Why Sector Demand Volatility Matters

For long-term investors, understanding sector demand volatility in US equities is crucial as it provides insights into potential risks and opportunities. It is an indicator of the elasticity of the market’s reaction to changes in the economy, industry trends, and geopolitical events. It also helps investors to predict the market’s future direction and make informed decisions.

Analysis of Key Business or Financial Drivers

The primary drivers of sector demand volatility include macroeconomic conditions, industry-specific factors, and investor sentiment. Macroeconomic conditions such as inflation, interest rates, and GDP growth can sway investor sentiment and create volatility. Industry-specific factors such as technological advancements, regulatory changes, and competitive dynamics can cause significant shifts in sector demand. Investor sentiment, fueled by factors such as market speculation and fear of missing out, can also lead to rapid swings in sector demand.

Expectations vs Reality

Market expectations are often based on forecasts and predictions of economic indicators. For example, if the expectation is for strong economic growth, then sector demand for cyclical stocks may be high. However, the reality can often deviate from these expectations due to unforeseen events or changes in market conditions. A sudden economic downturn or regulatory change can cause a sharp decline in sector demand, leading to increased volatility.

What Could Go Wrong

Investors need to be aware that sector demand volatility can increase due to unexpected events. These can range from geopolitical tensions, changes in government policies, shifts in consumer behavior, or sudden economic downturns. Increased volatility can lead to significant price fluctuations, which can negatively impact investment returns in the short term.

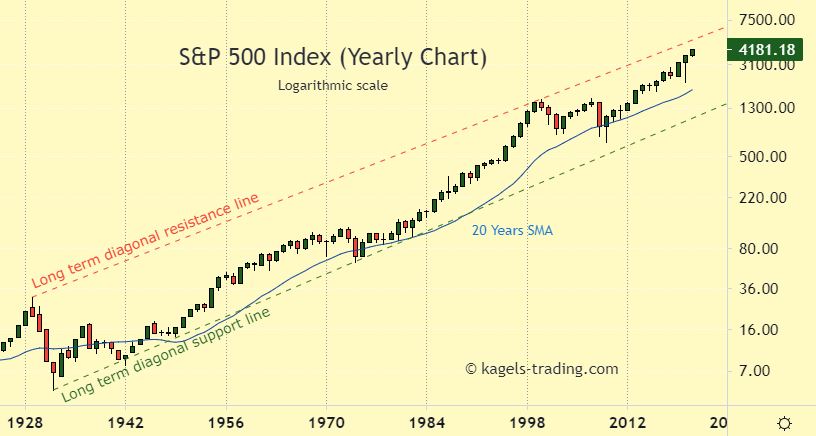

Long-Term Perspective

While sector demand volatility can create short-term disturbances, it can also present long-term investment opportunities. Investors who can accurately identify and understand the causes of this volatility may be able to capitalize on price fluctuations to enhance their long-term returns. Furthermore, understanding sector demand volatility can help investors to build a more resilient and diversified portfolio that can better withstand market shocks.

Investor Tips

- Stay informed about the macroeconomic conditions and industry trends that can impact sector demand.

- Monitor changes in investor sentiment, as this can often lead to increased sector demand volatility.

- Consider the potential risks and opportunities presented by sector demand volatility when making investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial position before making investment decisions.

Leave a Reply