Introduction: Why Portfolio Optimization Matters?

Portfolio optimization is an essential part of any astute investor’s strategy. Understanding this topic can help you maximize returns and minimize risks over the long term. In the US, consultation services are available to assist investors in optimizing their portfolios, and this article provides an in-depth analysis of the role these services play in investment strategies.

Key Business and Financial Drivers

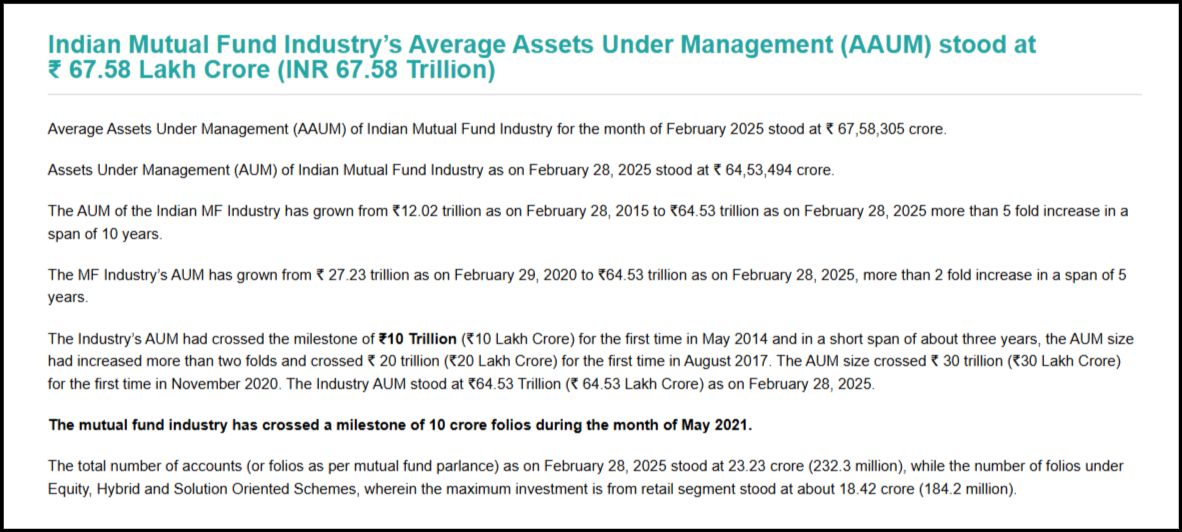

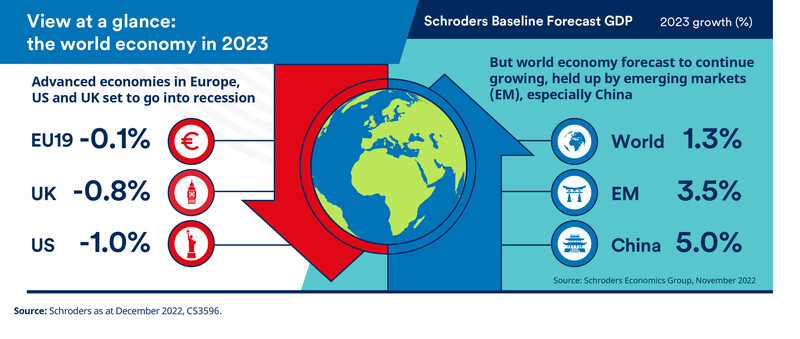

Several key financial and business drivers impact the demand for portfolio optimization consultation services. These include market volatility, changes in monetary policy, and investor sentiment. Market volatility can drive investors towards consultation services to help manage risk. Similarly, changes in monetary policy can impact investor strategies, leading to a need for professional consultation. Lastly, investor sentiment, driven by economic indicators, can also motivate people to seek expert advice.

Expectations vs Reality

Many investors approach portfolio optimization consultation services with the expectation of receiving a perfect investment strategy. However, the reality is that while these services can provide valuable insights and help manage risk, they cannot guarantee absolute profits. It is important to have a realistic understanding of what these services can provide.

What Could Go Wrong

Despite their expertise, portfolio optimization consultants cannot predict market movements with 100% certainty. Economic downturns, sudden market crashes, or unforeseen changes in monetary policy can all impact the effectiveness of an optimized portfolio strategy. Investors should be prepared for these potential risks.

Long-term Perspective

While short-term market fluctuations can impact your investment portfolio, it is essential to maintain a long-term perspective. Portfolio optimization consultation services can help you navigate short-term risks, but your long-term investment goals should guide your overall strategy. Sticking to a long-term investment plan can help you weather short-term market volatility and achieve sustained growth over time.

Investor Tips

- Seek portfolio optimization consultation services to manage risk and develop a strategic investment plan.

- Maintain realistic expectations about what these services can provide.

- Always keep your long-term investment goals in mind, even during periods of market volatility.

Disclaimer

This article is intended for informational purposes only and should not be considered as investment advice. Always do your own research or consult with a financial advisor before making investment decisions.

Leave a Reply