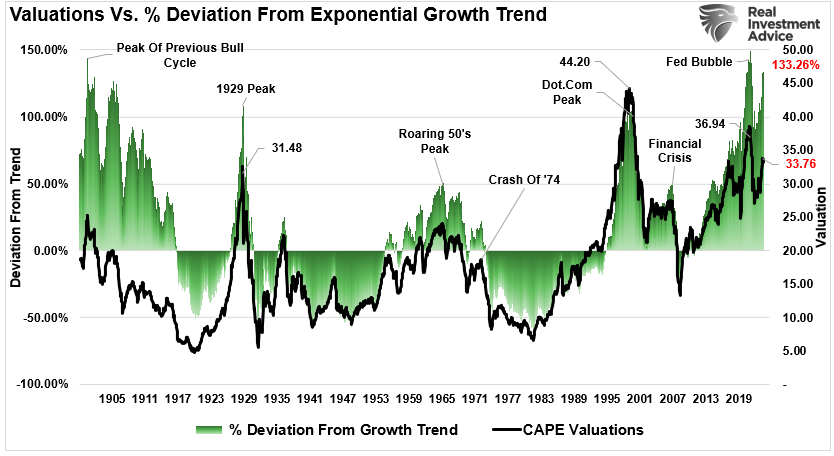

Why Earnings Volatility Matters

For long-term investors, understanding earnings volatility can provide a crucial perspective on a company’s financial stability. Companies with high earnings volatility may present increased risk, while those with lower volatility may indicate more predictable returns. This analysis focuses on how earnings volatility can impact investment decisions in the US stock market.

Key Drivers of Earnings Volatility

Earnings volatility can be influenced by a variety of factors, including industry trends, economic conditions, and company-specific issues. For example, cyclical industries often experience higher earnings volatility due to demand fluctuations. Similarly, companies with high operational leverage may see more earnings volatility due to fixed costs.

Industry Trends

- Companies in cyclical industries (e.g., automotive, construction) may face higher earnings volatility due to market demand fluctuations.

- Companies in stable industries (e.g., utilities, consumer staples) often exhibit lower earnings volatility.

Economic Conditions

- During economic downturns, companies may experience increased earnings volatility as revenues shrink and costs rise.

- Positive economic conditions can reduce earnings volatility as revenues grow and costs stabilize.

Expectations vs Reality

Investors often price in expected earnings volatility into a company’s stock price. However, when actual earnings volatility deviates from these expectations, it can trigger significant price movements. For example, if a company’s earnings are more stable than expected, its stock price may rise as investors reassess the company’s risk profile.

What Could Go Wrong

Earnings volatility can increase due to unforeseen factors such as sudden changes in market conditions, regulatory changes, or company-specific issues like management changes or product failures. This increased volatility can lead to sharp price movements, resulting in potential losses for investors.

Long-term Perspective

While earnings volatility can cause short-term fluctuations in stock prices, long-term investors should focus on the company’s underlying financial health and growth prospects. Over the long term, companies with strong fundamentals and stable earnings are likely to deliver more predictable returns, despite short-term earnings volatility.

Investor Tips

- Monitor earnings reports: Regularly review a company’s earnings reports to assess its earnings stability.

- Consider industry trends: Understand the cyclical nature of the company’s industry to anticipate potential earnings volatility.

- Assess economic conditions: Keep an eye on broader economic indicators to anticipate changes that might impact earnings volatility.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a professional investment advisor before making investment decisions.

Leave a Reply