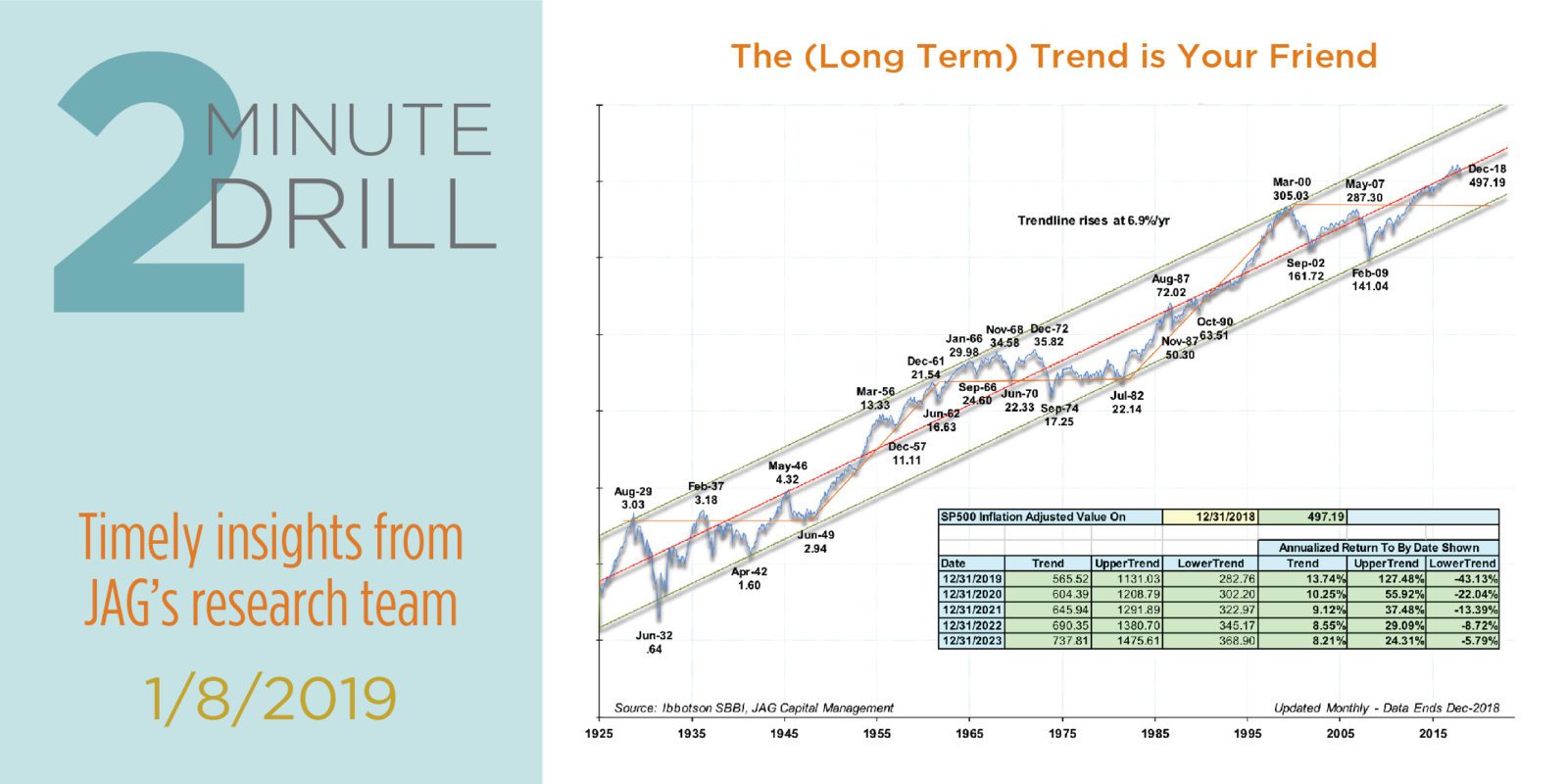

Long-Term Perspective

While short-term factors such as earnings reports and economic news can cause stock price volatility, the long-term performance of stocks is more closely tied to the underlying business fundamentals. A deceleration in industry growth can signal a maturing market, potentially leading to lower but more stable returns in the long run.

Investor Tips

- Stay informed about industry trends and changes in growth rates.

- Consider the impact of growth deceleration on individual companies within an industry.

- Adjust your investment strategy to align with changing market conditions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research before making any investment decisions.

Leave a Reply