Introduction

Understanding the intricacies of executing investment strategies in the US equities market is vital for investors. It can spell the difference between realizing significant returns on investment and incurring substantial losses. This article dissects the core aspects of implementing such strategies, the potential risks, and how to navigate them.

Key Business or Financial Drivers

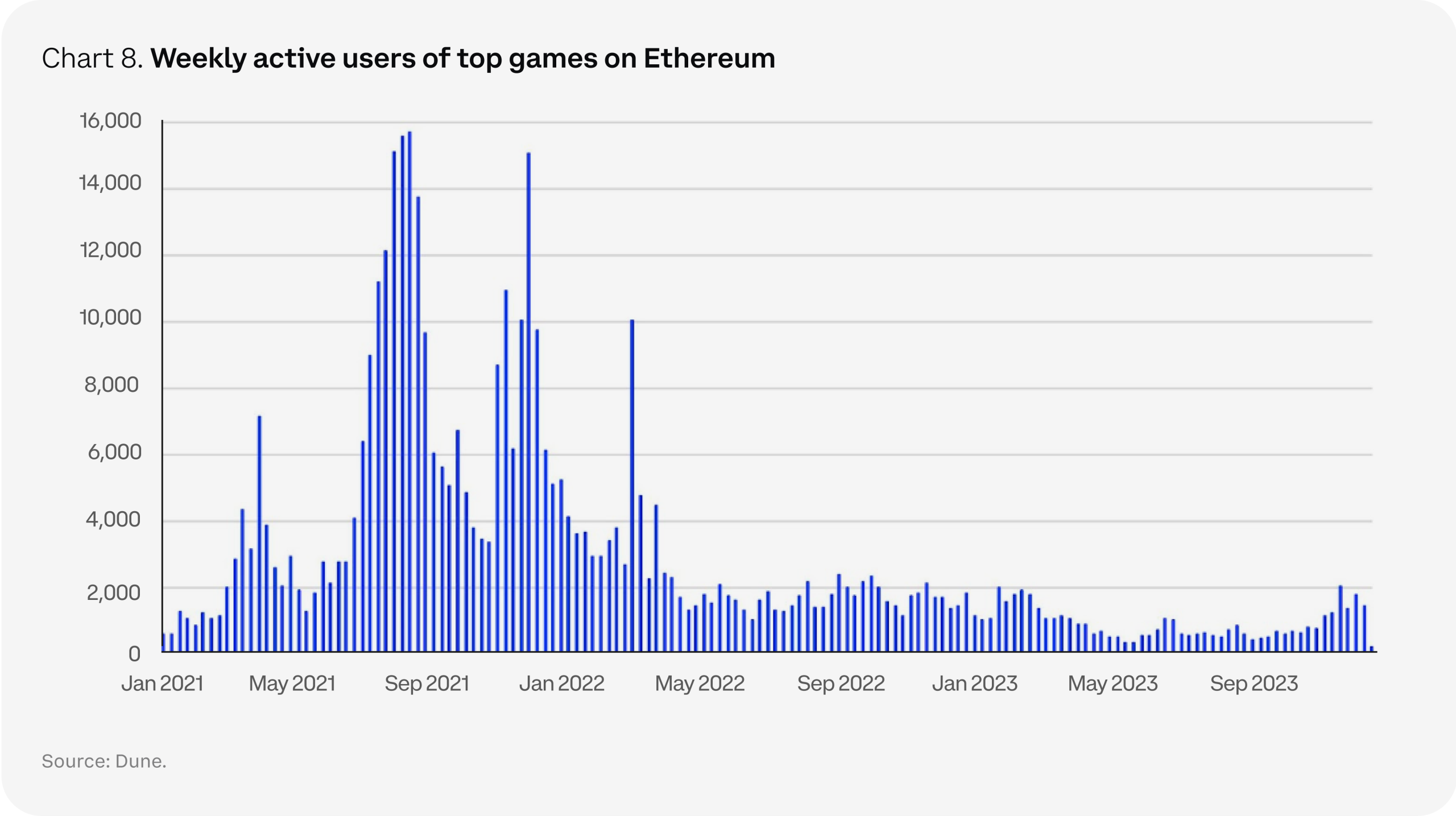

The performance of US equities is influenced by a myriad of factors. These include macroeconomic indicators such as GDP growth, interest rates, inflation, and unemployment rates. Corporate earnings, market sentiment, and geopolitical events also play a significant role in shaping the trajectory of the equities market.

