Why This Topic Matters to Investors

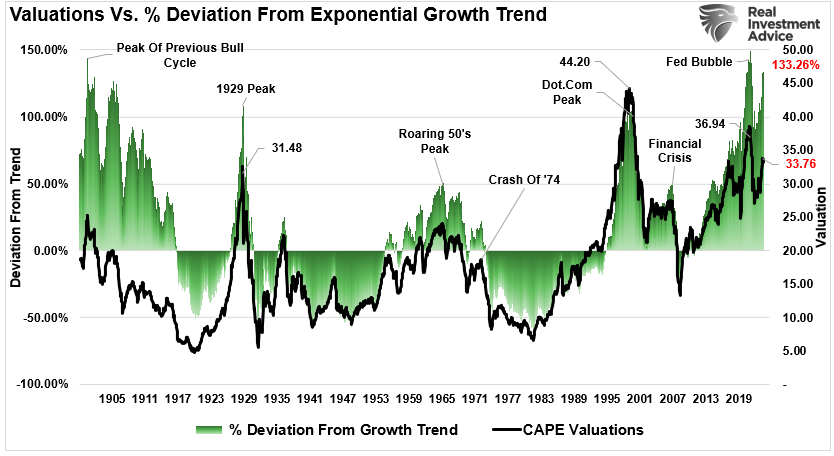

Understanding the dynamics of stock market recovery after a downturn is crucial for investors. It allows them to strategize their investment decisions effectively and maximize potential returns while mitigating potential risks. A case study of US stock recovery would provide meaningful insights into the patterns, indicators, and factors contributing to such scenarios.

Analysis of Key Business or Financial Drivers

The key drivers for a stock market recovery often revolve around macroeconomic indicators, corporate earnings, and market sentiment. Improving economic data, such as GDP growth and unemployment rates, can signal a potential recovery. Similarly, a rise in corporate earnings shows business resilience, which can drive stock prices up. Lastly, positive market sentiment, often influenced by factors like policy changes or vaccine breakthroughs (in the case of a pandemic), can also spur a market recovery.

Expectations vs Reality

Often, the expectation of a swift market recovery post-downturn is contrasted with the reality of a more gradual, and sometimes volatile, recovery process. Investors may anticipate immediate returns due to pent-up demand and fiscal stimulus, but the actual recovery might be slower due to lingering economic uncertainties or slow corporate earnings growth.

What Could Go Wrong

Several factors could potentially derail a market recovery. The economic damage from the downturn could be deeper than initially estimated, resulting in a slower recovery. Corporate earnings might not bounce back as expected due to disrupted supply chains or permanent changes in consumer behavior. Further, unexpected events like geo-political tensions or another wave of a pandemic could also push recovery off track.

Long-Term Perspective

While short-term factors can trigger market volatility, long-term investors should focus on the fundamental strength of the economy and business performance. Over the long term, solid economic fundamentals and resilient businesses tend to drive market recovery, notwithstanding temporary setbacks.

Investor Tips

- Monitor macroeconomic data and corporate earnings reports for signs of recovery.

- Maintain a diversified portfolio to spread risk.

- Consider long-term business performance and economic fundamentals over short-term market volatility.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or consult with a professional advisor before making investment decisions.

Leave a Reply