Why This Topic Matters to Investors

Many investors find themselves caught in the frenzy of short-term market predictions, often overlooking the potential of adopting a long-term investment strategy. Understanding how to invest without making short-term forecasts can provide investors with a more stable, growth-oriented investment approach. This strategy can lead to substantial wealth accumulation over time and serve as a cushion against the volatility of the stock market.

Key Business or Financial Drivers

Long-term investing is mostly influenced by fundamental factors such as a company’s earnings, business model, competitive advantage, and management quality. These factors are often more stable and predictable over the long-term, compared to short-term market fluctuations, making them crucial for long-term investment decisions.

Expectations vs Reality

Investors often base their decisions on market expectations, which are inherently uncertain and can lead to potential investment pitfalls. A long-term investment strategy, on the other hand, focuses on the inherent value of a business rather than temporary market sentiments. This approach can help investors avoid the anxiety and potential losses associated with short-term investing, providing a more realistic perspective on investment returns.

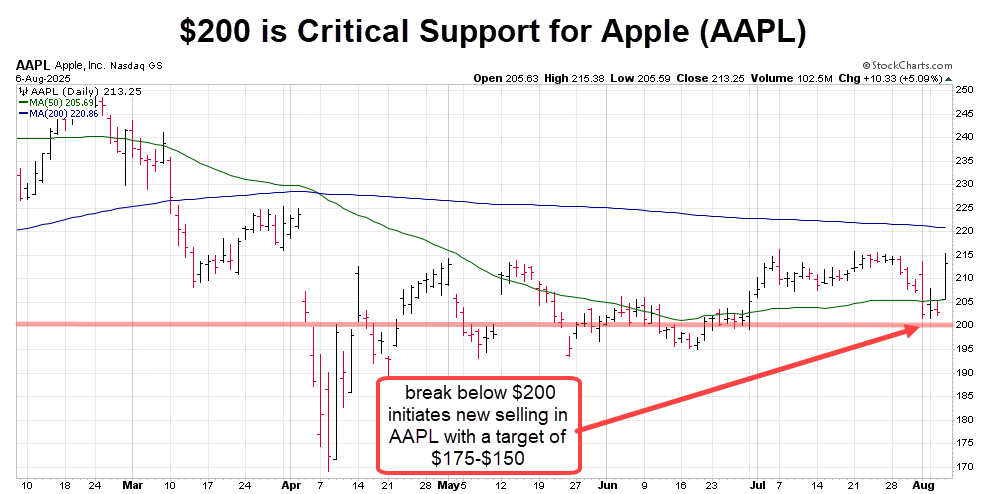

What Could Go Wrong

Despite the benefits of long-term investing, it’s important to note potential risks. These include investing in businesses without a sustainable competitive advantage, failing to properly understand a company’s financial health, or ignoring macroeconomic factors that could impact the company’s long-term performance.

Connecting Short-term Factors to Multi-year Outcomes

Although long-term investing means focusing less on short-term forecasts, it doesn’t mean ignoring short-term events completely. Significant events such as management changes, regulatory shifts, or major technological advancements can have long-term impacts on a company’s performance. A prudent long-term investor should therefore track these events, assessing their potential impact on a company’s long-term growth.

Investor Tips

- Focus on companies with a proven track record and a sustainable competitive advantage.

- Understand a company’s financial health before investing.

- Stay updated on significant short-term events that could affect long-term performance.

This article is intended to provide a general overview of long-term investing and should not be considered as investment advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

Leave a Reply