Why This Topic Matters

Investors often seek out companies with structural advantages—unique strengths that make a business more competitive over the long term—as these can translate into higher profitability and shareholder returns. This article explores how investors can identify and capitalize on these opportunities within the US equities market.

Key Business and Financial Drivers

Structural advantages can stem from a variety of business and financial drivers, including economies of scale, proprietary technology, and strong brand recognition. These factors can help a company maintain its competitive edge, even in challenging market conditions, and generate sustainable profits over the long term.

Expectations vs Reality

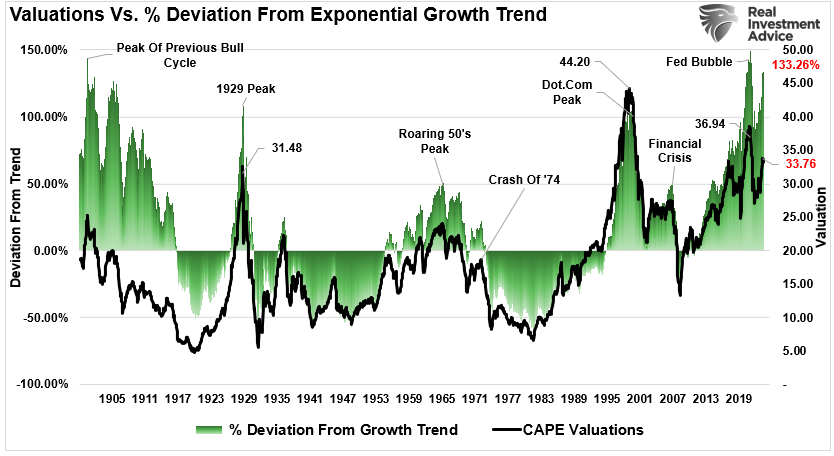

Investors often price in expectations of future earnings growth based on a company’s structural advantages. However, these expectations can sometimes be overly optimistic, ignoring potential risks and challenges. It’s important for investors to critically evaluate these assumptions and consider whether the company’s advantages are truly sustainable and capable of driving long-term earnings growth.

What Could Go Wrong

While structural advantages can offer significant investment opportunities, they’re not immune to risks. Market dynamics can change rapidly, potentially undermining a company’s competitive edge. Additionally, overreliance on a single advantage can leave a company vulnerable to disruptions in that area. For example, a company with a structural advantage in proprietary technology could face challenges if a competitor develops a superior solution.

Long-Term Perspective

Investing in companies with structural advantages requires a long-term perspective. Short-term market fluctuations can obscure the underlying value of these companies, but over the long term, their unique strengths can translate into consistent, above-average returns. However, it’s crucial to monitor these investments closely and reassess their prospects as market conditions evolve.

Investor Tips

- Identify companies with clear structural advantages, such as economies of scale, proprietary technology, or strong brand recognition.

- Evaluate whether these advantages are sustainable and capable of driving long-term earnings growth.

- Be aware of potential risks and challenges that could undermine a company’s structural advantages.

- Adopt a long-term investment perspective, but monitor your investments closely and reassess their prospects as market conditions change.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Always do your own research and consult with a professional investment advisor before making investment decisions.

Leave a Reply