Why Understanding Behavioral Biases Matters to Investors

Investor behavior often drives the ebb and flow of financial markets. Understanding behavioral biases can provide insights into market trends, enabling long-term investors to make informed decisions and possibly gain an edge in their investment strategies.

Key Business or Financial Drivers

Behavioral biases can significantly influence financial drivers such as market sentiment, risk perception, and investment decisions. Cognitive biases like overconfidence, herd behavior, and loss aversion can lead to irrational decisions, impacting market stability and prices.

Market Sentiment

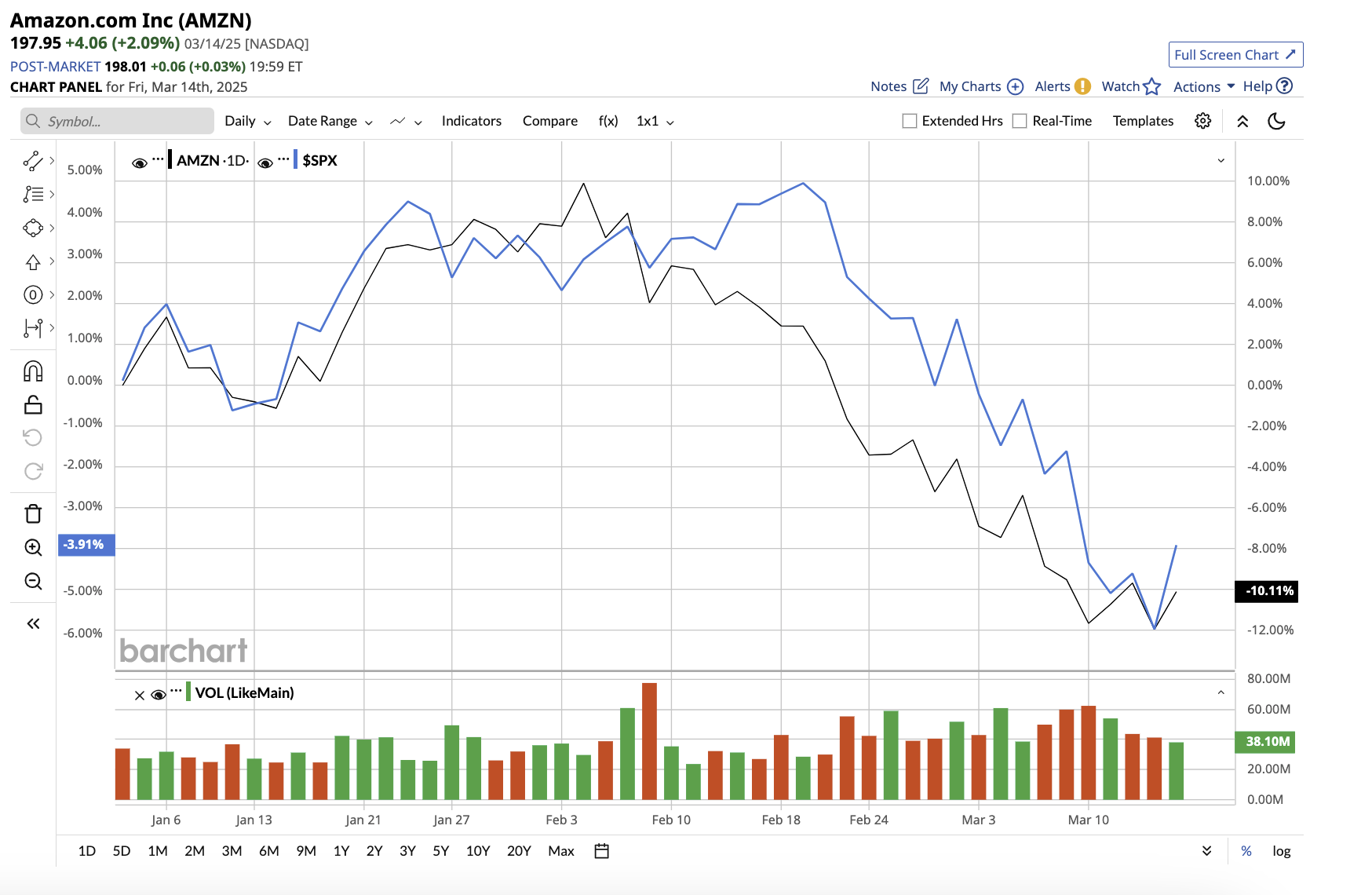

Investor sentiment, often driven by behavioral biases, can significantly influence market trends. For instance, overconfidence can inflate market bubbles, while fear can contribute to market crashes.

Risk Perception

Risk perception is another crucial factor affected by behavioral biases. Investors’ tendency to overestimate or underestimate risks based on their biases can have substantial implications for investment outcomes.

Expectations vs Reality

Behavioral biases can create a gap between investor expectations and market realities. Investors may overestimate the potential gains or underestimate the risks due to biases, resulting in unrealistic expectations. By understanding these biases, investors can adjust their strategies to align more closely with market realities.

What Could Go Wrong

Ignoring behavioral biases can lead to flawed investment decisions. For instance, succumbing to herd behavior can result in buying high and selling low, while loss aversion can prevent investors from cutting losses or taking necessary risks. Overconfidence can also lead to excessive trading and higher transaction costs.

Long-Term Perspective

While behavioral biases can have short-term impacts, understanding these biases can help investors navigate market volatility and stay focused on long-term goals. For example, resisting the urge to follow the crowd during market euphoria or panic can lead to better long-term investment outcomes.

Investor Tips

- Stay aware of your biases and how they may affect your investment decisions.

- Don’t let short-term market trends sway your long-term investment strategy.

- Maintain a diversified portfolio to mitigate risks.

This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

Leave a Reply