Why Sector Cyclicality Matters to Investors

Investors are not merely buying stocks; they are purchasing a piece of a company’s future earnings. Understanding sector cyclicality – the natural ebb and flow of industries in response to economic trends – is crucial in predicting these future earnings and making informed investment decisions. This article aims to delve deeper into the topic of sector cyclicality in US equities, exploring its implications for long-term investors.

Key Business and Financial Drivers

The performance of sectors in the stock market is heavily influenced by various factors such as economic cycles, interest rates, and technological advancements. For instance, during periods of economic expansion, cyclical sectors like consumer discretionary and industrials often perform well. On the other hand, sectors like utilities and consumer staples – known as defensive sectors – usually do well in economic downturns.

Expectations Vs Reality

Investor expectations often hinge on economic forecasts. However, the reality can sometimes deviate from these forecasts due to unpredictable factors such as geopolitical events or sudden changes in consumer behavior. For instance, the technology sector was expected to slow down in 2020, but the COVID-19 pandemic led to a surge in demand for tech services and products, outperforming expectations.

What Could Go Wrong

While understanding sector cyclicality can provide valuable insights, it’s important to remember that it’s not foolproof. Economic trends can reverse unexpectedly, and individual companies within a sector can perform differently from the sector as a whole. Over-reliance on sector cyclicality without considering other factors like company fundamentals and market sentiment can lead to poor investment decisions.

The Long-term Perspective

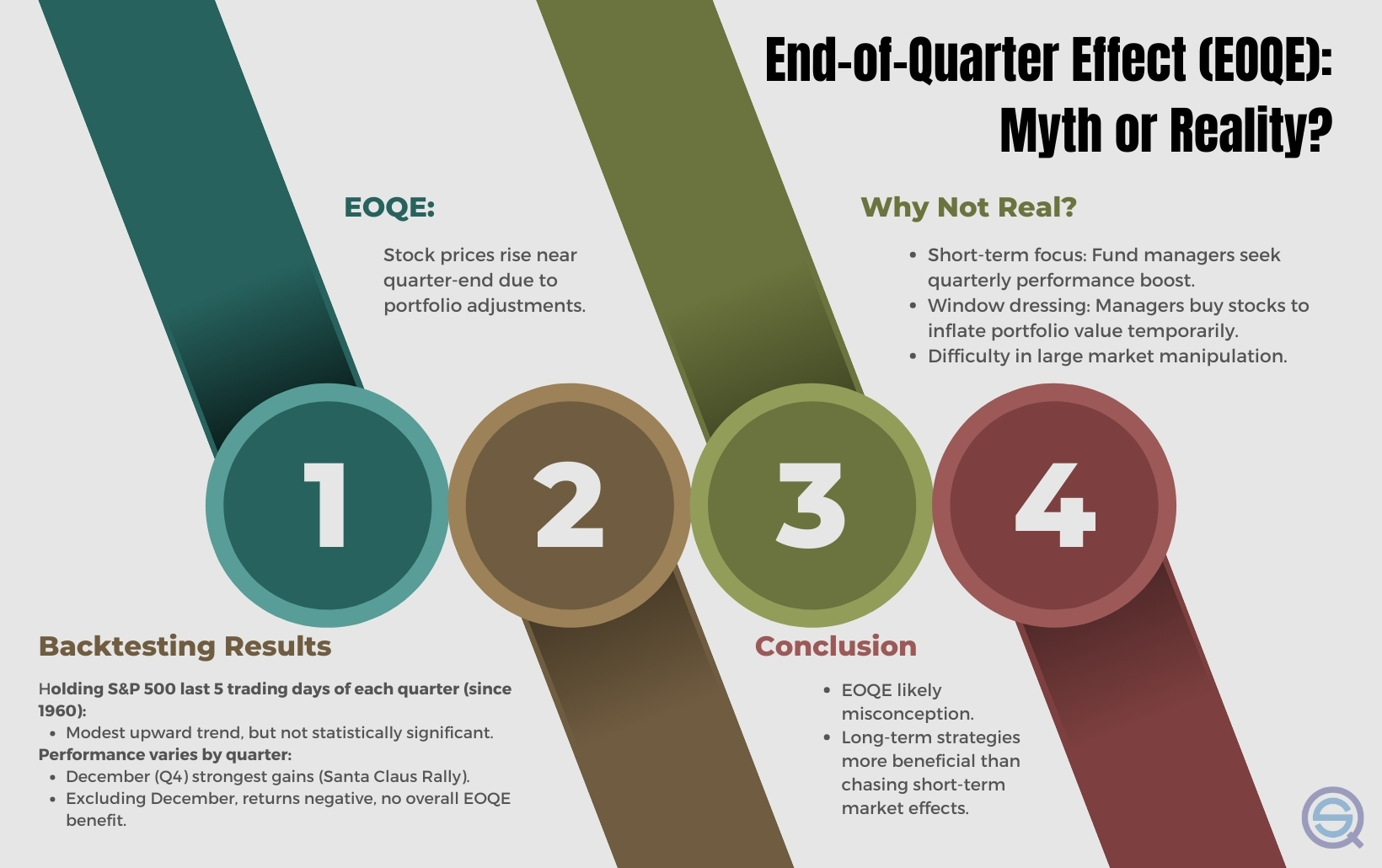

While sector cyclicality can affect short-term stock performance, the long-term success of an investment is more likely to be influenced by the company’s fundamentals, such as its competitive positioning and financial health. Therefore, it’s important for long-term investors to balance their understanding of sector cyclicality with a deep analysis of individual companies.

Investor Tips

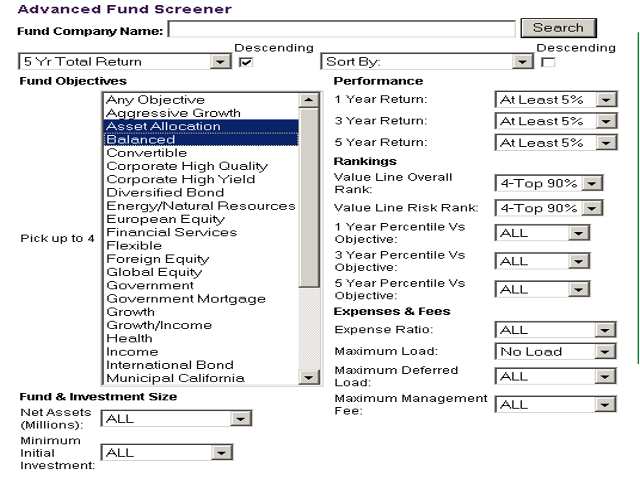

- Stay informed about changes in economic trends and how they may impact different sectors.

- Don’t rely solely on sector cyclicality. Remember to analyze the fundamentals of individual companies.

- Be prepared for the unexpected. Ensure your portfolio is diversified to mitigate potential risks.

This article is intended for informational purposes only. It is not intended to be investment advice. Always conduct your own research and consult with a professional before making investment decisions.

Leave a Reply