Why Earnings Variability Matters

Earnings variability, the fluctuation in a company’s profits from one period to another, can have a significant impact on a firm’s market value. For long-term investors, understanding this concept helps them gauge the stability of their investments and make informed decisions.

Key Drivers of Earnings Variability

Several factors can cause earnings variability, including changes in market demand, operational efficiency, and regulatory environment. Changes in the overall economy, such as inflation or interest rates, can also affect a company’s profitability.

Market Demand

Changes in consumer preferences or competitive dynamics can greatly influence a company’s sales volume, thus affecting its earnings.

Operational Efficiency

Significant changes in the cost of raw materials or efficiency of production processes can lead to variable earnings. Operational improvements or setbacks directly influence a company’s bottom line.

Regulatory Environment

Changes in taxation or industry-specific regulations can have a substantial impact on a company’s profitability. It’s important for investors to keep an eye on potential regulatory changes and how they might affect the companies they’re invested in.

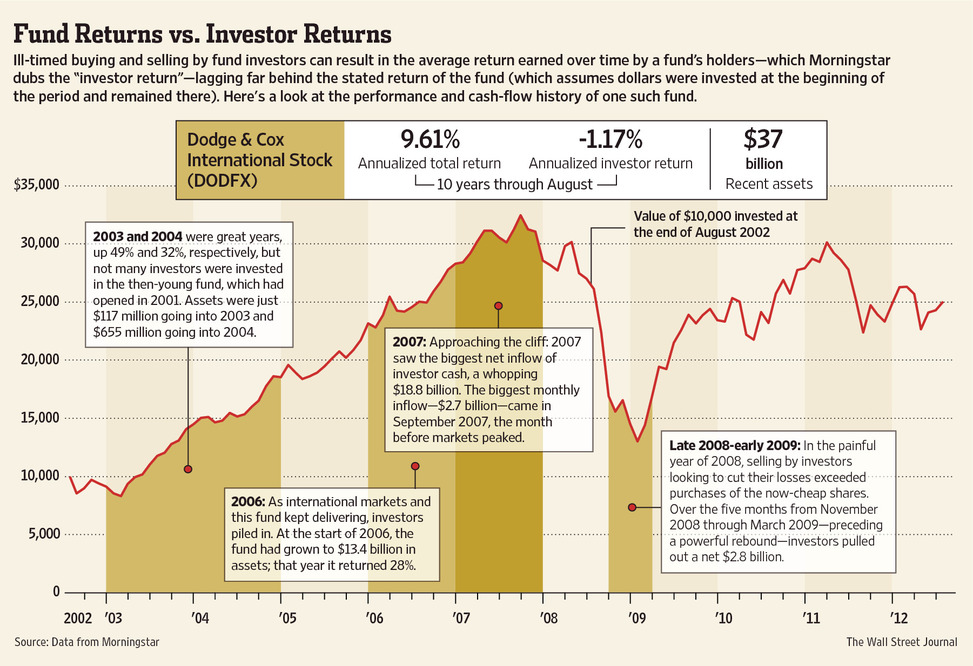

Expectations vs Reality

Investors often have expectations about a company’s future earnings based on its past performance. However, earnings variability can challenge these expectations. A company with high earnings variability may deliver unexpected results, affecting its stock price and investor sentiment.

What Could Go Wrong

Investing in companies with high earnings variability comes with risks. Sudden downturns in earnings could lead to a decrease in a company’s stock price, resulting in capital losses for investors. Additionally, high variability might indicate underlying business instability. It’s crucial for investors to consider these potential downsides when investing in such companies.

Long-Term Perspective

While earnings variability can impact short-term investor sentiments, long-term investors need to consider how it might affect a company’s multi-year outcomes. Persistent earnings variability might indicate deeper business issues that could affect a company’s long-term profitability and growth prospects.

Investor Tips

- Monitor trends in earnings variability to understand a company’s financial stability.

- Stay updated with changes in market conditions and regulatory environments that could affect earnings.

- Invest in companies with a solid history of stable earnings to mitigate the risks associated with earnings variability.

This article is intended for informational purposes only. It is not to be considered investment advice. Always conduct your own research and consult with a professional before making any investment decisions.

Leave a Reply