Why Profit Margin Durability Matters

For long-term investors, understanding the durability of profit margins is crucial. This financial metric provides insight into a company’s operational efficiency, cost control, and pricing power, which directly impacts the sustainability of profits and ultimately, shareholder returns.

Key Drivers of Profit Margin Durability

The profit margin durability of US companies can be influenced by several business and financial drivers. These include operational efficiency, cost management, pricing power, and competitive advantage.

Operational Efficiency

A company with high operational efficiency can maintain or improve profit margins even in challenging market conditions. This is because efficient operations often mean lower costs, which can help buffer profit margins.

Cost Management

Effective cost management is also integral to profit margin durability. Companies that can manage costs effectively are more likely to maintain stable profit margins over time.

Pricing Power

Pricing power, or the ability to raise prices without losing customers, is another important factor. Companies with strong pricing power can increase prices to offset rising costs, helping to maintain profit margins.

Competitive Advantage

Lastly, competitive advantage can influence profit margin durability. Companies with a strong competitive advantage can fend off competitors, maintain market share, and sustain profit margins in the long term.

Expectations vs Reality

Investors often have high expectations for profit margin durability, especially for well-established companies. However, numerous factors, from economic conditions to management decisions, can impact actual results. Hence, it’s crucial to assess a company’s performance against these expectations regularly.

What Could Go Wrong

Despite the best management efforts, several factors could negatively impact profit margin durability. Market downturns, increased competition, rising costs, and regulatory changes are just a few examples. Investors should monitor these and other potential risks closely.

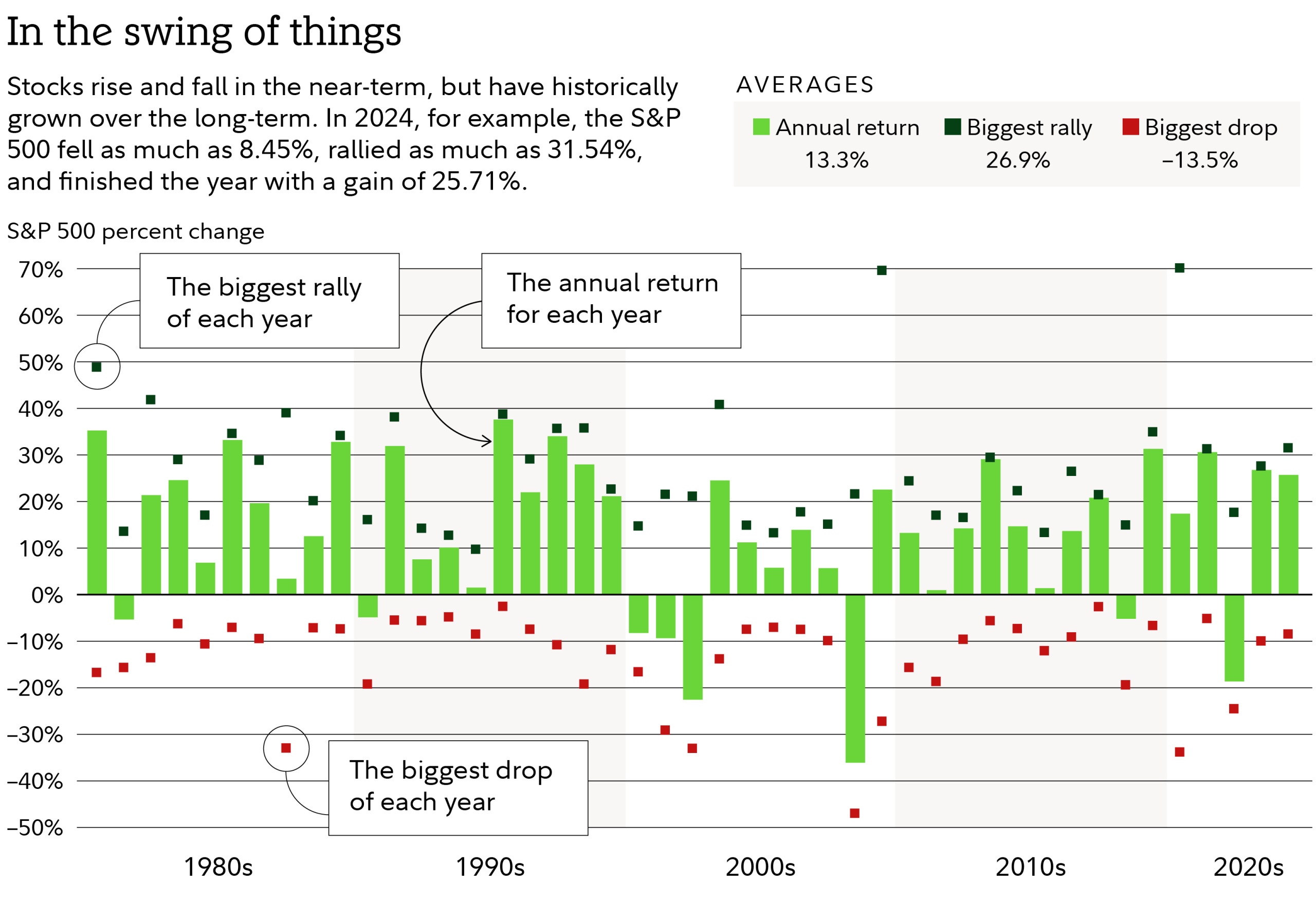

Long-Term Perspective

While short-term factors can impact profit margins, it’s important for investors to adopt a long-term perspective. Over the long term, companies with durable profit margins are more likely to deliver sustainable returns to shareholders.

Investor Tips

- Regularly monitor a company’s profit margin trend.

- Understand the factors that could potentially impact a company’s profit margins.

- Consider the company’s competitive advantage and its impact on profit margins.

Disclaimer: This article is for informational purposes only and not intended to be investment advice. Always conduct your own research before making any investment decisions.

Leave a Reply