Expectations vs Reality

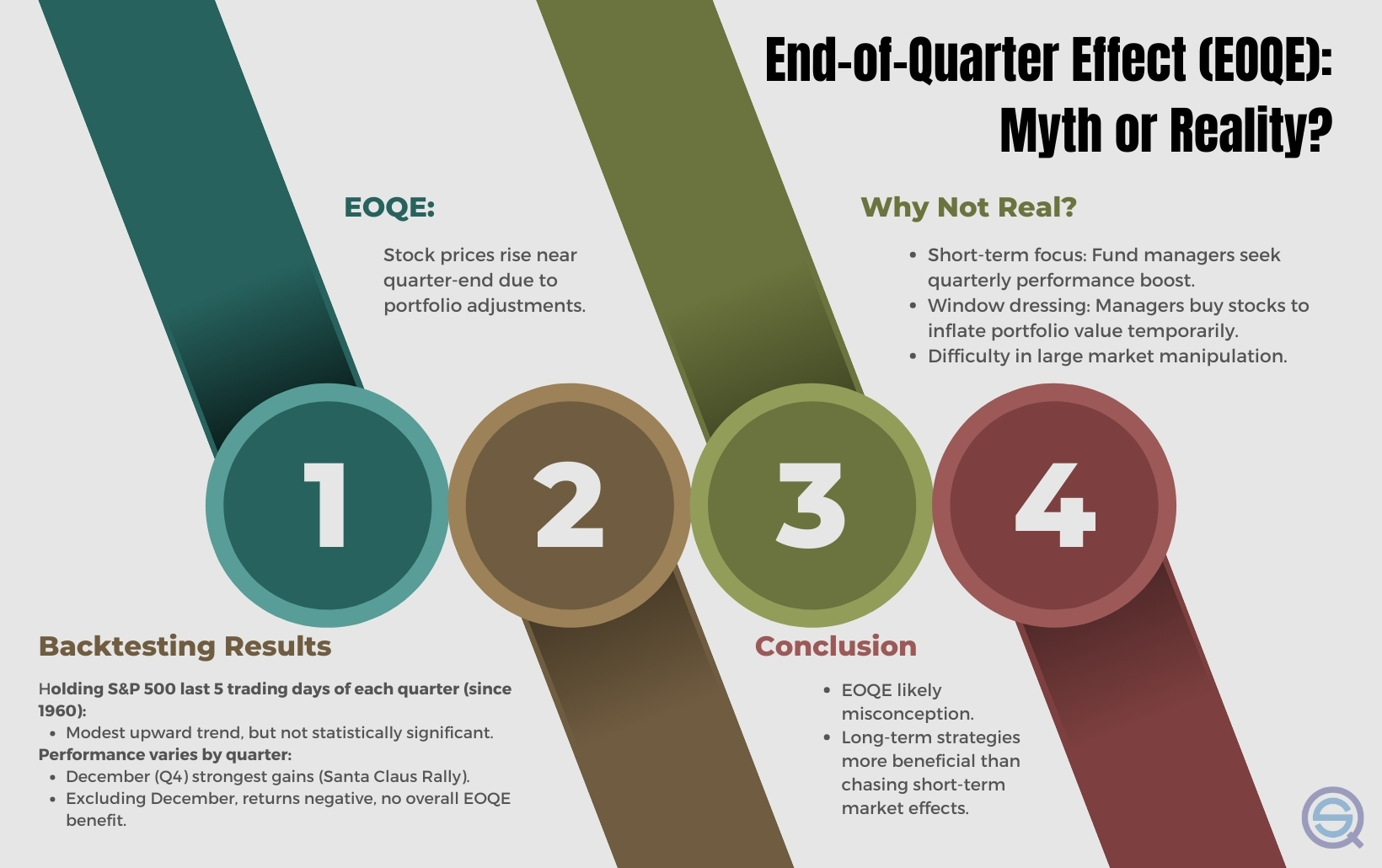

Investors often price in expectations based on the aforementioned factors. However, the reality can often diverge from these expectations, leading to market volatility. For instance, unexpected changes in monetary policy or geopolitical tensions can cause sharp fluctuations in stock prices.

