Why This Topic Matters to Investors

Identifying long-term visibility stock ideas is a crucial part of portfolio management. While short-term stock market fluctuations can be influenced by a myriad of factors, long-term investments are typically driven by fundamentals. Therefore, understanding the potential growth trajectory of a company, its competitive positioning, and the sustainability of its business model are critical for investors with a long-term horizon.

Analysis of Key Business or Financial Drivers

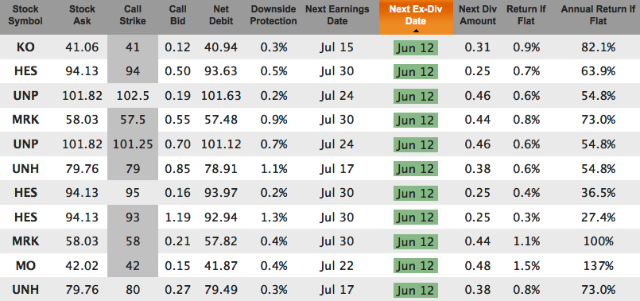

Revenue growth, profit margins, and return on equity are among the key financial metrics that impact a company’s stock performance over the long run. Companies that consistently deliver growth and profitability, having a competitive advantage, and are run by competent management teams, are likely to outperform in the long term.

Revenue Growth

Companies that can consistently grow their revenue over time are often able to do so because they have a strong competitive advantage, a large addressable market, and effective sales and marketing strategies. This is an important signal for investors as it indicates a company’s potential for long-term success.

Profit Margins

Profit margins are a key indicator of a company’s pricing power and cost efficiency. Companies with high and improving profit margins are often well-managed and operate in favorable market conditions. This is a positive signal for long-term investors.

Expectations vs Reality

While financial metrics are important, they only tell part of the story. Investors must also consider how a company’s actual performance compares to market expectations. The market’s expectations for a company are often reflected in its stock price. If a company consistently exceeds these expectations, it can be a strong signal for long-term investors.

What Could Go Wrong

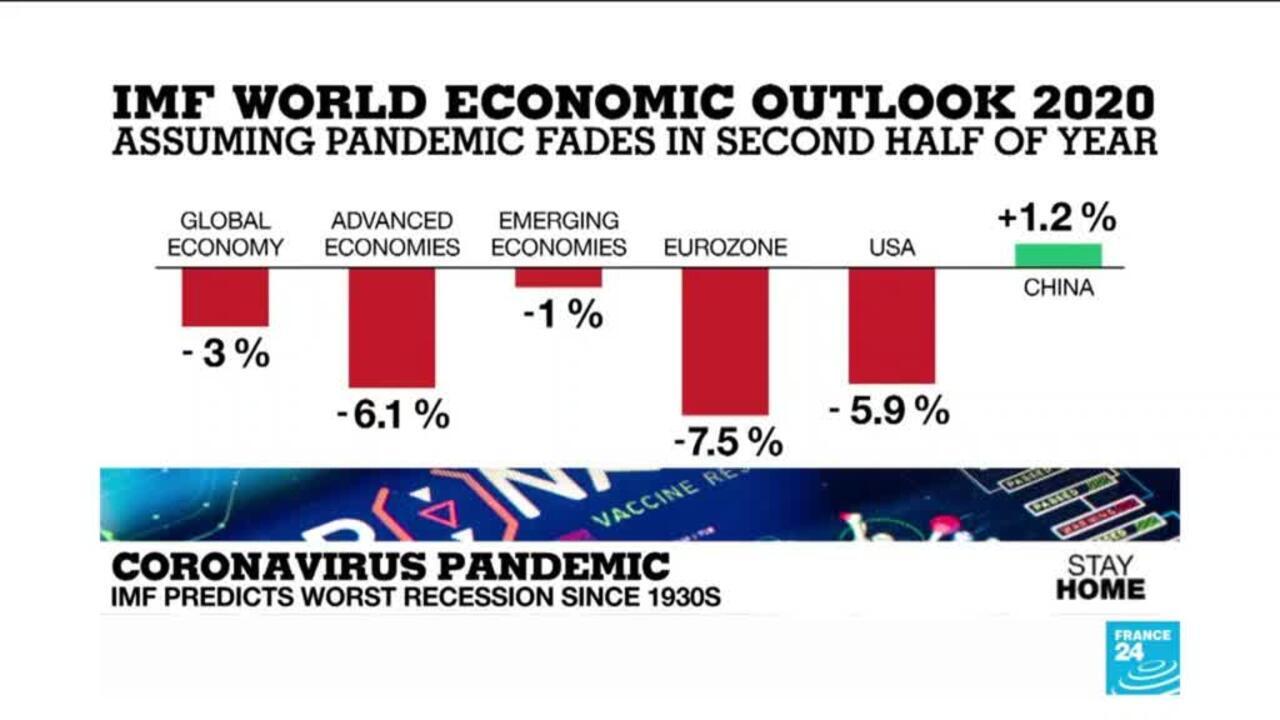

While there are many potential upsides to long-term investing, there are also risks that need to be considered. For instance, economic recessions, changes in regulatory environments, and competitive dynamics can all impact a company’s long-term performance. Investors should always be prepared for these risks and adjust their investment strategies accordingly.

Long-term Perspective

When looking at long-term visibility stock ideas, it’s important to connect short-term factors to multi-year outcomes. For instance, a company’s ability to weather economic downturns, adapt to regulatory changes, and respond to competitive threats can all provide insight into its long-term potential.

Investor Tips

- Focus on companies with strong competitive advantages and sustainable business models.

- Look for companies that consistently exceed market expectations.

- Always consider the potential risks and adjust your investment strategy accordingly.

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional investment advisor before making investment decisions.

Leave a Reply