Introduction: Why This Topic Matters To Investors

The US stock market is one of the biggest and most influential markets in the world. Understanding its dynamics is crucial for investors seeking opportunities for long-term growth. This research will provide insights into the key drivers and potential risks associated with this market.

Key Business and Financial Drivers

The performance of the US stock market is largely driven by factors such as economic growth, corporate earnings, interest rates, and geopolitical events. Investors need to keep a close eye on these indicators as they can significantly affect the valuation of stocks and thus, the returns from their investments.

Expectations Vs Reality

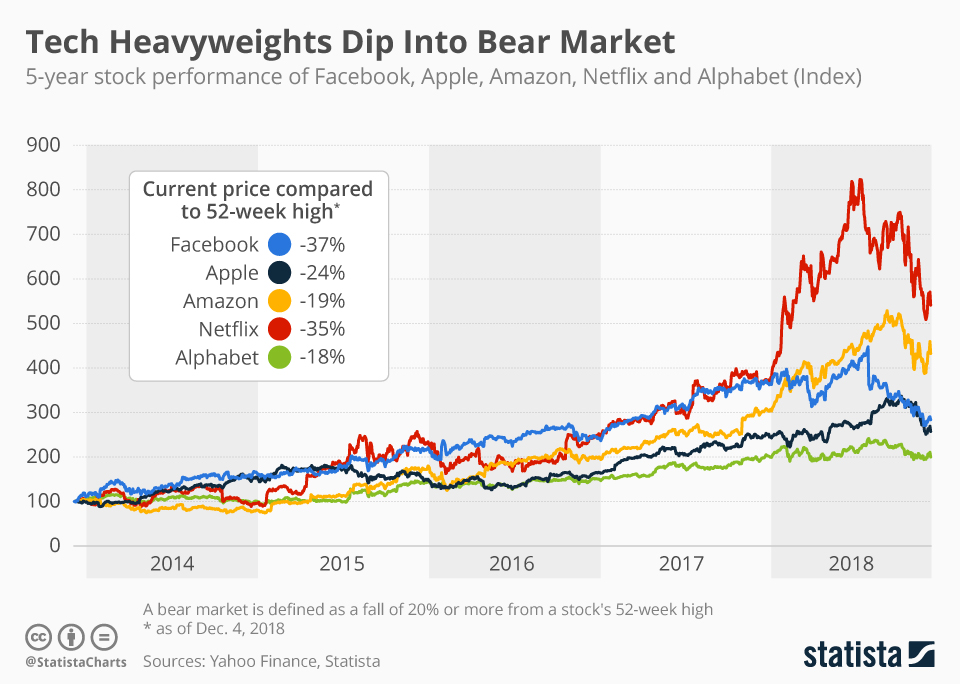

Often, the market prices in expectations about future earnings growth, interest rate movements, and other factors. However, reality can differ significantly from these expectations, leading to volatility in stock prices. For instance, if actual corporate earnings fall short of expectations, it can result in a market correction.

What Could Go Wrong

Several factors can negatively impact the US stock market. A slowdown in economic growth, negative corporate earnings surprises, sudden increases in interest rates, and geopolitical uncertainties are among the key risks. Investors need to be prepared for these eventualities and have a strategy in place to manage these risks.

Long-term Perspective

While short-term factors can cause volatility in the stock market, it is important for long-term investors to focus on the underlying fundamentals. Over the long term, the performance of the stock market tends to reflect the health of the economy and corporate earnings growth. Therefore, investors should focus on these factors rather than getting swayed by short-term market noise.

Investor Tips

- Stay informed about the key economic indicators and corporate earnings trends.

- Don’t get swayed by short-term market volatility. Focus on the long-term fundamentals.

- Have a risk management strategy in place to protect your portfolio from market downturns.

Please note that this article is for informational purposes only and should not be regarded as investment advice. Always consult with a financial advisor before making any investment decisions.

Leave a Reply