Why Scenario Thinking Matters in Equity Research

Scenario thinking is a strategic planning method that investors use to make flexible long-term plans. This approach is particularly crucial in equity research as it allows investors to understand multiple possible future scenarios for a company and its stock. By envisioning various outcomes, investors can determine the potential risks and rewards associated with each scenario, enabling them to make more informed, and potentially lucrative, investment decisions.

Key Business and Financial Drivers

The key business drivers that investors should consider when employing scenario thinking in equity research include the company’s competitive positioning, growth potential, profitability, and risk profile. Financial drivers, on the other hand, may encompass aspects like revenue growth, profitability margins, cash flow stability, and financial leverage. Understanding these drivers and their potential trajectories under various scenarios can offer valuable insights into a company’s future equity value.

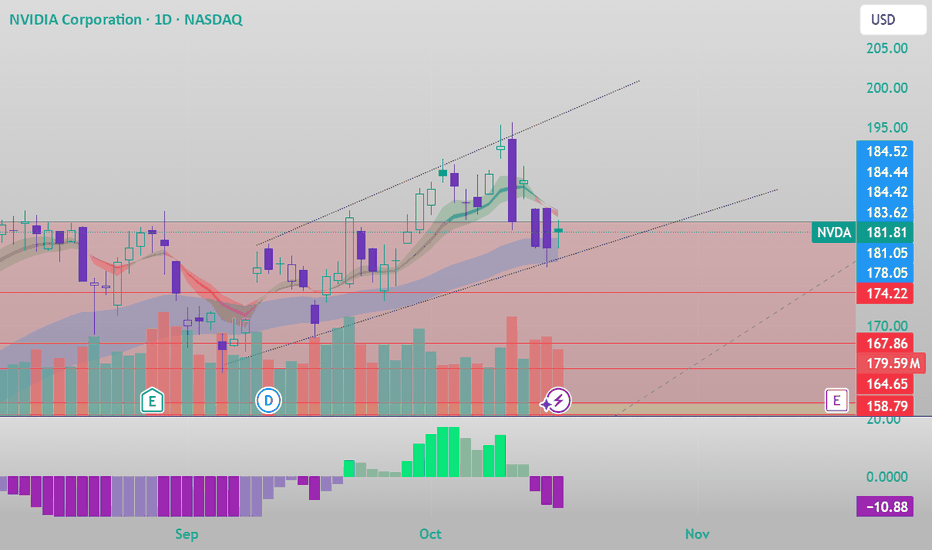

Expectations vs Reality

One common pitfall in equity research is the gap between market expectations and reality. Investors often base their decisions on projected earnings and anticipated market trends. However, these expectations may not always align with the company’s actual performance. Scenario thinking allows investors to consider a range of potential outcomes, thereby bridging the gap between expectations and reality, and ensuring more robust investment decisions.

What Could Go Wrong

While scenario thinking can provide invaluable insights, it is not without risks. One potential drawback is the over-reliance on a single scenario, leading to confirmation bias. Another risk is underestimating the probability of an unlikely but high-impact event. Hence, investors should always consider a broad range of scenarios and remain open to adjusting their views as new information becomes available.

Long-Term Perspective

Scenario thinking encourages long-term perspective, linking short-term factors to multi-year outcomes. For instance, a temporary market downturn may appear detrimental in the short-term, but under a different scenario, it could present a buying opportunity for long-term growth. By considering multiple scenarios, investors can better navigate short-term volatility and stay focused on their long-term investment goals.

Investor Tips

- Always consider multiple scenarios, not just the most likely one.

- Regularly review and update your scenarios as new information becomes available.

- Use scenario thinking as a tool to manage risk, not to predict the future.

This article is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.

Leave a Reply