Valuation driven investing is a critical approach to long-term stock investing that can significantly influence investment outcomes. This article aims to provide a deeper understanding of this concept through a US case study. It is crucial for investors because it helps them evaluate stocks based on their intrinsic value, providing a solid basis for investment decisions.

The Core Investment Question

How does valuation driven investing impact long-term investment outcomes in the US stock market?

Key Business and Financial Drivers

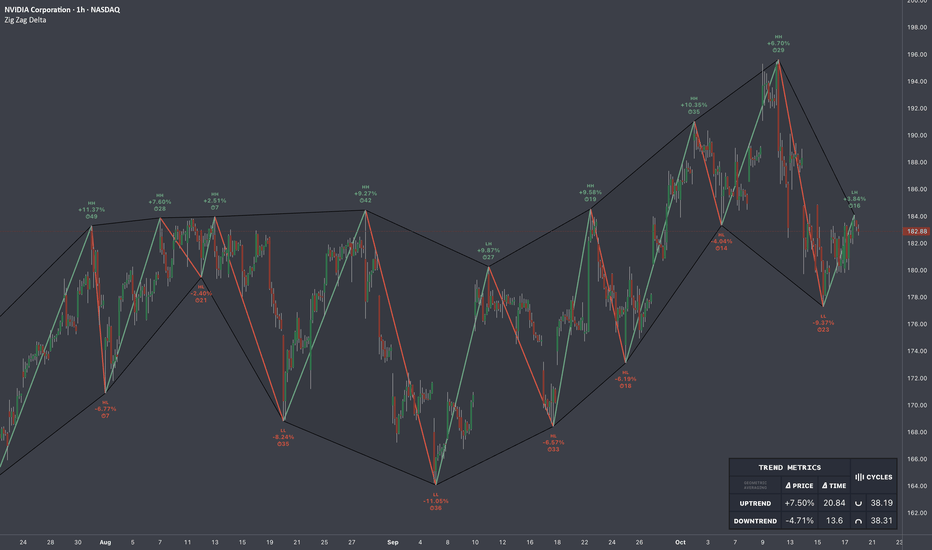

Valuation driven investing is significantly impacted by two main drivers: the market environment and financial performance of companies. The market environment, including the economy and investor sentiment, can affect stock prices and hence, valuations. Meanwhile, a company’s financial performance, such as its earnings, cash flow, and balance sheet strength, can influence its intrinsic value.

Expectations vs Reality

Valuation driven investing is anchored on the belief that the market will eventually recognize a company’s intrinsic value. However, in reality, market prices can diverge from intrinsic value for extended periods. This divergence can be due to various factors such as market inefficiencies, irrational investor behavior, and changing economic conditions. Therefore, it’s important for investors to be patient and maintain a long-term focus.

What Could Go Wrong

There are several risks associated with valuation driven investing. First, it assumes that the market will eventually reflect a company’s intrinsic value, which may not always be the case. Second, it relies heavily on accurate financial analysis and valuation techniques, which can be prone to errors. Finally, it may not be suitable for all investors, especially those with a short-term investment horizon or low risk tolerance.

Long-term Perspective

Despite the short-term fluctuations and potential risks, valuation driven investing can yield significant returns over the long term. It allows investors to buy stocks at a discount to their intrinsic value, providing a margin of safety and potential for capital appreciation. However, it requires patience, discipline, and a thorough understanding of financial analysis and valuation techniques.

Investor Tips

- Understand the company’s business model and financial health before investing.

- Be patient and maintain a long-term focus.

- Always consider the margin of safety when evaluating a stock’s intrinsic value.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

Leave a Reply