Why Capital Preservation Matters in Stock Investments

Capital preservation is a critical aspect of long-term investing, particularly in the volatile U.S. stock market. It is not just about maintaining the initial investment, but also about mitigating potential losses. As a long-term investor, understanding capital preservation strategies can help protect your portfolio from detrimental market shifts and boost your overall returns over time.

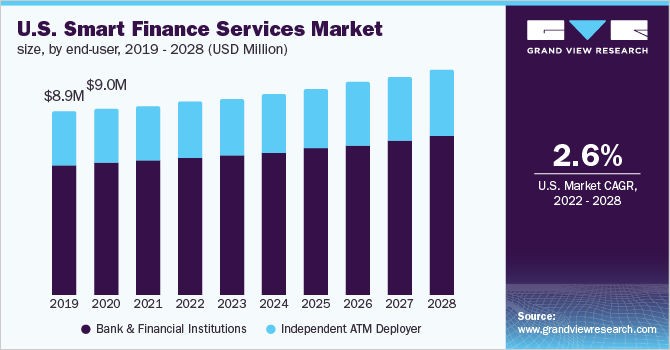

Key Business or Financial Drivers

Several key business and financial drivers influence capital preservation strategies. These include the stability of the company, its earnings growth, dividend payouts, and the overall market conditions. A company with a stable business, consistent earnings growth, and regular dividend payouts is more likely to preserve its capital value over time. Conversely, adverse market conditions can erode the capital value of even the most robust stocks.

Expectations Vs Reality

Market expectations often factor in a company’s potential for growth and its ability to maintain dividend payouts. However, reality can differ significantly. For instance, a company might be expected to continue its earnings growth, but a sudden market downturn could lead to a decline in profits. As a long-term investor, it’s crucial to align expectations with reality and adjust investment strategies accordingly.

