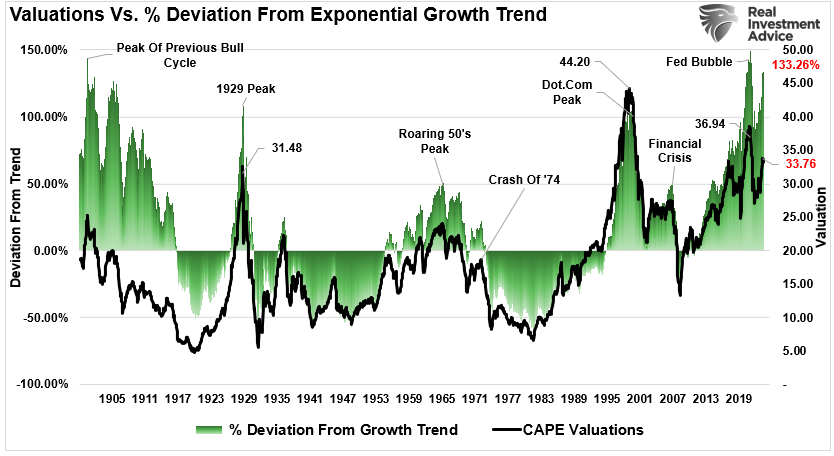

Why Market Share Shifts Matter

For long-term investors, understanding industry market share shifts is crucial. Market share is the percentage of an entire industry’s sales that a specific company controls. Shifts in market share can signal changes in a company’s competitive position, which can impact future profitability and stock performance. Consequently, investors need to scrutinize these shifts to make informed investment decisions.

Analyzing Key Business Drivers

Several factors can drive shifts in market share, including technological advances, changes in consumer preferences, regulatory changes, and competitive actions. For example, a company that fails to adapt to new technologies may lose market share, while a company that successfully innovates may gain market share. Similarly, changes in consumer preferences or regulations can either benefit or harm a company’s market position.

Expectations vs Reality

Investors often base their expectations on a company’s historical market share. However, past performance is not always indicative of future results. A company that has been gaining market share may not continue to do so if its competitive advantages erode. Conversely, a company that has been losing market share may turn things around with a successful new product or strategy. Therefore, investors should not solely rely on historical trends but should also consider a company’s future prospects.

What Could Go Wrong

Investors should be aware of the risks associated with investing based on market share shifts. One risk is the possibility of misinterpreting the reasons behind a shift. For instance, a company may lose market share due to a temporary setback rather than a fundamental problem. Another risk is overestimating the impact of a shift. A small change in market share may not necessarily lead to a significant change in a company’s stock price.

Long-Term Perspective

While short-term market share shifts can provide important insights, investors should not lose sight of the bigger picture. A company’s long-term performance depends not only on its market share but also on factors like its ability to innovate, its financial strength, and its management team. Therefore, while monitoring market share shifts, investors should also consider these other factors.

Investor Tips

- Keep an eye on industry trends and changes that could impact market share.

- Consider a company’s competitive position and future prospects, not just its historical market share.

- Be aware of the risks associated with investing based on market share shifts.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional financial advisor before making investment decisions.

Leave a Reply