What Could Go Wrong

Executing an investment strategy in US equities is not without risks. One risk is the possibility of an economic downturn, which could lead to a broad market sell-off. Additionally, overreliance on a single strategy without considering changing market conditions can also lead to underperformance. Finally, there’s the risk of unexpected corporate events such as bankruptcies or scandals, which could cause significant losses for shareholders.

Long-Term Perspective

While short-term factors can affect the performance of US equities, it’s crucial to maintain a long-term perspective. Over time, the impact of short-term volatility tends to diminish, and the fundamental performance of the economy and individual companies becomes more prominent.

Investor Tips

- Stay informed about macroeconomic indicators and corporate earnings.

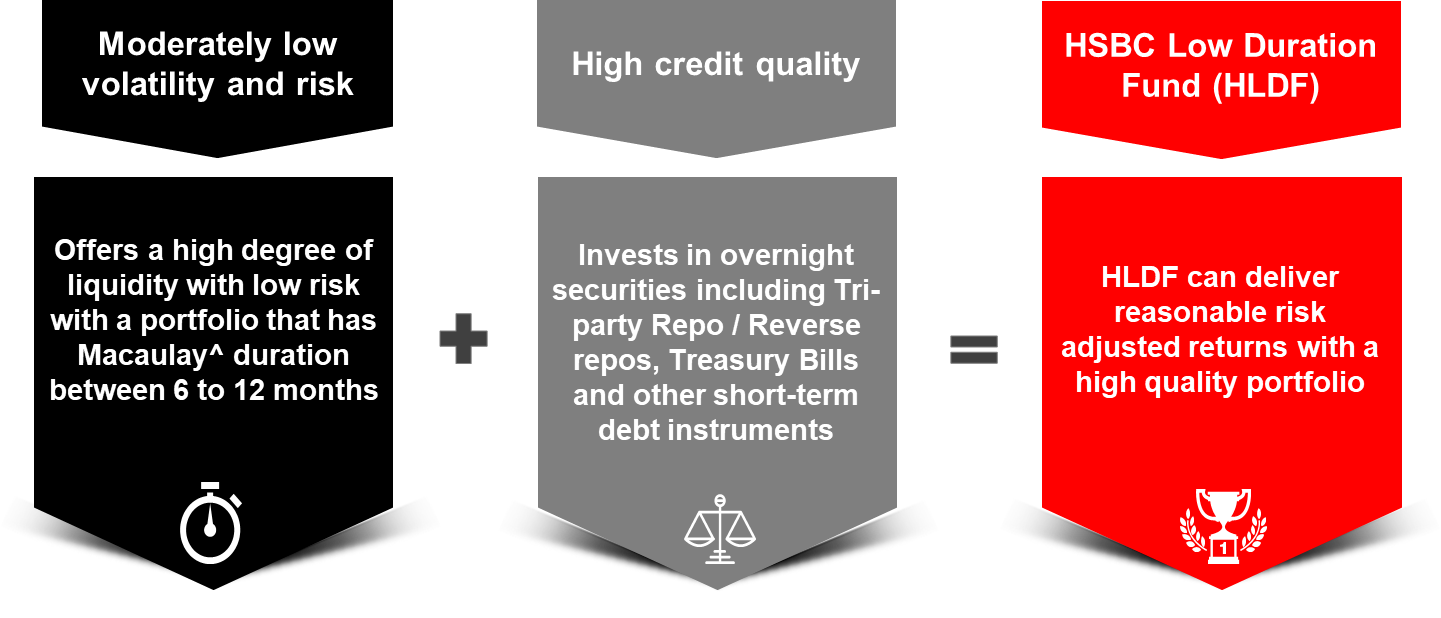

- Adopt a diversified investment strategy to mitigate risks.

- Consider both short-term volatility and long-term trends when making investment decisions.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply