Why Industry Supply Chain Risks Matter

As an investor, comprehending the dynamics of industry supply chain risks is integral to making informed decisions about your stock portfolio. These risks can significantly impact a company’s operations, profitability, and ultimately, its stock value.

Key Business and Financial Drivers

Several factors can influence the impact of supply chain risks on a company’s financial performance. These include the company’s ability to manage and mitigate these risks, its reliance on particular suppliers, and the geopolitical landscape, among others.

Supply Chain Management

How a company manages its supply chain can significantly impact its ability to weather supply chain disruptions. Companies with robust risk management strategies are often better positioned to handle these disruptions, protecting their operations and profitability.

Supplier Dependence

Companies highly dependent on a single supplier or a small group of suppliers are often at a higher risk of disruption. This dependence can result from factors such as unique product needs, long-term contracts, or geographic limitations.

Geopolitical Landscape

Changes in the geopolitical landscape, including trade policies and international relations, can also impact supply chains. For instance, trade tensions can lead to increased costs or delays, disrupting operations and impacting profitability.

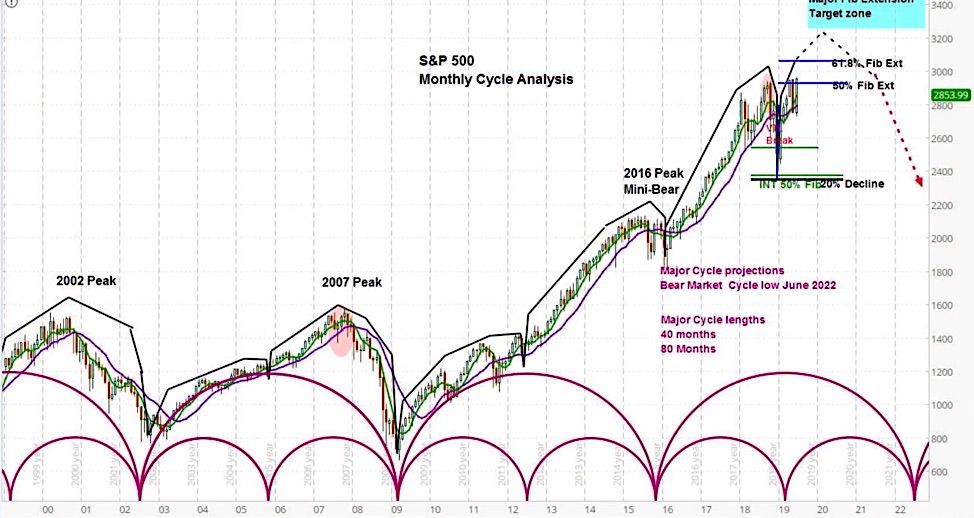

Expectations vs Reality

While investors often price in anticipated supply chain disruptions, the reality can be unexpectedly severe or prolonged, leading to greater impacts on a company’s stock value than initially expected. For instance, the Covid-19 pandemic highlighted the potential for extreme and unforeseen supply chain disruptions.

What Could Go Wrong

There are several worst-case scenarios that could arise from supply chain risks. These include the complete disruption of a critical supply chain, leading to a halt in operations, or a significant increase in costs due to supply chain issues, which could erode profitability.

Long-Term Perspective

While supply chain disruptions can have immediate impacts on a company’s stock value, they can also have long-term implications. The company’s ability to effectively manage these disruptions can influence investor confidence and the company’s reputation, impacting its stock value over the long term.

Investor Tips

- Keep an eye on a company’s supply chain management strategies and their effectiveness.

- Consider the company’s dependence on specific suppliers and the potential risks this presents.

- Stay informed about changes in the geopolitical landscape and their potential impacts on supply chains.

Disclaimer: This article is for informational purposes only and is not investment advice. Always do your own research and consider your investment goals before making investment decisions.

Leave a Reply