Introduction: Why Balanced Portfolio Matters

For long-term investors, maintaining a balanced portfolio is crucial to withstand market volatility and to optimize risk-adjusted returns. This article examines various balanced stock ideas in the United States, their key business drivers, and potential risks.

Analysis of Key Business and Financial Drivers

When considering balanced portfolio stock ideas, it’s essential to consider both the company’s performance and trends in the broader market. Factors such as company earnings, industry position, macroeconomic conditions, and regulatory environment play a significant role in the potential success of a stock.

Company Earnings and Industry Position

Companies with strong earnings and a solid position within their industry are likely to provide steady returns over the long term. This stability can help to balance the riskier elements of a portfolio.

Macroeconomic Conditions and Regulatory Environment

The broader economic and regulatory environment can significantly impact a company’s performance. For example, a booming economy can boost consumer spending and corporate profits, while a favorable regulatory environment can enable companies to operate more efficiently.

Expectations vs Reality

While market expectations can drive stock prices in the short term, the long-term performance of a stock is often determined by the company’s actual results. For instance, a company may be expected to deliver strong earnings growth, but if it fails to meet these expectations, its stock price could suffer.

What Could Go Wrong

Even the most promising stock ideas can face unexpected challenges. For example, a shift in consumer preferences, a regulatory change, or an economic downturn could negatively impact a company’s performance. Therefore, it’s essential for long-term investors to diversify their portfolios to mitigate these risks.

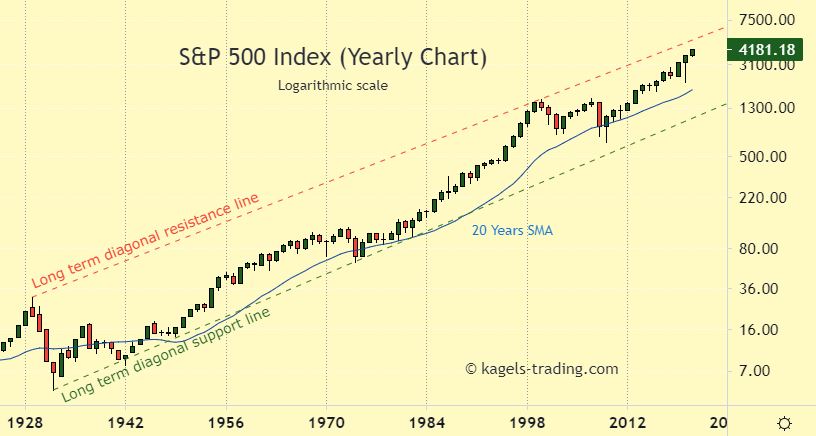

Long-Term Perspective

While short-term market fluctuations can be unpredictable, a balanced portfolio of diverse stocks can provide stable returns over the long term. This stability can help investors to weather short-term market volatility while benefiting from long-term economic growth.

Investor Tips

- Consider stocks from a variety of sectors to diversify your portfolio.

- Pay close attention to the fundamental drivers of a company’s performance.

- Stay informed about the broader economic and regulatory environment.

This article is for informational purposes only and should not be considered as investment advice or a recommendation to buy or sell any particular security. Always consult with a financial advisor before making investment decisions.

Leave a Reply