Why Understanding Mistakes in Sector Analysis Matters

Investing in the stock market requires sound decision-making, and sector analysis plays a crucial role. However, even seasoned investors can make common mistakes in sector analysis, leading to flawed investment strategies. Knowledge of these pitfalls can enhance your investment approach and potentially improve long-term returns.

Key Business and Financial Drivers

Understanding the dynamics of a sector involves assessing its key business and financial drivers. These include economic factors, business cycles, technological advancements, regulatory changes, and market competition. Misunderstanding or overlooking these drivers can lead to costly investment mistakes.

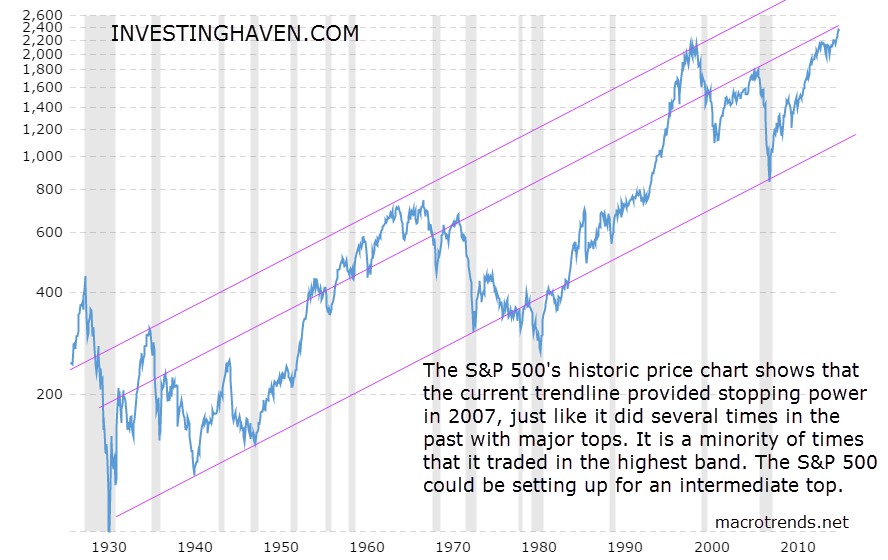

Economic Factors and Business Cycles

Investors often neglect the impact of macroeconomic factors and business cycles on sector performance. For example, sectors like consumer discretionary often thrive during economic booms but may suffer during downturns. This dependence on economic health is crucial in sector analysis.

Technological Advancements

Another common mistake is underestimating the role of technology. Rapid technological advancements can disrupt traditional business models, creating winners and losers within sectors. Investors need to stay abreast of these changes to make informed investment decisions.

Expectations Vs. Reality

Investors often make the mistake of basing investment decisions purely on the expectations priced into a stock, without considering the likelihood of these expectations being met. It is essential to balance these expectations with a realistic assessment of the company’s prospects within its sector.

What Could Go Wrong

Failure to conduct a comprehensive sector analysis can lead to undiversified portfolios, overexposure to sector-specific risks, and misguided investment decisions. For example, over-reliance on a single sector could lead to significant losses if that sector underperforms. Similarly, ignoring regulatory changes can result in unexpected investment outcomes.

The Long-Term Perspective

While sector analysis can help identify short-term investment opportunities, it also plays a crucial role in shaping long-term investment strategies. By avoiding common mistakes in sector analysis, investors can better understand sector trends, manage risks, and maximise their long-term investment returns.

Investor Tips

- Stay updated on economic indicators and business cycles that impact sectors you’re invested in.

- Keep track of technological trends that could disrupt the sectors you’re invested in.

- Balance expectations priced into a stock with a realistic assessment of the company’s prospects within its sector.

- Ensure your portfolio is sufficiently diversified across different sectors.

- Stay informed about regulatory changes that could impact your investments.

This article is intended for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial position before making investment decisions.

Leave a Reply