Introduction

Understanding and avoiding common behavioral mistakes in stock investing is crucial for long-term investors. It’s not just about picking the right stocks, but also about how you react to market movements, your investment decisions, and how you manage your emotions. In this article, we delve into the common errors investors make and offer tips on how to steer clear of them.

Key Behavioral Traps in Stock Investing

Investors are often swayed by cognitive biases that can lead to irrational decisions. Understanding these biases can help investors make more informed decisions, potentially leading to better investment outcomes.

Overconfidence Bias

Overconfidence can lead investors to underestimate the risk associated with their investment choices, often resulting in overexposure to specific assets or sectors. This can negatively impact portfolio diversification and risk management.

Confirmation Bias

Investors often seek out information that confirms their existing beliefs, leading to a lack of objectivity. This can lead to poor investment decisions as it prevents investors from fully considering all relevant information.

Expectations vs Reality

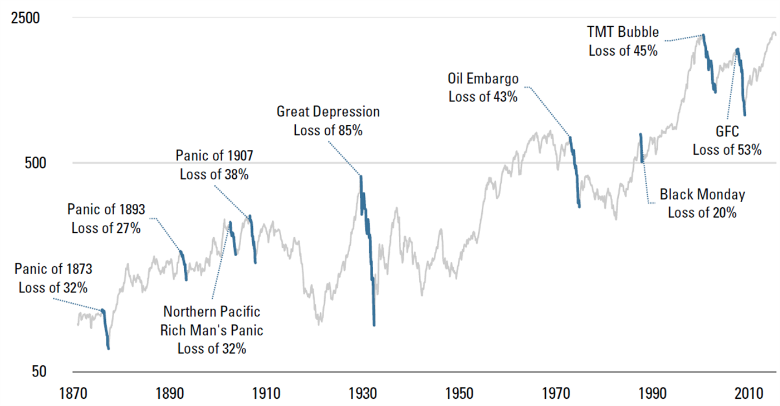

Investors often have unrealistic expectations about future stock performance, which can lead to disappointment and poor decision-making when those expectations are not met. It’s vital to have a realistic understanding of market volatility and the risks involved in investing.

What Could Go Wrong

Ignoring the potential downsides of an investment can lead to significant losses. It’s crucial to consider the worst-case scenarios and have a plan in place to manage them. Failure to do so can result in panic selling during market downturns, which can lock in losses and prevent investors from benefiting from potential market recoveries.

Long-term Outlook

Investing is a long-term endeavor. Short-term market fluctuations can be unnerving, but it’s essential to stay focused on the long-term goals. By maintaining a long-term perspective, investors can make more informed decisions that align with their investment objectives, rather than reacting impulsively to short-term market movements.

Investor Tips

- Stay focused on your long-term investment goals and don’t let short-term market fluctuations distract you.

- Regularly review your investment portfolio to ensure it aligns with your risk tolerance and investment objectives.

- Seek advice from a financial advisor or use investment tools to help manage your investments and mitigate potential risks.

Please note that all investing involves risk, including the possible loss of principal, and there can be no assurance that any investment strategy will be successful.

Leave a Reply