Why Portfolio Drawdown Analysis is Crucial for Investors

Portfolio drawdown analysis is a critical measure for long-term investors. It evaluates the potential risk and loss in a portfolio by calculating the largest drop from a peak to a trough. By understanding this risk, investors can make more informed decisions, manage their portfolios effectively, and mitigate potential losses.

Key Business and Financial Drivers in Portfolio Drawdown Analysis

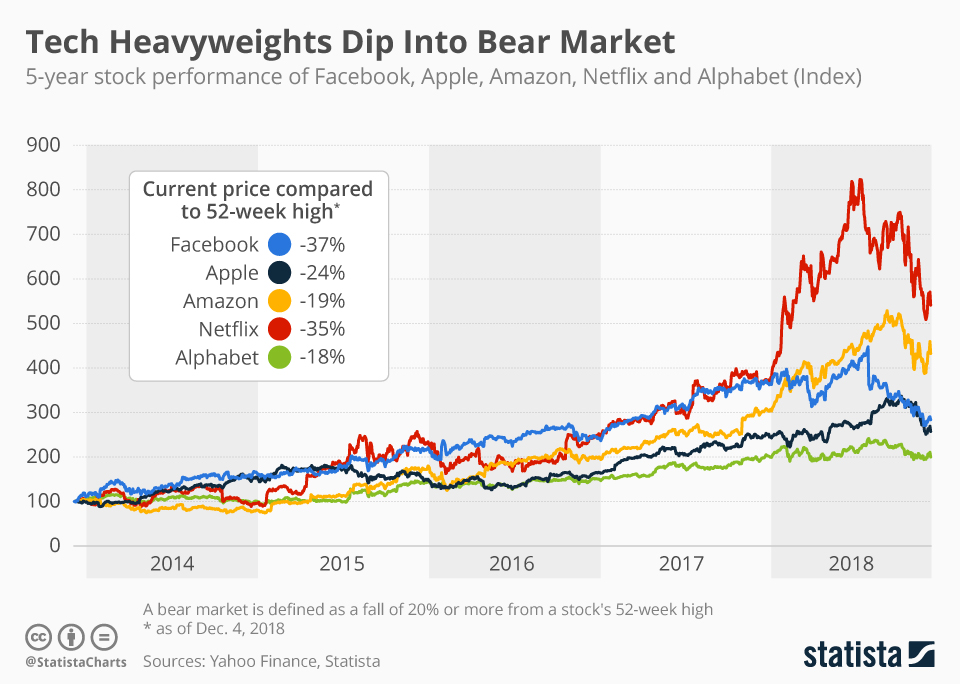

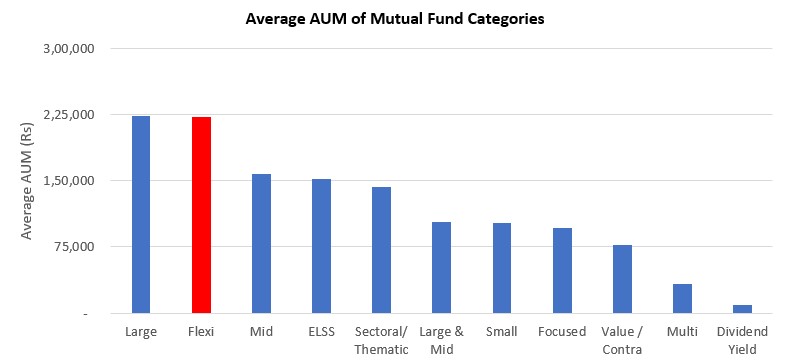

The major drivers influencing portfolio drawdown include market volatility, asset correlation, and the risk tolerance of the investor. High market volatility and a high correlation of assets within a portfolio can lead to larger drawdowns. Conversely, a portfolio with diverse, uncorrelated assets and a low-risk profile can help in minimizing drawdowns.

Expectations vs Reality in Portfolio Drawdowns

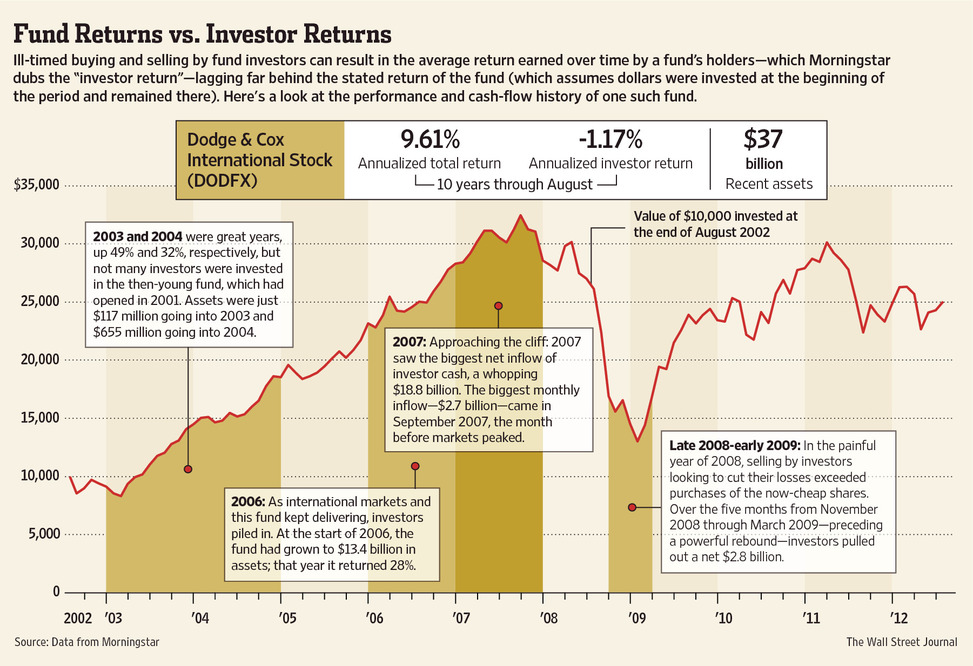

Many investors expect their portfolios to continuously generate positive returns. However, the reality is that investments can fluctuate and often experience drawdowns. The key is not to avoid drawdowns altogether, but to manage them effectively and understand their potential impact on the portfolio’s long-term performance.

What Could Go Wrong

Failure to consider drawdown risks can lead to significant financial losses, especially during market downturns. Overconfidence in one’s investment strategy or neglecting to diversify can also lead to higher drawdowns. Another risk is panic selling during a drawdown which can lock in losses and miss potential rebounds.

The Long-Term Perspective

While short-term drawdowns can be disconcerting, it’s important to maintain a long-term perspective. Drawdown analysis helps investors understand the depth and duration of potential losses. It’s a tool that assists in creating a balanced, resilient portfolio that can weather short-term volatility and achieve long-term investment goals.

Investor Tips

- Regularly conduct drawdown analysis to understand the risk profile of your portfolio.

- Diversify your investments to reduce potential drawdown.

- Keep a long-term perspective and avoid panic selling during drawdowns.

Disclaimer: This article is for informational purposes only. It should not be considered financial or investment advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply