Why Understanding Financial Return Trends Matters

For any long-term investor, understanding the financial return trends of US equities is crucial. Not only does it provide insights into the past performance of the stock market, but it also helps investors make informed decisions about future investments.

Key Financial Drivers

The financial return trends of US equities are influenced by a range of factors:

- Macroeconomic Factors: These include GDP growth, inflation rates, and unemployment rates. They offer a broad view of the nation’s economy and can directly impact stock market performance.

- Corporate Earnings: The profitability of companies plays a significant role in stock price movement. Higher earnings often lead to increased investor confidence and higher stock prices.

- Interest Rates: The Federal Reserve’s interest rate decisions can influence the stock market. Lower interest rates can make borrowing cheaper, potentially leading to increased corporate profits and higher stock prices.

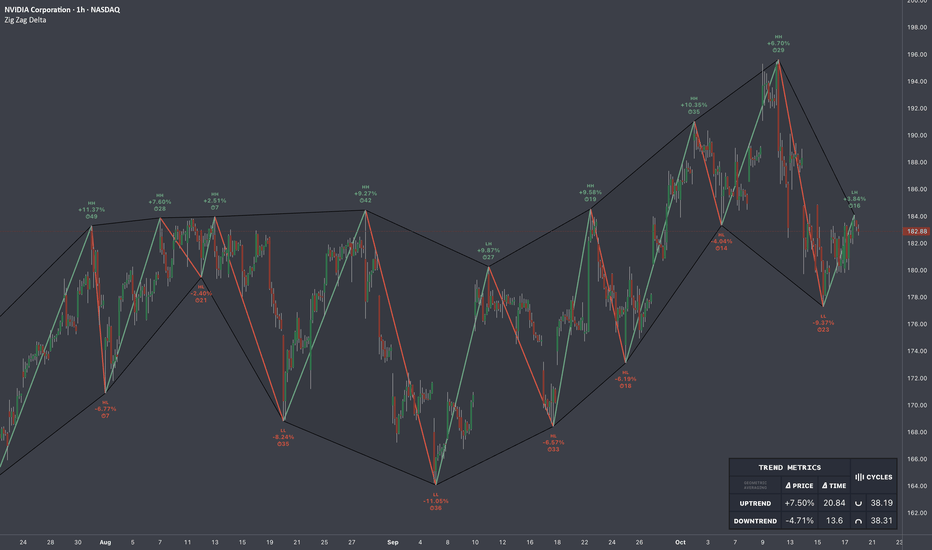

Expectations vs Reality

Investors often have expectations about the future performance of US equities based on historical trends. However, these expectations may not always align with reality. For example, while the historical trend may suggest a steady increase in stock prices, unforeseen circumstances such as a sudden economic downturn or a global pandemic can drastically impact the market.

What Could Go Wrong

While investing in US equities can offer significant returns, it’s important to understand the potential risks. The stock market can be volatile, and short-term price fluctuations can impact long-term returns. Moreover, external factors such as geopolitical tensions, changes in government policies, or economic recessions can negatively impact the stock market.

Long-Term Perspective

Despite short-term volatility, it’s important for investors to maintain a long-term perspective. While short-term factors can impact the stock market, the long-term performance of US equities has historically been positive. Investors who remain patient and committed to their investment strategy can potentially reap significant returns over the long term.

Investor Tips

Investors should consider the following tips when analyzing financial return trends:

- Stay Informed: Regularly review economic indicators and corporate earnings reports.

- Be Patient: Don’t let short-term market volatility deter you from your long-term investment strategy.

- Diversify: To mitigate risks, consider diversifying your portfolio across different asset classes and sectors.

Please note, this article is intended for informative purposes only and should not be considered as financial advice. Always do your own research or consult with a professional advisor before making investment decisions.

Leave a Reply