Why Business Resilience Matters to Investors

Business resilience, the ability of a company to adapt to disruptions while maintaining continuous business operations, is an essential factor for long-term investors. It reflects a company’s capacity to withstand market volatilities and economic downturns, thereby safeguarding investors’ capital.

Key Business and Financial Drivers

Business resilience is driven by both operational and financial factors. Operationally, a resilient company is adaptable, with robust supply chains and an ability to pivot in response to market changes. Financially, it has strong balance sheets, diversified revenue streams, and prudent risk management strategies. These elements reduce the vulnerability of a company to external shocks, and hence, protect the value of investments.

Operational Adaptability

A company’s ability to quickly adapt its operations in response to disruptions is crucial. This can involve diversifying suppliers to avoid supply chain disruptions, or altering product lines to meet changing demand. Companies with high operational adaptability are better positioned to maintain profitability during unexpected events.

Financial Stability

Resilient companies often have strong balance sheets, characterized by low debt levels and ample cash reserves, enabling them to weather financial storms. They also have diversified revenue streams that can cushion the impact of a downturn in any particular sector.

Expectations Vs Reality

Investors often expect resilient companies to deliver steady, reliable returns. However, it’s important to understand that business resilience does not guarantee immunity from business cycle fluctuations. Even the most resilient companies can experience short-term performance dips during severe market disruptions. But, their strength lies in their ability to recover and continue on a growth trajectory in the long run.

What Could Go Wrong

Despite a company’s resilience, several factors could potentially impact its stock performance. These include severe economic downturns, geopolitical risks, technological disruption, or poor management decisions. Such factors could strain a company’s resources and impact its resilience, leading to potential declines in stock value.

Long-term Perspective

While business resilience can influence short-term stock performance, its true value is appreciated over the long term. Resilient companies are better equipped to navigate through challenging times, ensuring the continuity of operations and profitability. Consequently, they offer a higher probability of delivering sustainable returns to investors over multi-year horizons.

Investor Tips

- Look beyond short-term performance: Consider a company’s business resilience before investing.

- Review operational and financial drivers: These provide insights into a company’s resilience.

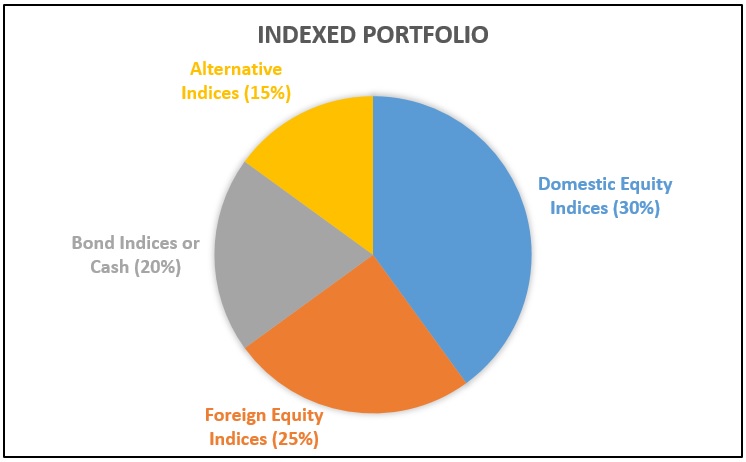

- Consider diversification: This can help manage risks associated with individual stocks.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply