Why Strategic Diversification in US Equities Matters

Investing in US equities is a fundamental component of many investment portfolios. However, the key to successful investing lies in strategic diversification. This approach reduces risk exposure while potentially boosting long-term returns. It’s essential for investors to understand the importance of this strategy in managing their portfolio’s performance and risk level.

Key Drivers of Strategic Diversification

Strategic diversification in US equities involves spreading investments across various sectors, industries, and company sizes. This strategy is crucial as it helps investors mitigate market volatility, sector-specific risks, and company-specific risks.

- Market Volatility: Diversified portfolios can cushion against market swings, helping to smooth out returns over time.

- Sector-specific Risks: By spreading investments across different sectors, investors can protect themselves from downturns in any single sector.

- Company-specific Risks: Investing in a range of companies helps to mitigate the impact of poor performance or unforeseen events in any single company.

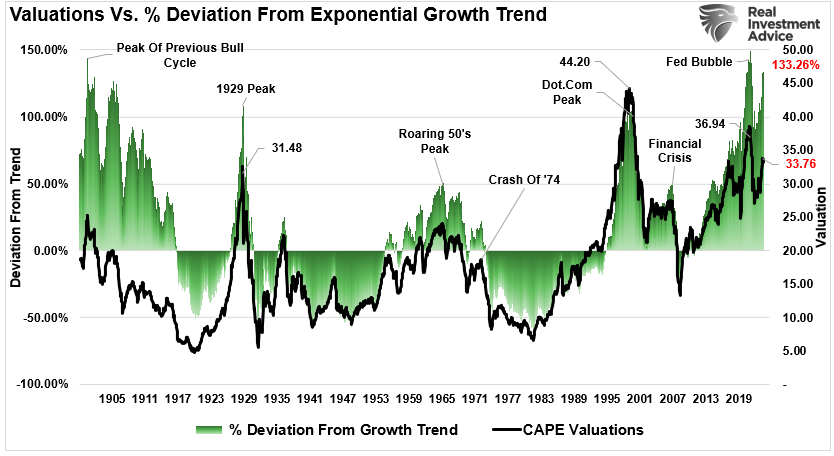

Expectations vs Reality

Investors often anticipate that diversification will completely eliminate risks and guarantee positive returns. However, the reality is that while diversification can reduce risk, it doesn’t entirely eliminate it. Investors should be prepared for potential losses in their portfolio, even when it’s well-diversified.

What Could Go Wrong

Despite the benefits, strategic diversification in US equities isn’t without its potential pitfalls. Over-diversification could cause investors to spread their funds too thin, potentially diluting returns. Additionally, diversification may not protect against systemic risks that affect the entire market.

Long-Term Perspective

From a long-term perspective, strategic diversification in US equities is an effective way to manage risk and potentially improve returns. While short-term market fluctuations can be unsettling, a well-diversified portfolio can weather these storms and deliver steady, positive returns over the long term.

Investor Tips

- Ensure your portfolio is diversified across various sectors, industries, and company sizes.

- Avoid over-diversification to prevent spreading your investment too thin.

- Regularly review and adjust your portfolio to maintain an optimal level of diversification.

This article is for informational purposes only and does not constitute financial advice. Investors should do their own research and consult a financial advisor before making any investment decisions.

Leave a Reply