Introduction: The Relevance of Growth Investing Strategies

The discussion of growth investing strategies in US stocks is crucial for investors looking to capitalize on companies with accelerated expansion rates. These strategies allow investors to identify and invest in companies whose earnings are expected to grow at an above-average rate compared to other companies in the market.

Key Drivers of Growth Investing

Understanding the underlying drivers of growth investing is an integral part of successful portfolio management. The key factors that typically drive growth investments include technological innovation, market leadership, superior management, and regulatory tailwinds. These factors often lead to higher than average earnings growth, thus providing significant capital appreciation potential over the long term.

Technological Innovation

Companies that are at the forefront of technological innovation often have significant growth potential. They can disrupt existing markets or create new ones, leading to rapid revenue growth.

Market Leadership

Firms that possess a dominant market share or have unique competitive advantages typically generate robust and sustainable earnings growth. These companies can often reinvest their earnings at high rates of return, fueling future growth.

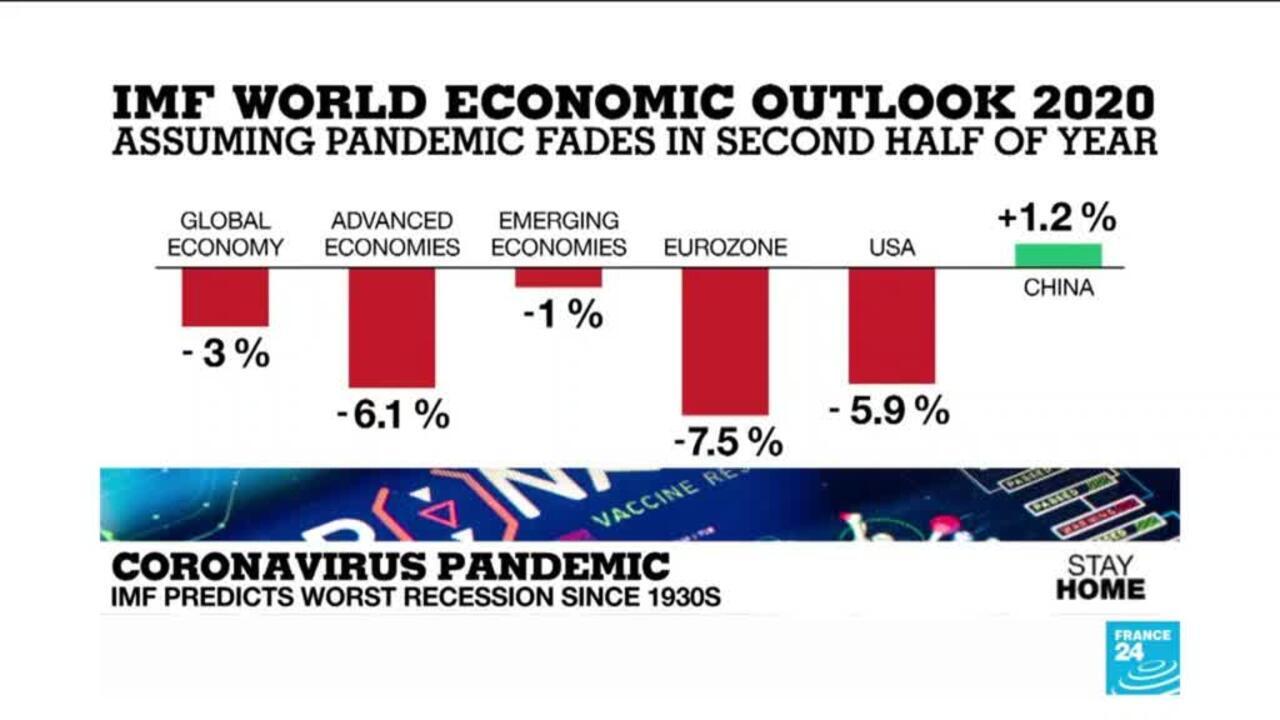

Expectations vs Reality

While growth investing strategies can provide substantial returns, it’s vital to align expectations with reality. Given the high expectations for growth stocks, they can be more vulnerable to market downturns if these expectations are not met. Therefore, it’s essential to assess whether the projected growth rates are realistic and sustainable over the long term.

What Could Go Wrong

Investing in growth stocks comes with its share of risks. The most common risk is overvaluation, where investors pay a premium for expected future growth that may not materialize. Other risks include increased competition, changes in market conditions, or regulatory challenges that could hamper a company’s growth trajectory.

Long-Term Perspective

While short-term market fluctuations can affect the performance of growth stocks, a long-term perspective is essential. Over the long term, the fundamentals of a company, such as its earnings growth and competitive advantages, will drive its stock performance.

Investor Tips

- Assess the sustainability of a company’s growth: Look beyond short-term earnings growth and evaluate whether the company’s competitive advantages are durable over the long term.

- Consider the valuation: While growth stocks often trade at higher valuations, it’s important to ensure that these valuations are justified by the company’s growth prospects.

- Stay patient: Growth investing requires a long-term perspective. It’s important to stay patient and not get swayed by short-term market fluctuations.

Please note, this article is for informational purposes only and should not be construed as investment advice. Always conduct your research or consult with an investment professional before making investment decisions.

Leave a Reply