Introduction: Why Earnings and Stock Volatility Matter to Investors

Earnings and stock volatility are interrelated aspects that significantly influence an investor’s decision-making process. Understanding these elements can help investors anticipate price fluctuations, mitigate risks, and make informed investment choices for the long-term.

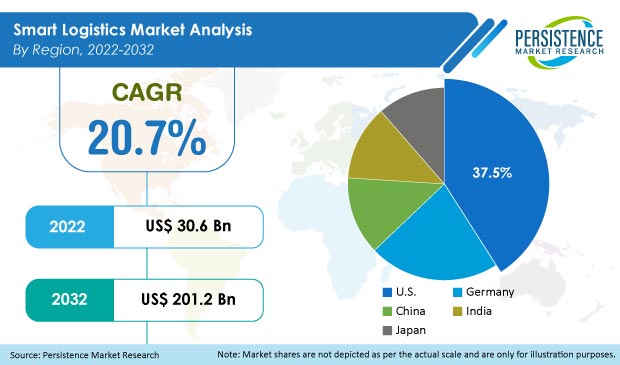

Analysis of Key Business or Financial Drivers

Corporate earnings are a critical driver of stock prices. A company with consistently high earnings is likely to see its stock price rise over time. Conversely, if a company’s earnings are decreasing, its stock price may fall.

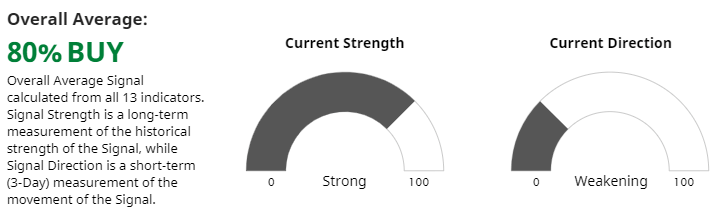

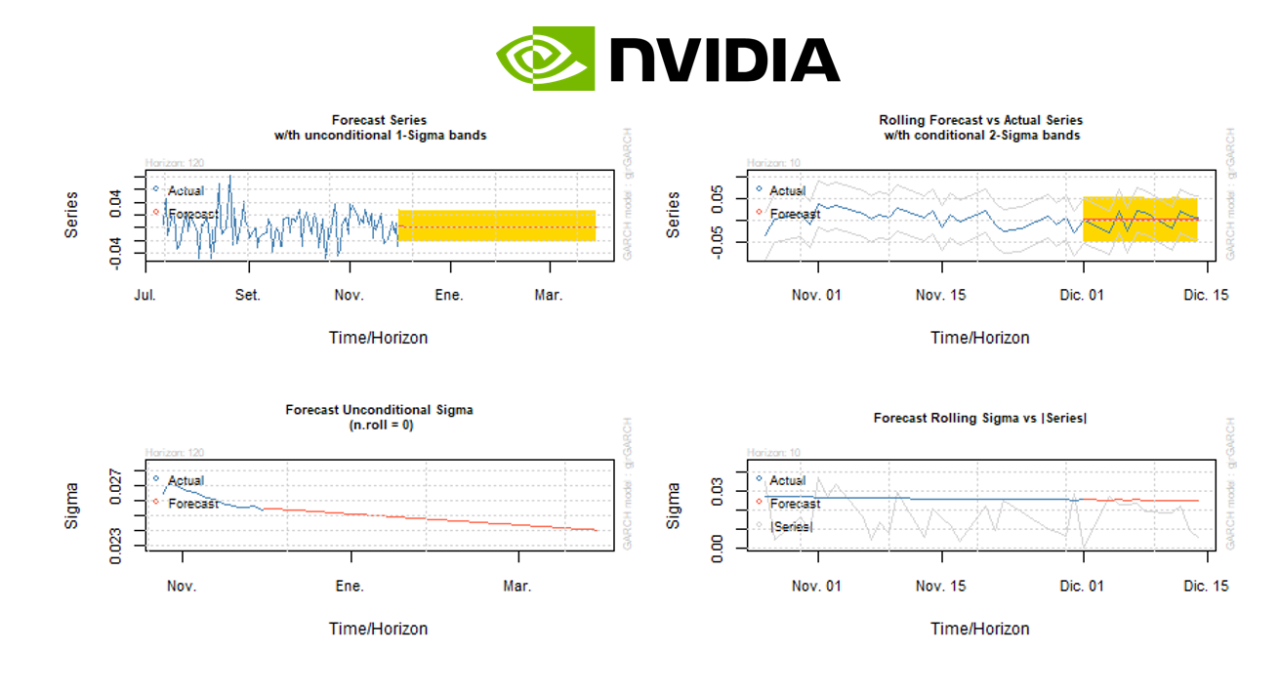

Stock volatility, on the other hand, refers to the degree of variation in a stock’s price. High volatility often signifies higher risk and potential reward, while low volatility may indicate stability but also limited growth potential.

Earnings and Stock Volatility: Expectations vs Reality

Investors often expect that strong earnings will lead to a stable and rising stock price. But reality can be different. Even companies with robust earnings can experience significant stock volatility due to market sentiment, economic factors, or unexpected events.

What Could Go Wrong

Underestimating the impact of stock volatility can lead to substantial investment losses. For instance, if an investor ignores the volatility and invests in a high-earning but highly volatile stock, they might face significant losses if the stock price plummets.

Long-Term Perspective

While short-term earnings and stock volatility can impact immediate investment decisions, it’s crucial to consider these factors from a long-term perspective. Over multiple years, a company’s ability to maintain or grow earnings and manage volatility will significantly influence its stock price and, consequently, investment returns.

Investor Tips

- Regularly monitor a company’s earnings and the volatility of its stock.

- Don’t be swayed by short-term earnings or volatility. Focus on the long-term trends and prospects.

- Consider the company’s earnings and stock volatility in the context of its industry and the overall market.

Disclaimer

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research or consult with a professional financial advisor before making investment decisions.

Leave a Reply