Why Investment Thesis Development Matters

Understanding the intricacies of investment thesis development is paramount for long-term investors, especially those eyeing US equities. The process involves a detailed analysis of the market scenario, valuation of stocks, and predictions about future trends. This knowledge allows investors to make informed decisions, mitigating risks while optimizing potential returns.

Key Drivers of US Equities

The performance of US equities is influenced by a myriad of factors, including economic indicators like GDP growth, inflation rates, and unemployment levels. Corporate earnings, interest rates, and political stability also play substantial roles in shaping the equity market. Recognizing and understanding these drivers can help investors predict market movements and devise effective investment strategies.

Expectations vs Reality

Often, market expectations and actual outcomes may not align. For instance, a company may be expected to perform well due to strong economic indicators, but unforeseen events such as a market crash or a change in management can lead to different outcomes. Thus, it’s crucial for investors to monitor market trends and adjust their strategies accordingly.

What Could Go Wrong

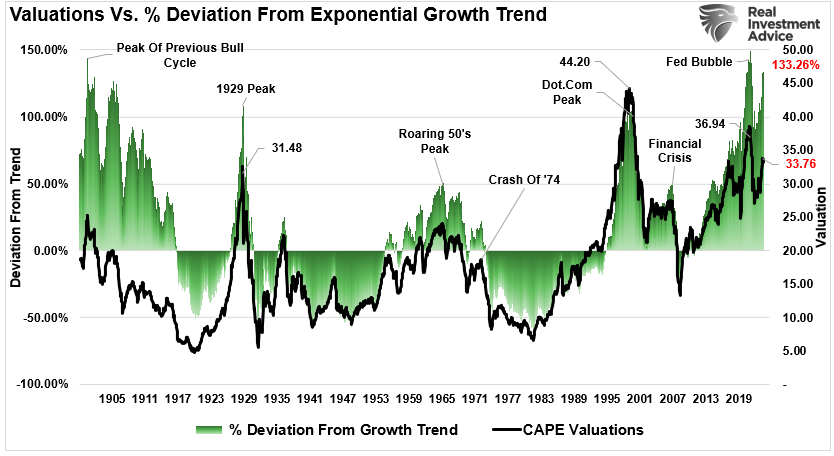

Investing in US equities is not without its risks. Market volatility, changes in fiscal policies, or global economic upheavals can negatively impact equity performance. Additionally, overvalued stocks and speculative trading can lead to investment bubbles, which can burst and result in significant losses. Hence, investors must always consider potential risks and have contingency plans in place.

Long-Term Perspective

While short-term market fluctuations are important, investors should not lose sight of their long-term objectives. Overreacting to short-term setbacks can lead to imprudent decisions. Instead, investors should focus on companies with solid fundamentals and growth potential that promise sustainable returns over the long run.

Investor Tips

- Stay informed about market trends and economic indicators.

- Invest in companies with strong fundamentals and growth potential.

- Be prepared for potential risks and have contingency plans in place.

Note: This article is intended for informational purposes only and should not be used as a primary basis for investment decisions. Always consult with a certified financial advisor before making investment decisions.

Leave a Reply