Why Investment Framework Alignment Consultation Matters

Investment Framework Alignment Consultation is a crucial aspect of investment management that has profound implications for long-term stock investors. It involves streamlining and aligning investment strategies according to the changing market conditions and regulatory requirements. By understanding the implications of this consultation, investors can better navigate the financial markets, make informed decisions, and ultimately improve their return on investment.

Analysis of Key Business and Financial Drivers

The market dynamics, the regulatory landscape, and the performance of the investment portfolio are the key factors driving the need for Investment Framework Alignment Consultation. Market dynamics constantly change due to economic, political, and technological factors. The regulatory landscape is also constantly evolving, necessitating regular updates to the investment framework. Furthermore, the performance of the investment portfolio needs to be continually monitored and adjusted to align with the investor’s financial goals.

Expectations vs. Reality

Investors often expect that their investment framework, once set, will continually yield positive returns. However, the reality is that the financial markets are dynamic, and maintaining a static investment framework can lead to suboptimal returns. Regular alignment consultation can help in adjusting the investment framework according to the changing market conditions, thereby enhancing the potential for better returns.

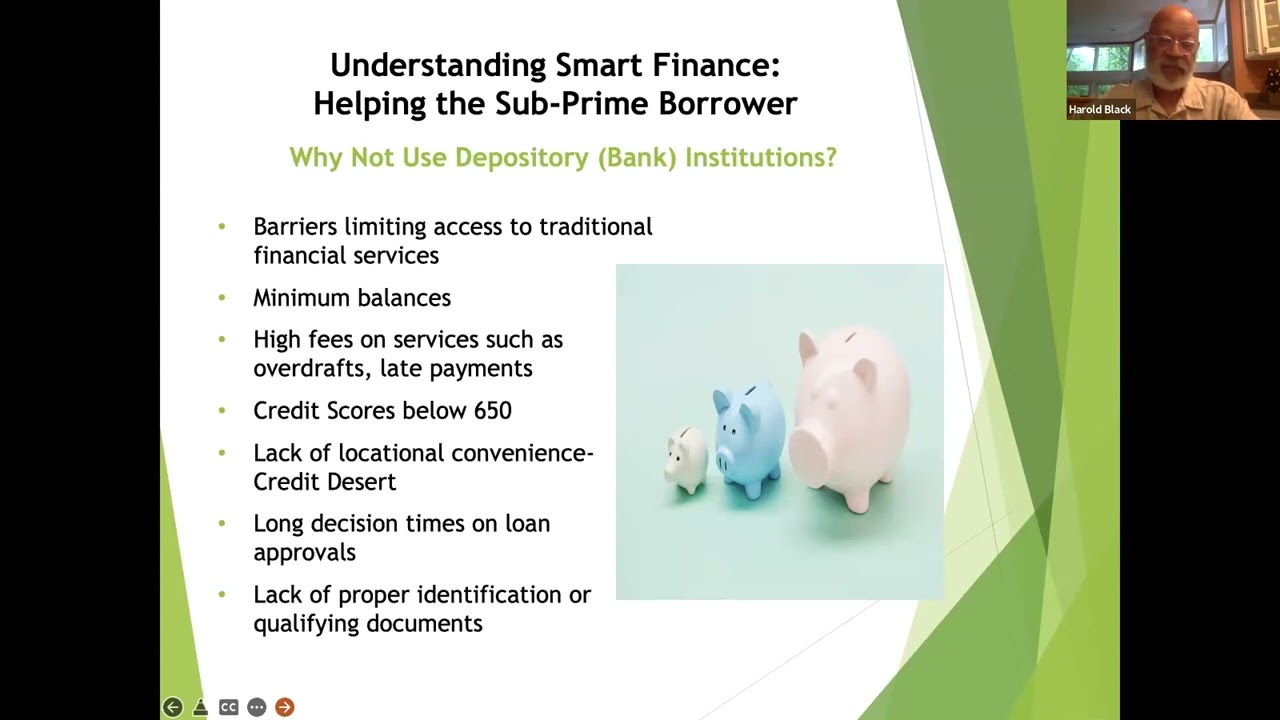

What Could Go Wrong

Without regular Investment Framework Alignment Consultation, investors run the risk of their investment framework becoming outdated and not in sync with their financial goals. This could lead to poor portfolio performance and, in worst-case scenarios, significant financial losses. Furthermore, non-compliance with the changing regulatory requirements could also result in legal issues and penalties.

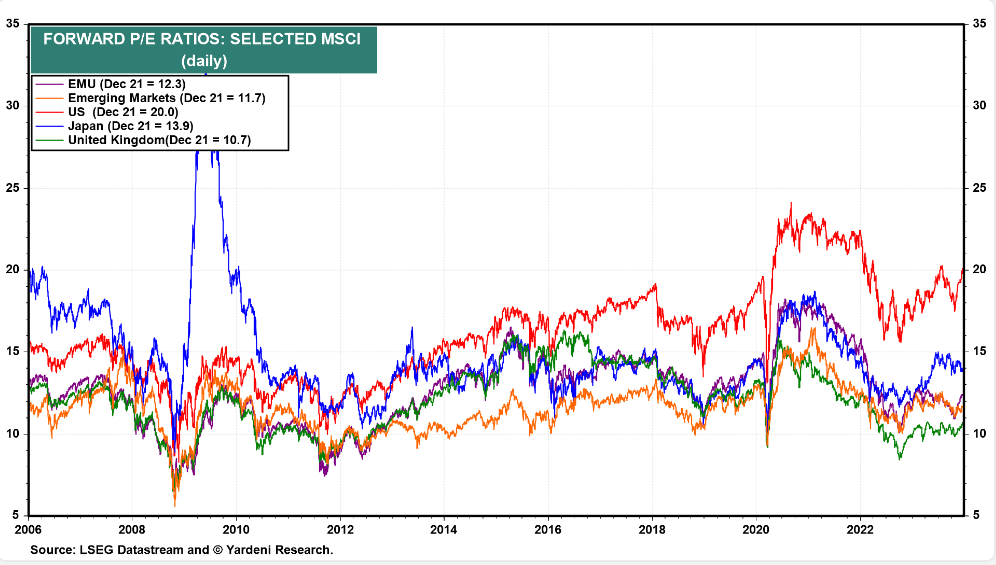

Long-term Perspective

While short-term market fluctuations can impact the performance of an investment portfolio, it is the long-term trends that ultimately determine the success of an investment strategy. Regular alignment consultation can help in identifying these trends and adjusting the investment framework accordingly. This approach can contribute to achieving consistent returns over the multi-year period and meeting the investor’s long-term financial goals.

Investor Tips

- Regularly review and adjust your investment framework in consultation with a financial advisor.

- Stay updated with the changing market dynamics and regulatory landscape.

- Monitor the performance of your investment portfolio and adjust your investment strategies accordingly.

This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply