Introduction: Why Stress-Test Valuations Matter

When it comes to long-term stock investments, understanding the valuation of a company is paramount. This is where analysts’ stress-test valuations come into play. These tests are designed to assess how a company’s financial health might fare under various unfavorable scenarios. For investors, these evaluations can highlight potential risks and rewards, aiding in investment decision-making.

Key Business or Financial Drivers

Stress-test valuations hinge on a number of key factors. These might include a company’s debt levels, revenue growth, profit margins, and cash flows. A company with higher debt levels, for example, might be more vulnerable in a downturn. Conversely, a company with strong cash flows might be better equipped to weather a storm.

Expectations vs Reality

Investors often have expectations about a company’s performance based on its current valuation. However, stress-test valuations can sometimes paint a different picture. For instance, a company might appear to be overvalued based on its current financials, but a stress-test valuation might reveal that it’s well-positioned to handle a future financial crisis.

What Could Go Wrong

Stress-test valuations, while useful, are not foolproof. They are hypothetical scenarios, and the actual outcomes can be far different. For instance, the stress scenarios might not consider all potential risks, or the assumptions made during the stress test might prove to be inaccurate. Therefore, investors should use these valuations as part of a broader investment strategy, not as the sole basis for investment decisions.

Long-Term Perspective

While stress-test valuations mainly consider short-term factors, they can also provide valuable insights for long-term investments. By identifying potential vulnerabilities, they can help investors make decisions that align with their long-term investment goals.

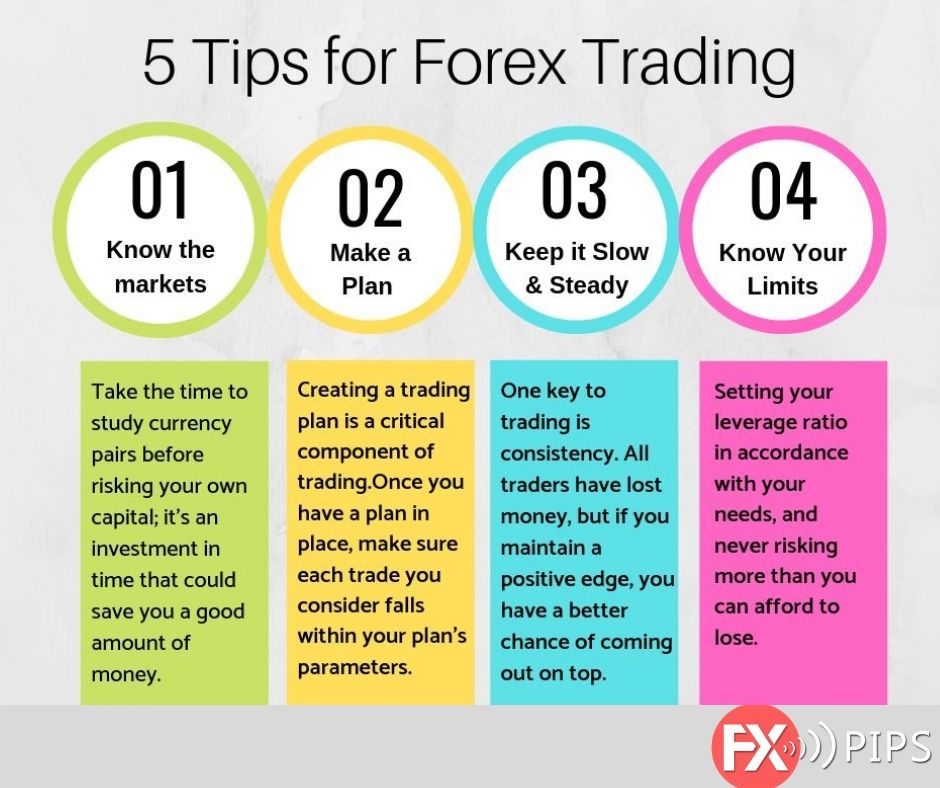

Investor Tips

- Evaluate stress-test valuations in conjunction with other financial data and market trends.

- Consider the assumptions made during the stress-test valuation and how they might impact the results.

- Remember that while stress-test valuations can reveal potential risks, they don’t guarantee future outcomes.

Investing in stocks always carries risk, and it’s important to conduct thorough research and consider a variety of factors before making an investment decision.

This article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions.

Leave a Reply