Why Sector Volatility Matters

For long-term stock investors, understanding sector volatility is paramount. It is a key factor that influences investment decisions, portfolio diversification, and ultimately, the potential returns of your investments. High volatility often equates to higher risk and potential for greater returns, while low volatility may suggest stability but lower returns. Hence, grasp of sector volatility provides a strategic advantage in navigating stock market uncertainties.

Key Drivers of Sector Volatility

Stock market sectors do not operate in isolation; they are influenced by a myriad of factors, including economic indicators, corporate earnings, and geopolitical events. For instance, interest rate hikes or cuts by central banks can cause substantial volatility in financial sectors. Similarly, changes in commodity prices can trigger volatility in energy or agriculture sectors.

Economic Indicators

Fluctuations in GDP growth, inflation rates, or unemployment figures can cause significant shifts in sector volatility. These changes often reflect the overall health of the economy, influencing investor sentiment and triggering price movements in associated sectors.

Corporate Earnings

Corporate earnings reports are another key driver. A company exceeding or falling short of its earnings expectations can cause notable price swings, affecting the volatility of its respective sector.

Expectations vs Reality

Investor expectations about particular sectors often influence stock prices. For instance, if investors anticipate strong growth in the tech sector due to innovation and technological advancements, they may drive up stock prices. However, if the growth doesn’t materialize as expected, a market correction could ensue, leading to increased sector volatility. It’s crucial for investors to balance expectations with reality, carefully analyzing underlying business fundamentals and market dynamics.

What Could Go Wrong

Unforeseen events or changes in market conditions can increase sector volatility. Major geopolitical events, such as trade wars or conflicts, can create uncertainty, leading to price fluctuations. Similarly, sudden changes in government regulations or policies can impact specific sectors, causing volatility. Additionally, market bubbles, often driven by irrational investor behavior, can lead to high volatility if they burst.

Long-term Perspective

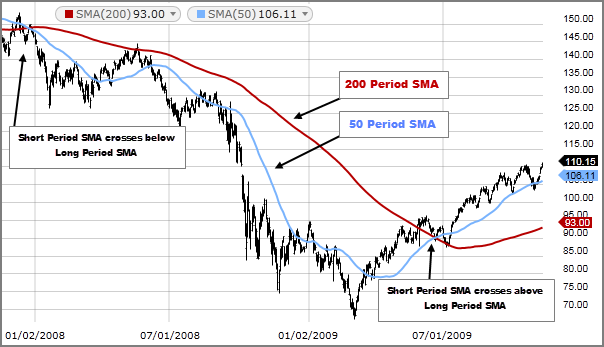

While sector volatility can influence short-term investment decisions, long-term investors should focus on how these volatilities tie into multi-year outcomes. It’s essential to understand that volatility is part and parcel of stock market investing. A sector that experiences high volatility in the short-term might stabilize over the long run and vice versa. Therefore, a long-term perspective can help investors ride out short-term volatilities and focus on sustained growth potential.

Investor Tips

- Stay informed about the broader economic indicators and how they affect different sectors.

- Keep an eye on corporate earnings and understand how they impact sector volatility.

- Balance your expectations with reality, taking into account market dynamics and business fundamentals.

- Prepare for unexpected events that can trigger volatility, and diversify your portfolio accordingly.

This article is intended for informational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Leave a Reply