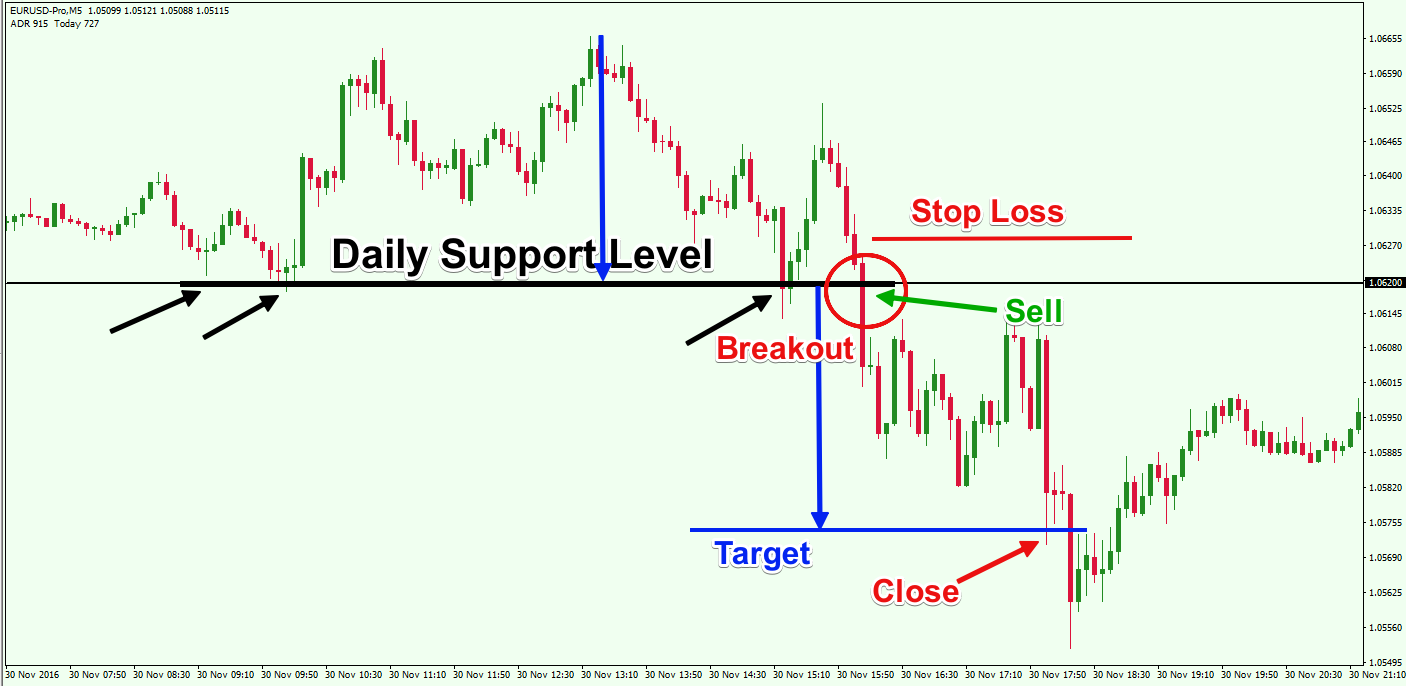

What Could Go Wrong

Despite the best capital preservation strategies, things can go wrong. Market volatility, unforeseen business challenges, or economic downturns can negatively impact your investments. Therefore, diversification across different sectors or asset classes is a recommended strategy to mitigate such risks.

Long-Term Perspective

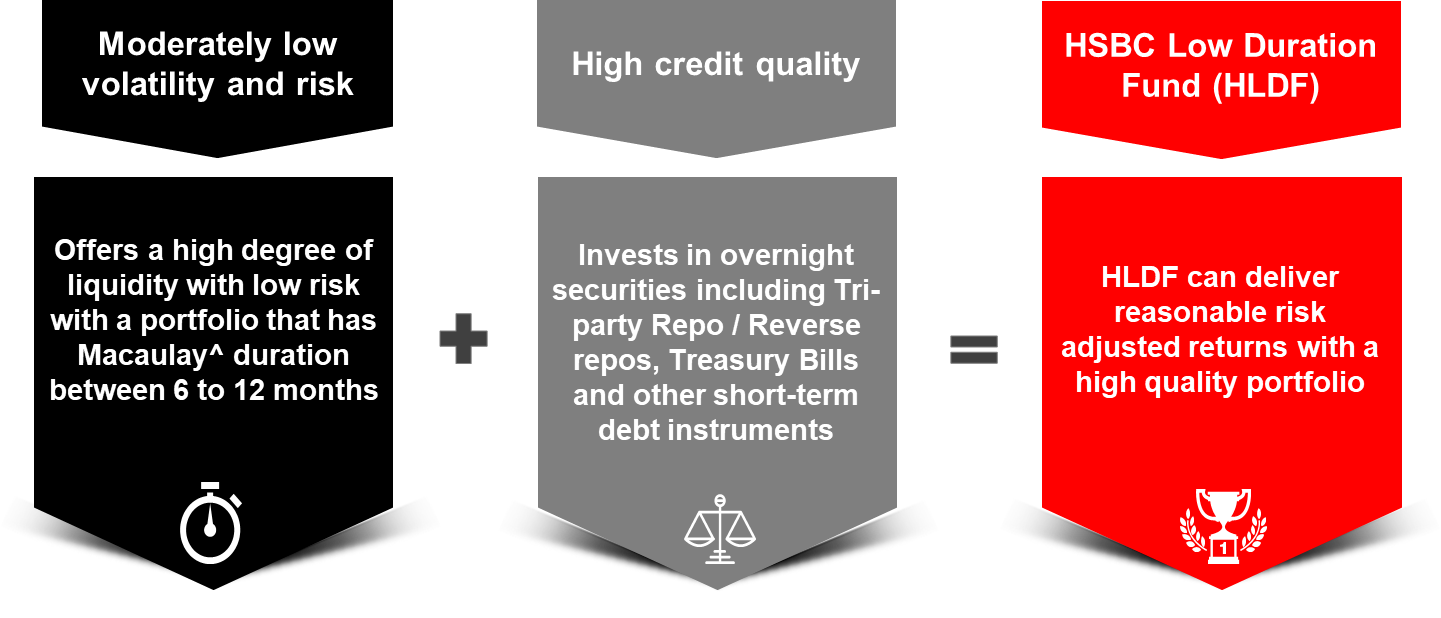

From a long-term perspective, market fluctuations are a part and parcel of investing. While short-term volatility can cause temporary capital erosion, a well-diversified portfolio and a long-term investment horizon can help navigate these challenges and preserve capital over time.

Investor Tips

- Invest in stable companies with consistent earnings growth and regular dividend payouts.

- Align your expectations with reality and adjust your investment strategies accordingly.

- Diversify your portfolio across different sectors or asset classes to mitigate risks.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always do your own research or consult with a financial advisor before making investment decisions.

Leave a Reply